Carbon allowances remain a somewhat overlooked class of commodities by advisors and investors. They are positioned to provide strong diversification potential for portfolios, with a number of positive price pressures in the years ahead. Advisors looking to gain global diversified exposure to this commodity class should consider the KraneShares Global Carbon ETF (NYSE: KRBN).

KRBN is the first ETF of its kind to offer an investment take on carbon credits trading and is up 0.63% YTD. The fund provides exposure to major carbon markets worldwide with mechanisms to include future markets as they mature.

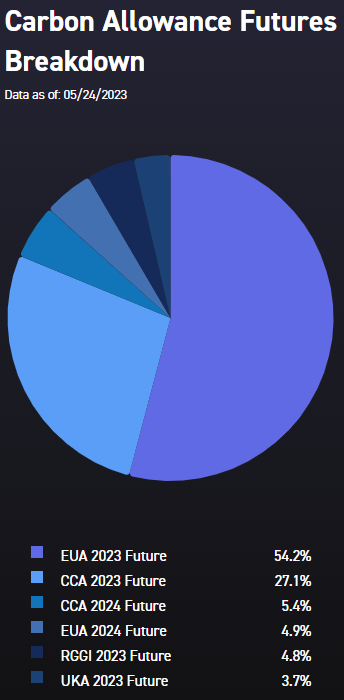

KRBN tracks the IHS Markit Global Carbon Index, which follows the most liquid carbon credit futures contracts in the world. This includes contracts from the European Union Allowances (EUA) and the United Kingdom Allowances (UKA) overseas. It also includes the California Carbon Allowances (CCA) and Regional Greenhouse Gas Initiative (RGGI) markets domestically.

See also: “How to Add Diversification With Carbon Allowances and KRBN“

Positioning and Performance for World’s First Carbon ETF

Image source: KraneShares

Current positioning of the fund puts a heavy weight on the well-established European carbon market at 59.1% total. The California carbon market is the second largest allocation at 32.5% weight. RGGI exposure is 4.8% and the U.K. carbon market is the smallest allocation at 3.7%. All percentages are as of 05/24/23.

Because it invests in overseas markets, the fund does have significant foreign currency exposure, primarily in the euro. As of 05/24/23 KRBN’s main currency exposure is to the euro at 59.3%. The U.S. dollar is a 36.6% exposure and the British pound is a 4.0% exposure.

The fund offered noteworthy distributions last year alongside the diversification benefits it carries. KRBN paid out an annual distribution of 8.35 in December for an annual dividend yield of 22.25%.

It’s been a fairly volatile year for markets and the macro environment and that has played a role in KRBN’s performance. In Q1 2023, the fund traded at premium 30 days and at discount 32 days according to the issuer’s website. So far in the second quarter, the fund traded 14 days at premium and 23 days at discount. This is calculated by finding the difference between the daily market price and the NAV of the fund.

KRBN carries an expense ratio of 0.78%.

For more news, information, and analysis, visit the Climate Insights Channel.