![]() By ProShares

By ProShares

Resilience in a Market Downturn

Dividend growth strategies held up better than the broader market during the recent downturn and also had the consistent growth to perform in rising markets. The key is quality—dividend growers generally had the financial stability to weather market turmoil.

Quality Drove Results

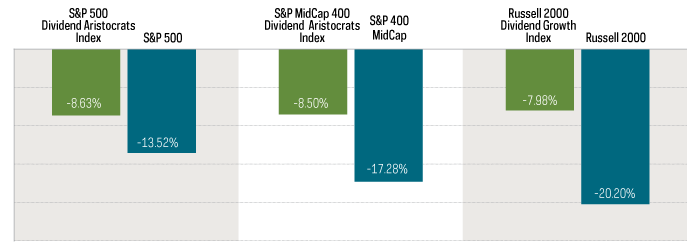

While the S&P 500® declined more than 13% during the three-month period from October 1, 2018 through December 31, 2018, dividend growth strategies fared far better. And that wasn’t limited to the domestic large-cap stock universe. It applied to mid-cap and small-cap stocks as well.

Outperformance during the recent downturn

October 1, 2018 – December 31, 2018

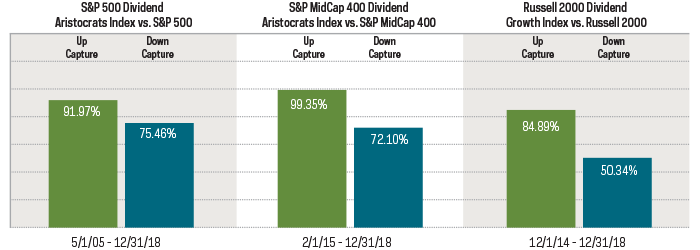

Strong up/down capture ratios

Index inception – December 31, 2018

How Can This Benefit Investors?

The more uncertain the markets, the more investors may want to consider incorporating a dividend growth strategy into their portfolios. Why? Historically, companies that have grown their dividends have outperformed, with lower volatility, over time. ProShares offers the only ETF tracking the S&P 500 Dividend Aristocrats Index, as well as ETFs covering a variety of domestic and international market caps. Visit ProShares.com to download a copy of this report or for more information about ProShares Dividend Growers ETFs.

Performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Shares are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Market price returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. ET (when NAV is normally determined for most funds) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Current performance may be lower or higher than the performance quoted. Standardized returns and performance data current to the most recent month end, see Performance. Index information does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

† Since inception returns are cumulative for funds less than one year old; otherwise, returns are annualized. Market returns are based on the composite closing price and do not represent the returns you would receive if you traded shares at other times. The listing date is typically one or more days after the fund inception date. Therefore, NAV is used to calculate market returns prior to the listing date.

[1] The expense ratio for certain funds includes a contractual fee waiver that results in a lower net expense ratio for some or all periods shown. For information about a specific ETF’s fee waiver, please view its product page.

Any forward-looking statements herein are based on expectations of ProShare Advisors, LLC at this time. Whether or not actual results and developments will conform to ProShare Advisors, LLC’s expectations and predictions, however, is subject to a number of risks and uncertainties, including general economic, market and business conditions, changes in laws or regulations or other actions made by governmental authorities or regulatory bodies, and other world economic and political developments. ProShare Advisors, LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

This information is not meant to be investment advice. There is no guarantee dividends will be paid. Companies may reduce or eliminate dividend at any time, and those that do will be dropped from the indexes at reconstitution. There is no guarantee any ProShares ETF will achieve its investment objective. Shares of any ETF are generally bought and sold at market price (not NAV) and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Investing involves risk, including the possible loss of principal. This ProShares ETF is diversified and entails certain risks, including imperfect benchmark correlation and market price variance, that may decrease performance. Please see summary and full prospectuses for a more complete description of risks. Investments in smaller companies typically exhibit higher volatility. Smaller company stocks also may trade at greater spreads or lower trading volumes, and may be less liquid than stocks of larger companies.

The “S&P 500® Dividend Aristocrats® Index” and “S&P MidCap 400® Dividend Aristocrats Index” are products of S&P Dow Jones Indices LLC and its affiliates. “Russell 2000® Dividend Growth Index” and “Russell®” are trademarks of Russell Investment Group. All have been licensed for use by ProShares. “S&P®” is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”) and “Dow Jones®” is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and its affiliates. ProShares have not been passed on by these entities and their affiliates as to their legality or suitability. ProShares based on these indexes are not sponsored, endorsed, sold or promoted by these entities and their affiliates, and they make no representation regarding the advisability of investing in ProShares. THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing.

ProShares are distributed by SEI Investments Distribution Co., which is not affiliated with the funds’ advisor or sponsor.