Commodities, particularly agriculture commodities, saw healthy gains in April. According to the S&P Dow Jones Indices, the S&P GSCI Agriculture gained 5.8% over the month, driven up by strong performance across the grains and oilseeds complex.

Corn was the stand-out performer for the month, with the S&P GSCI Corn rallying 9.6%. Meanwhile, the S&P GSCI Soybean Oil rose to record levels in April, ending the month up 23%.

The S&P GSCI gained an additional 5.1% in April, buoyed by another higher inflation reading.

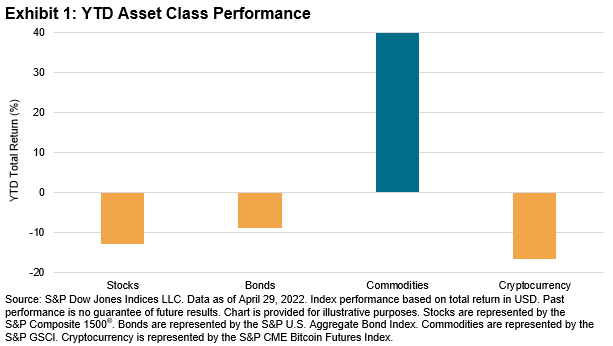

Jim Wiederhold, associate director of commodities and real assets at S&P Dow Jones Indices, noted that many investors realized that the Federal Reserve may be behind the curve and have started allocating capital to commodities in 2022. Among the major asset classes, commodities’ outperformance year-to-date has been noteworthy.

The rise in agricultural commodities has been extremely positive for agricultural ETFs, such as the Teucrium Corn Fund (CORN), the Teucrium Wheat Fund (NYSEArca: WEAT), and the Teucrium Soybean Fund (NYSEArca: SOYB), which have gone up 36%, 41%, and 23% year-to-date, respectively.

For investors looking to buffer inflation, experts believe that commodities may also be beneficial for inflationary periods, making them a valuable hedge against the recent surge in the prices of goods and services over the last year.

For more news, information, and strategy, visit the Commodities Channel.