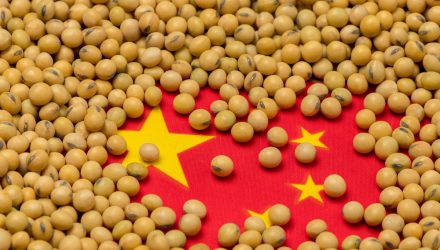

Increased demand for commodities could be a byproduct of China’s re-opening. As the second-largest economy regains its footing after challenges over the past few years, commodities could stand to benefit.

China is forging on after a real estate development crisis was paired with stringent government regulation on big tech companies. Both sectors comprise a significant portion of the country’s GDP, which stunted economic growth.

Additionally, a resurgence in COVID-19 cases also forced additional government-mandated lockdowns. That only exacerbated the lull in economic growth, but as the country starts to re-open again, commodities could be a beneficiary of the country’s increased economic activity.

As CNBC noted, “China’s post-pandemic reopening will boost demand for commodities more significantly than it did when the country emerged from the 2008 financial crisis,” based on forecasts from Andrew Forrest, executive chairman of Fortescue.

“It’s like that, but this time it’s only going to be bigger in volume,” Forrest told CNBC when commenting on how China’s demand at this stage in the pandemic would compare to demand after the 2008 Financial Crisis.

“What we’re seeing now is uniform demand across China,” Forrest added, “And uniform demand but increasing, thankfully, in the supply chain, the ecosystem which will create [for the] renewable energy industry.”

NBCM Offers Flexible Commodities Exposure

As China continues to transition its economy into a new stage of the pandemic, investors can get commodities exposure. Additionally, they can opt for more dynamic exposure via active management for more flexibility in the commodities market.

More specifically, they can look more closely at the Neuberger Berman Commodity Strategy ETF (NBCM). The fund uses active management, which, as mentioned, allows for fluidity when adding commodities exposure.

With its active management style, NBCM puts the portfolio holdings in the hands of seasoned portfolio managers, which will allow for changes to holdings when market conditions warrant necessary adjustments. This adds a layer of flexibility to an investor’s portfolio, especially with the capital markets responding to the U.S. Federal Reserve and interest rate policy.

The fund invests in commodity-linked derivatives with an active risk-balanced, diversified approach that seeks to minimize the effects of market volatility — something privy to the commodities market. Tactical exposure adjustments expand potential alpha sources by considering top-down macro variables among commodity sectors and individual commodity outlooks to take advantage of short- and long-term opportunities.

For more news, information, and analysis, visit the Commodities Channel.