Advisors and investors in search of not just shorter-term opportunities amidst economic downturn and recession in the U.S. but also longer-term investment potential in the leading companies of tomorrow should consider equities that are already well underway with the energy transition. Such companies could be positioned to be at the forefront of their industries in a decarbonizing world, and KraneShares hosted a recent webinar to discuss the opportunities in these equities and their fund that captures these transitional companies, the KraneShares Global Carbon Transformation ETF (KGHG).

“The concept of the energy transition is all about adapting our current energy and industrial systems to less polluting business models,” explained Roger Mortimer, PM of KGHG. It is booming while many other areas of the economy struggle.

Increasing investor awareness alongside recent global regulation in support of the energy transition is creating a sort of “climate gold rush,” according to Mortimer into the industries that are most impacted and also largely responsible for global emissions, industries that collectively makeup about 20% of the world’s economy.

“There’s an opportunity for investors to get exposure to secular growth that is driven by climate policy… This is non-correlated to the broader economic environment,” Mortimer said.

Investing in Transitioning Equities With KGHG

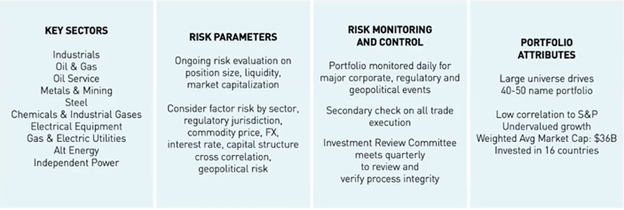

KGHG focuses on the global industry leaders that are pushing the global transition to net-zero emissions. KraneShares believes that the upside potential of investing in these companies as they transition is enormous.

Image source: KraneShares webinar

“The thesis of this fund, KGHG, is that there is a policy-driven capital cycle coming that is the largest we’ve ever seen and it’s focused on a group of industries that will see their growth prospects transform,” Mortimer explained. “As an investor, you want to get exposure to these companies that will benefit when they’re revalued.”

The fund seeks to capture the true potential within the carbon transition by focusing on companies from within industries that are traditionally some of the highest emission offenders but that are on the precipice of transitioning to renewable technologies. These companies that are set to disrupt their industries would benefit greatly from being leaders in the transition, as the cost of carbon emissions will only become more expensive, cutting into the bottom line as demand decreases for high emissions offenders.

“We think that the most effective strategy for the energy transition is actually to invest in the problem and capture the transition of companies that are gray today but are going to be green tomorrow,” said Mortimer. “The important point here is that 90 companies account for two-thirds of global emissions, and by definition, they have to be part of the solution.”

KGHG is an actively managed fund that invests globally across market caps and sectors in carbon emissions reducers that are taking active steps to reduce their carbon footprints and services or the carbon footprints of other companies. This also includes companies within the supply chain of the carbon-reducing companies and companies that are growing their businesses with companies that are materially reducing carbon emissions.

The fund utilizes proprietary, fundamental, bottom-up analysis using information disclosed by companies and third-party data.

KGHG carries an expense ratio of 0.89%.

For more news, information, and analysis, visit the Climate Insights Channel.