![]() With both equity and fixed-income valuations hovering at elevated levels, investors may consider commodity ETFs to hedge risks and diversify a traditional portfolio of stocks and bonds.

With both equity and fixed-income valuations hovering at elevated levels, investors may consider commodity ETFs to hedge risks and diversify a traditional portfolio of stocks and bonds.

On the recent webcast (available On Demand for CE Credit), End of Year Market Outlook, James Butterfill, Head of Research and Investment Strategy for ETF Securities, argued 10-year Treasury yields need to break above 3% to signal an end to the current bull market condition.

However, this is unlikely to happen anytime soon as the desperate hunt for yield has pushed many money managers and investors to riskier credit and lower-rated debt securities as highly rated government debt remains depressed.

Equities may look vulnerable as well, Butterfill added. Stock traders are growing increasingly complacent with the CBOE Volatility Index, a measure of market fear, hovering near record lows. On the other hand, S&P 500 price-to-earnings valuations are hovering at elevated levels.

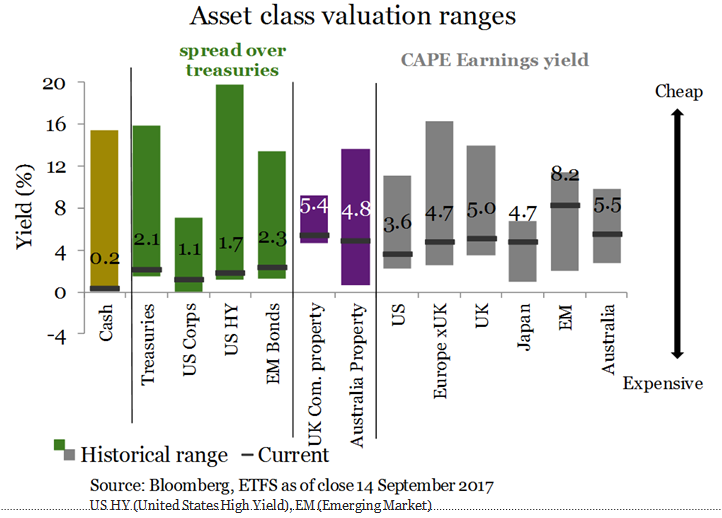

U.S. equities are now among the most expensive in the global markets. While the recent corporate earnings season have helped support higher prices, the MSCI U.S. cyclically adjusted price-to-earnings, or so-called CAPE ratio, is among the highest, compared to international markets.

Along with ongoing market conditions, investors may also have to consider the changing demographics that could affect the economy. For instance, the rising millennial generation will be a key economic driver, especially in the emerging markets where this young group makes up 86% of the population, with China and India alone accounting for over a third of this demographic. This generation is also highly levered with total U>S. student loans hitting a record $1.4 trillion as of March 2017, despite dips in overall debt service ratio for U.S. households, which has contributed shifting financial behaviors such as low home ownership and a preference for renting.