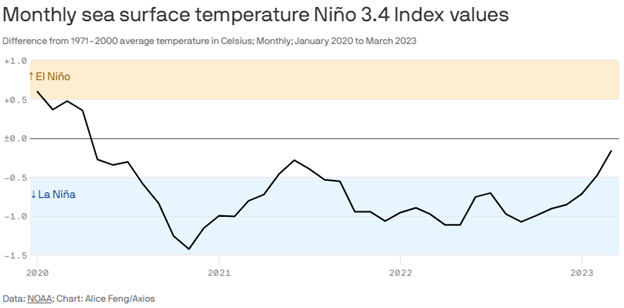

The National Oceanic and Atmospheric Administration has set a 62% chance of an El Niño cycle developing between May and July, bringing with it the likelihood of significantly warmer weather. Hotter summer months will put greater strain on the energy infrastructure of the U.S., and greater energy demand will lead to increased emissions and increased demand for carbon allowances in states with regulated carbon markets.

An El Niño cycle occurs when surface water in the Pacific Ocean warms and wind currents weaken or reverse over the ocean. Odds of it happening increases to 85% later in the year Michelle L’Heureux, meteorologist and head of the El Niño-Southern Oscillation team at NOAA’s Climate Prediction Center, told Axios.

Image source: Axios

The onset of warmer weather alongside the warming already happening from man-made climate change is likely to result in the hottest year on record next year, according to climate experts. The last time there was a major El Niño event was in 2015-2016, the same year that increasing weather catastrophes and warming temperatures drove the global community to create and sign the Paris Agreement.

“While it’s too early to know for sure, it is likely that 2024 will be the warmest year on record. Exactly how warm will depend on how long El Niño conditions persist,” Zeke Hausfather, climate research lead at Stripe, told Axios.

Hotter summertime temperatures are likely to test the U.S. energy infrastructure again. Looking towards winter, El Niño cycles typically bring more precipitation and colder weather to the West Coast and California according to the U.S. Geological Survey, the home of one of the U.S.’s two cap-and-trade carbon markets.

KCCA Benefits During Emissions Demand Spikes

Greater energy demand will likely lead to higher emissions over the summer, and for the California carbon market, the potential for increased energy demand in the winter as well. Higher emissions mean that participants of cap-and-trade programs will likely have an increased demand for carbon allowances which could lead to positive price pressure in the near and longer term.

The KraneShares California Carbon Allowance ETF (KCCA) offers targeted exposure to the joint California and Quebec carbon allowance markets and will benefit from California’s aggressive push to reduce emissions alongside the increasing demand for allowances within the market.

KCCA is up 6.63% YTD as of April 20, 2023, and is trading above its 50-day simple moving average (SMA) as well as its 200-day SMA, a signal to buy for trend followers.

KCCA is a fund that offers exposure to the California cap-and-trade carbon allowance program, one of the fastest-growing carbon allowance programs worldwide and is benchmarked to the IHS Markit Carbon CCA Index. The CCA includes up to 15% of the cap-and-trade credits from Quebec’s market.

The index measures a portfolio of futures contracts on carbon credits issued by the CCA and only includes futures with a maturity in December in the next year or two while using a wholly owned subsidiary in the Cayman Islands to prevent investors from needing a K-1 for tax purposes.

KCCA carries an expense ratio of 0.78%.

For more news, information, and analysis, visit the Climate Insights Channel.