By WingCapital Investments

- Hoya Capital Housing ETF (HOMZ), a diversified U.S. real estate ETF launched this year, offers a balance of growth potential in the booming U.S. housing sector and considerable dividend yield.

- HOMZ is highly correlated to the homebuilders ETF (XHB) due to its sizable exposure to homebuilders and home improvement industry.

- Low interest rates and strong fundamentals suggest another solid year ahead in the real estate sector.

- HOMZ offers a compelling alternative to XHB with its well-diversified portfolio, lower volatility and higher current income.

On the heels of homebuilder confidence hitting a 20-year high based on the National Association of Home Builders/Wells Fargo Housing Market Index, the housing sector is now deemed the ‘hottest part’ of the U.S. economy.

To invest in housing-related equities, while homebuilders (XHB, ITB) and REIT ETFs (REZ, IYR) have been the main vehicles, investors now have an additional option in Hoya Capital Real Estate’s recently launched HOMZ, which offers diversified exposure to both homebuilders, REITs as well as sub-industries within the residential real estate ecosystem. Since its debut in March, several introductory articles with valuable information on HOMZ have been published on Seeking Alpha. Quoting from Jussi Askola’s piece In The Long Run, The House Wins – An Introduction To HOMZ:

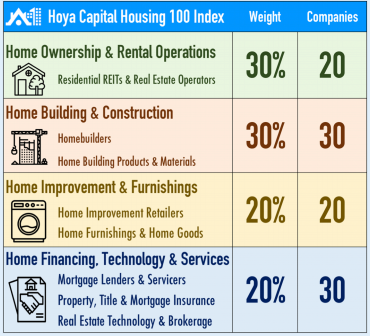

“HOMZ tracks the Hoya Capital Housing 100 Index, a rules-based index composed of the 100 companies that collectively represent the performance of the US housing industry. The index is designed to track the total spending on housing and housing-related services, and as such, investors are able to gain exposure to all major segments of the housing market, each weighted based on their relative contribution to US GDP. The four main categories of the ETF are the following:

Source: Hoya Capital Index Innovations

Source: Hoya Capital Index Innovations

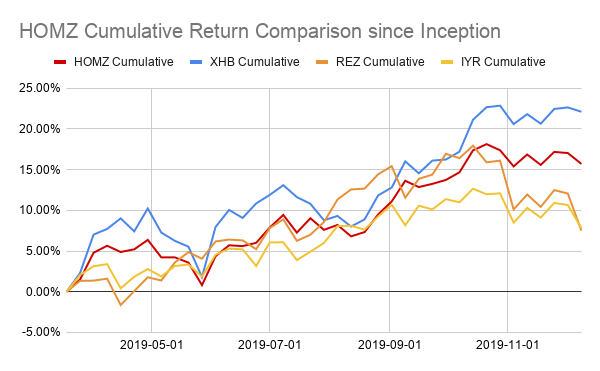

We are honored to be invited by Hoya Capital to write about HOMZ, and are happy to share our view from a macro, quantitative perspective. Taking a quick look at its performance since inception, HOMZ is up +15% which is right between XHB’s +22% and REZ and IYR’s +7%:

The correlation between HOMZ and its comparable real estate-related ETFs is as follow:

| HOMZ Correlation vs. | XHB | REZ | IYR |

| 87.95% | 39.57% | 56.23% |

The high correlation to XHB is not surprising considering its 30% and 20% weight on homebuilders and home improvement sectors respectively. Considering the fact that HOMZ tracks XHB closely, we will analyze its outlook using XHB as the longer historical time series allows for a more comprehensive analysis.