A busy earnings week helped the S&P 500 close at a new record high at 2,940 on Tuesday. The previous closing high was 2,930.75 set back in Sept. 20, 2018.

“Among the key companies that have reported, most of them have beaten expectations,” said Peter Cardillo, chief market economist at Spartan Capital Securities. “That means we’re probably going to escape an earnings recession. That will be key for the market to rally from here.”

Earnings from the following companies have helped boost the S&P 500:

- Coca-Cola: $0.48 earnings per share versus $0.46 estimate

- United Technologies: $1.91 earnings per share versus $1.71 estimate

- Twitter: $0.37 earnings per share versus $0.15 estimate

- Lockheed Martin: $5.99 earnings per share versus $4.34 estimate

- Procter & Gamble: $1.06 earnings per share versus $1.03 estimate

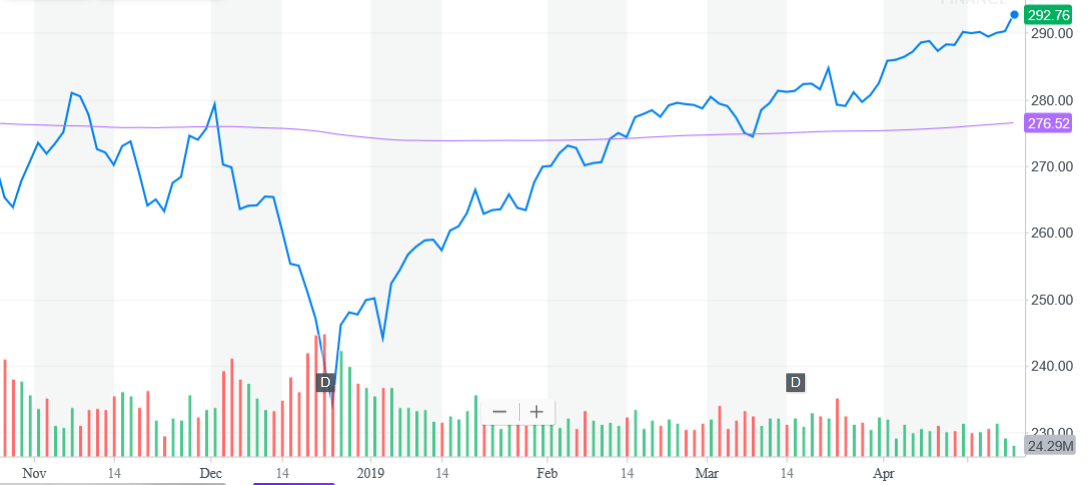

Meanwhile, the SPDR S&P 500 ETF (NYSEArca: SPY) is feeling the strength from the index, rising about 1 percent. SPY is up 13.52 percent year-to-date. From a technical standpoint, SPY is hovering above its 200-day moving average.

Ignoring the Slower Global Growth

It’s a serendipitous rise for the S&P 500 given a number of analysts were expecting a weaker first-quarter showing for corporate earnings. Investors were possibly looking at a 4.3 percent year-over-year reduction in earnings growth, according to FactSet estimates.

In addition, fears of slowing global growth were also potential roadblocks heading into first-quarter earnings season. Earlier this month, the IMF cut its global growth forecast to the lowest level since the financial crisis, citing the impact of tariffs and a weak outlook for most developed markets.

According to the IMF, the world economy will grow at a 3.3 percent pace, which is 0.2 percent lower versus the initial forecast in January.

“This is a delicate moment,” said IMF chief economist Gita Gopinath at a press briefing in Washington.

In addition, the global volume of trade in goods and services will increase 3.4 percent in 2019, which represents a drop from the 3.8 percent gain last year. The IMF, however, did mention that recent policy implementations like the U.S. Federal Reserve keeping interest rates steady are positive signs moving forward.

“Amid waning global growth momentum and limited policy space to combat downturns, avoiding policy missteps that could harm economic activity needs to be the main priority,” said the IMF.

For more market trends, visit ETF Trends.