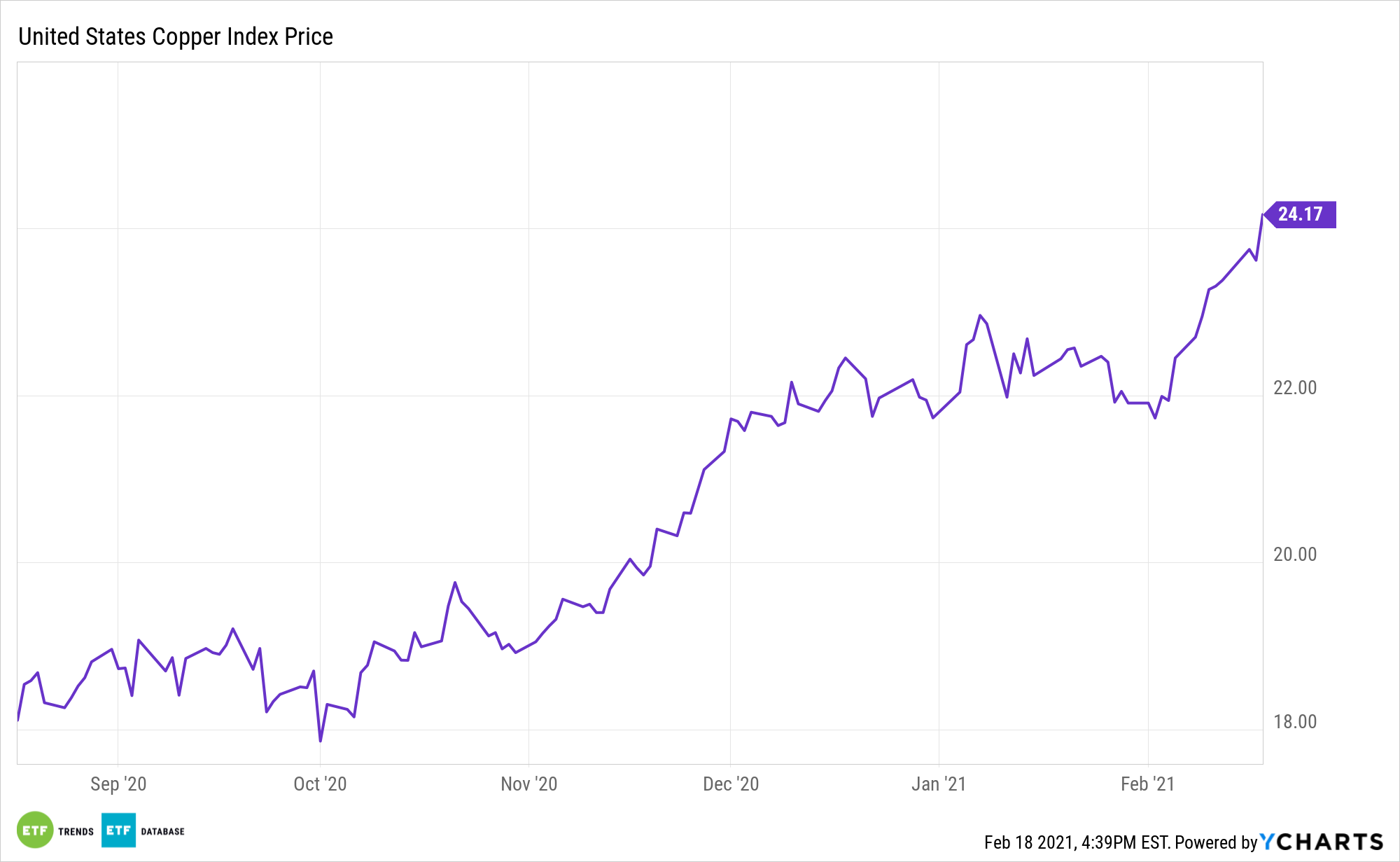

Copper exchange traded funds led the charge on Thursday as Chinese investors returned from a week-long Lunar New Year holiday and fanned the flames under the ongoing rally in the industrial metal.

On Thursday, the United States Copper Index Fund (NYSEARCA: CPER) was up 2.5% and iPath Series B Bloomberg Copper Subindex Total Return ETN (NYSEArca: JJC) was 2.3% higher. Meanwhile, COMEX Copper futures rose 2.3% to $3.913 per pound and traded near their highest level since April 2012.

Global copper prices chased after gains in China where the most-traded copper contract on the Shanghai Futures Exchange SCFcv1 rallied to as high as 63,290 yuan, or $9,784, up almost 6% and touching its highest since September 2011, Reuters reports.

Fueling the ongoing rally in the industrial metal, China, the biggest metals consumer, has seen a surge in demand on its rebounding economy. Additionally, there were increased expectations of tight supply and a rush of speculative investment, with many analysts jumping on the multi-year bull run.

However, Commerzbank warned that the metals market may be too frothy, arguing that commodities were “completely detached from reality.” MarketWatch reports.

“No new data is available to underpin the pronounced rise in metals prices, particularly in the last few weeks,” according to Commerzbank. “Metals prices are currently being driven to a large extent by speculation, and the upswing is beginning to look excessive.”

Commerzbank analysts said the gains may be attributed to hopes of a significant global economic recovery. The analysts noted that Chinese traders have returned to the markets following a week-long holiday, which also helped push prices higher.

Lastly, Commerzbank noted that other commodities, including crude oil, nickel, and aluminum, may be overvalued.

For more information on the commodities market, visit our commodity ETFs category.