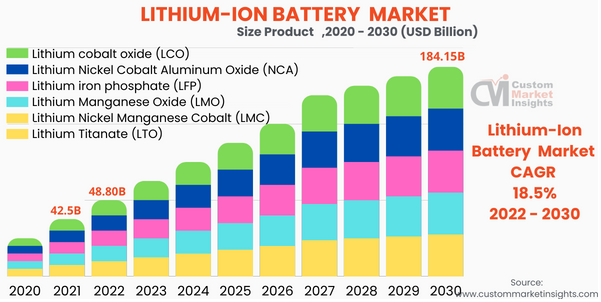

Electrification of the automobile industry continues at a rapid pace, and increasingly more traditional automotive companies have committed to manufacture electric vehicles. It’s a growth that’s expected to fuel sustained, increasing demand for lithium-ion batteries, with the market expected to hit $184.15 billion by 2030.

Latest estimates based on a market research study from Custom Market Insights put the global lithium-ion battery market size and shares at a value of $48.8 billion by the end of the year, a growth of over $6 billion from last year. Increasing demand in the coming years is anticipated to boost growth of the lithium-ion battery market to $184.15 billion by 2030 at a CAGR of 18.5%.

Image source: Custom Market Insights

Demand won’t just come from the EV conversion though: lithium-ion batteries will play an integral part in the transition of the electrical grid, storing energy from renewable sources and releasing it as needed. It’s an appealing solution because lithium-ion batteries are cheaper than many of the alternatives, have low rates of self-discharge, and are heat-resistant, making them ideal solutions in hotter climates, remote locations, and in thermal control applications, according to Custom Market Insights.

“The key factors driving the market are increasing demand for EVs and increase battery usage in the power grid and energy storage systems,” according to the report overview.

They’re also a core component for many tech devices these days, valued for their high energy density and superior power output over many other batteries, and demand for their use in consumer electronics goods is expected to continue to grow.

Investing in Lithium-Ion Battery Demand and Through Metals

KraneShares recently launched the KraneShares Electrification Metals ETF (KMET), which offers targeted exposure to the metals necessary for the electrification and clean energy transition of the world’s economy in the pivot to net-zero emissions.

The fund seeks to track the Bloomberg Electrification Metals Index and is comprised of futures contracts on copper, nickel, zinc, aluminum, cobalt, and lithium. These metals are all core components for batteries, electric vehicles, and the renewable energy infrastructure being created and expanded as countries aim for net-zero emissions by 2050 to curtail global warming.

KMET has an expense ratio of 0.79% and is part of the climate-focused lineup of funds from KraneShares.

For more news, information, and analysis, visit the Climate Insights Channel.