By Michael A. Gayed, CFA

- Expectations for 2020 are for higher inflation and a rotation to commodities.

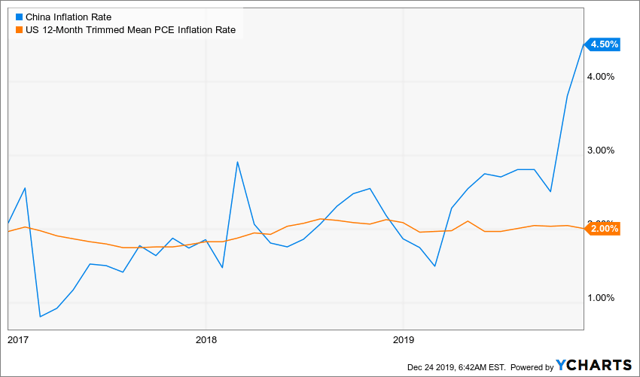

- Inflation in China is increasing, and trade tensions are decreasing.

- The iShares Commodities Select Strategy ETF could be a good choice for a broad-based commodity investment.

“Gold is money. Everything else is credit.” – J.P. Morgan

As we approach year-end and think about where to invest for the new year, some of the strongest trends I see happening are the dollar continues to weaken, the yield curve continues to steepen, and there is reinflation. This leads to a situation where riskier assets should outperform such as emerging markets, commodities, and small-caps. One area many investors lack exposure to is commodities. When anyone says the word “commodity”, most people automatically think gold or oil, but there is a whole variety of investable commodities that can add value to your portfolio. A broad-basket commodity ETF is one of the best ways to invest in the sector and add diversification to your portfolio.

Commodities have a positive correlation to the rate of inflation, unlike stocks and bonds. Commodity prices help determine the inflation rate, while interest rates and stock prices get discounted due to future cash flows being worth less with greater inflation. Inflation in the US has been slowly increasing and looks poised to continue. Commodity prices have not risen like the inflation rate this year due to the slowing demand from China, but inflation in China has picked up in the second half of 2019.

As the world’s economy remained stable this year, commodity prices are also starting to move upward. From looking at the chart of commodity prices, copper, aluminum, and agricultural prices are starting to turn positive. As trade tensions ease with China, it will help commodity prices even more. China has been oversupplying the world market with aluminum this year, but even that has relaxed recently.