Governmental support for environmental initiatives in the U.S. is finally on the cusp of becoming a reality with the passage by the Senate of the Inflation Reduction Bill on Sunday, August 7. The bill addresses a host of topics, including inflation, taxation for corporations, healthcare regulations for prescription prices within Medicare, and a huge focus on climate and emissions reductions.

The Inflation Reduction Act of 2022 goes to the House this week and then once passed, will go to President Biden to sign into law. It will be the most sweeping climate legislation to ever be passed within the U.S.

Princeton University’s Zero-Carbon Energy Systems Research and Optimization Laboratory (Zero Lab) conducted a preliminary report on the energy and climate impacts that the bill will have utilizing their Rapid Energy Policy Evaluation and Analysis Toolkit (REPEAT).

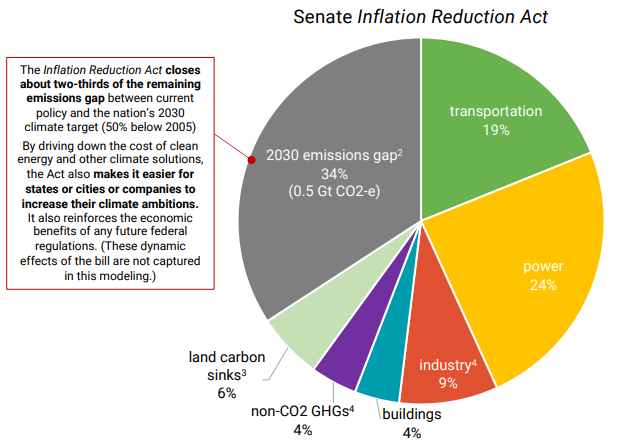

They found that the legislation will cut an extra 1 billion metric tons by 2030 in annual emissions from current policy levels, reduce the emissions gap between the 2030 emissions target of a 50% reduction (based on 2005 levels) and where the current policies are by two-thirds, and put the U.S. within approximately 500 million tons of its 2030 reduction goals. It would also reduce cumulative greenhouse gas emissions by 6.3 billion tons in the next 10 years in the U.S.

Image source: REPEAT Project’s estimates of emissions reductions created beyond current policy

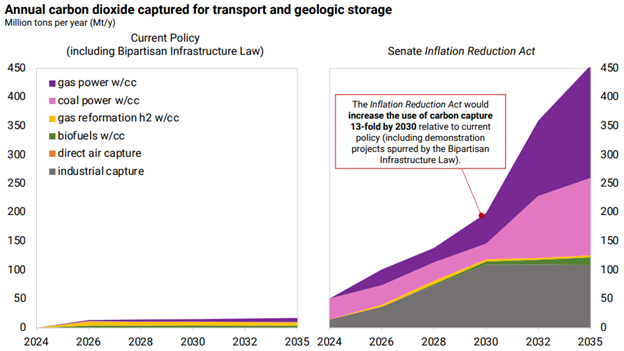

The climate provisions of the bill cover a vast expanse of initiatives: the bill includes tiered rebates for updating housing to be more energy efficient — including higher rebates for low- to moderate-income households; funds the adoption of updated building codes that will require all new buildings are compliant with the 2021 International Energy Conservation Code for residential buildings and the ANSI/ASHRAE/IES Standard 90.1-2019 for commercial buildings; and increases available loans to green energy projects, including carbon capture technologies and sequestration.

The bill also increases loans to boost domestic EV production, reinvests in updating the energy infrastructure, and contains requirements for any fossil fuel energy producer to have “controls or technologies to avoid, reduce, utilize, or sequester air pollutants and anthropogenic emissions of greenhouse gases.”

It outlines funding for nuclear research, land conservation, ecosystem preservation, planning and building water projects to assist in drought mitigation, expands offshore wind capabilities, and tackles emissions across sectors — including a focus on methane emissions from fossil fuel energy producers and penalizations for failing to reduce greenhouse gas emissions by the sector.

What the Bill Means for Carbon Allowances

The bill is going to have broad-reaching impacts and will catapult the U.S. into a major emissions reduction player on the world stage.

Luke Oliver, managing director, head of climate investments and head of strategy at KraneShares, the issuer behind the first carbon allowances ETF, the KraneShares Global Carbon Strategy ETF (KRBN), discussed what having a regulatory framework focused on emissions reductions could mean for the U.S. and carbon allowances investors.

“This is an interesting moment,” Oliver explained in a communication to VettaFi, addressing what it means for KraneShares’ carbon suite of funds. “While the Inflation Reduction Act doesn’t directly touch on the Emission Trading Systems (ETS), this is a clear signal on the direction of travel of climate action. Being long carbon can be viewed as being long emission regulation, which consensus supports.”

Image source: REPEAT Project

“Between Gavin Newsom’s comments on tightening the California program, the recent Infrastructure Bill and now the Inflation Reduction Act there is a very clear directional path and appetite for increased climate regulation, creating an environment that can be very bullish for U.S. carbon prices, while also giving positive momentum to reducing pollution in the long term,” Oliver said.

KraneShares has a suite of ETFs with a variety of targeted exposures to global cap-and-trade carbon allowance markets that invest in carbon credit futures. These funds include coverage of U.S. markets through the KraneShares Global Carbon Strategy ETF (KRBN), which invests in carbon allowances futures globally from the EU, California markets, RGGI, and the U.K., as well as the more targeted KraneShares California Carbon Allowance Strategy ETF (KCCA).

For more news, information, and strategy, visit the Climate Insights Channel.