The U.S.’s economic outlook continues to dim as earnings season reveals the true cost of banking sector stress in the first quarter. Many businesses have slowed manufacturing, and consumer confidence and spending haven fallen. Despite increasing recession risks, however, the energy transition continues to churn away, with more and more companies committing to climate pledges and decarbonization. The KraneShares Global Carbon Transformation ETF (KGHG) is positioned to capture the valuation potential of these transitioning companies.

KGHG focuses on the global industry leaders pushing the transition to net-zero emissions. KraneShares believes that the upside potential of these transitioning companies is enormous, as the dirty companies of today become the industry leaders of tomorrow.

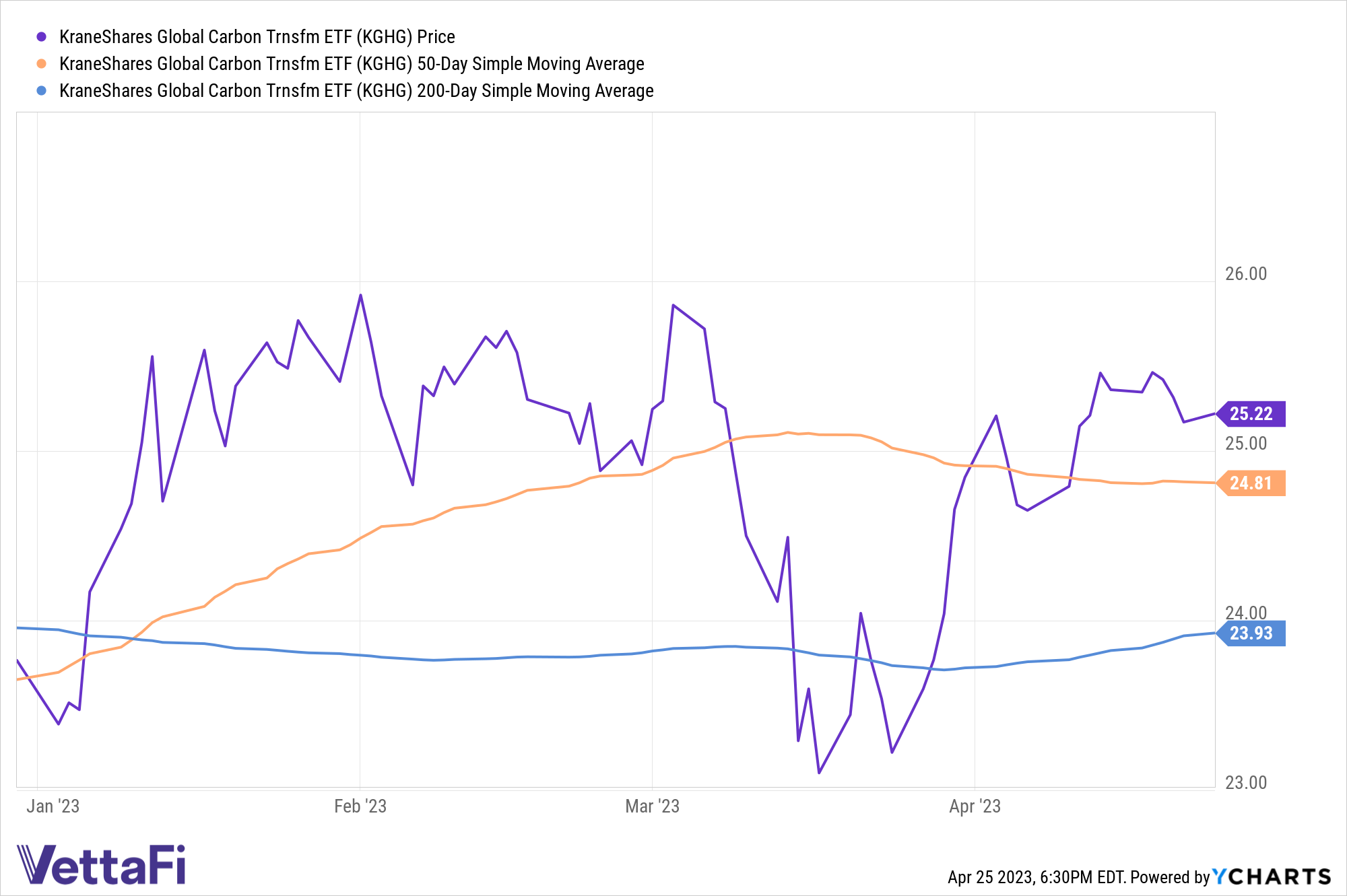

Currently up 6.12% YTD, KGHG is flashing strong buy signals for trend followers. It is trending above both its 50-day Simple Moving Average as well as its 200-day SMA.

KGHG is currently up 6.12% YTD. It is trending above both its 50-day Simple Moving Average as well as its 200-day SMA.

Inside The Portfolio Of This KraneShares Carbon ETF

This KraneShares ETF focuses on companies in industries that are traditionally some of the highest emission offenders, but which are transitioning to renewable technologies. These companies will benefit greatly from being leaders, as the cost of carbon emissions is only growing. More expensive carbon prices will inevitably cut into their bottom line..

As of the end of March, top sector allocations for KGHG were energy at 32%, industrials at 30%, utilities at 18%, materials at 17.99%, and information technology at 1%. Top holdings for the fund include BP PLC (BP) at a 4%; Rexel Sa (RXL) at 4%; and Eni Spa (ENI) at 4.13%.

KGHG is an actively managed fund that invests globally across market caps and sectors in carbon emissions reducers. These companies are taking active steps to reduce their carbon footprints or the carbon footprints of other companies. KGHG also includes companies within the carbon-reducing companies’ supply chain, and companies growing their businesses via carbon emissions reduction.

The fund utilizes proprietary, fundamental, bottom-up analysis using information disclosed by companies and third-party data.

KGHG carries an expense ratio of 0.89%.

For more news, information, and analysis, visit the Climate Insights Channel.