BYD surpassed Volkswagen in sales in China in the first quarter of 2023, becoming the top car brand for the first time, reported Bloomberg. The Chinese electric vehicle (EV) manufacturer continues to gain ground, expanding into overseas markets in Europe, Asia, and Latin America. It’s also a stock inside the KraneShares Electric Vehicles and Future Mobility ETF (KARS).

BYD sold over 440,000 vehicles in Q1, compared to Volkswagen’s 427,000: Volkswagen has been the top automaker in China since 2008. The China EV manufacturer discontinued traditional internal combustion engine vehicles last year. Now, BYD focuses solely on hybrid and fully electric offerings.

According to a recent report from the International Energy Agency, EV sales are predicted to soar in 2023. That’s after sales of over 10 million EVs last year.

“Electric vehicles are one of the driving forces in the new global energy economy that is rapidly emerging – and they are bringing about a historic transformation of the car manufacturing industry worldwide,” Fatih Birol, IEA Executive Director, said in the report announcement.

EV sales are anticipated to reach 14 million this year, a 35% growth year-over-year, and grow global EV automobile market share from 14% in 2022 to 18% this year.

China alone made up 60% of all EV sales worldwide in 2022 and continues to dominate global market share this year. For it’s part, BYD sold 1.86 million automobiles in 2022, a total higher than all four previous years together, and looks to be well on its way this year: two out of every five electric vehicle sales in China in Q1 were BYD, with the Chinese EV giant logging sales of nearly 550,000 in Q1.

Capture the Opportunity in EVs and BYD With KARS

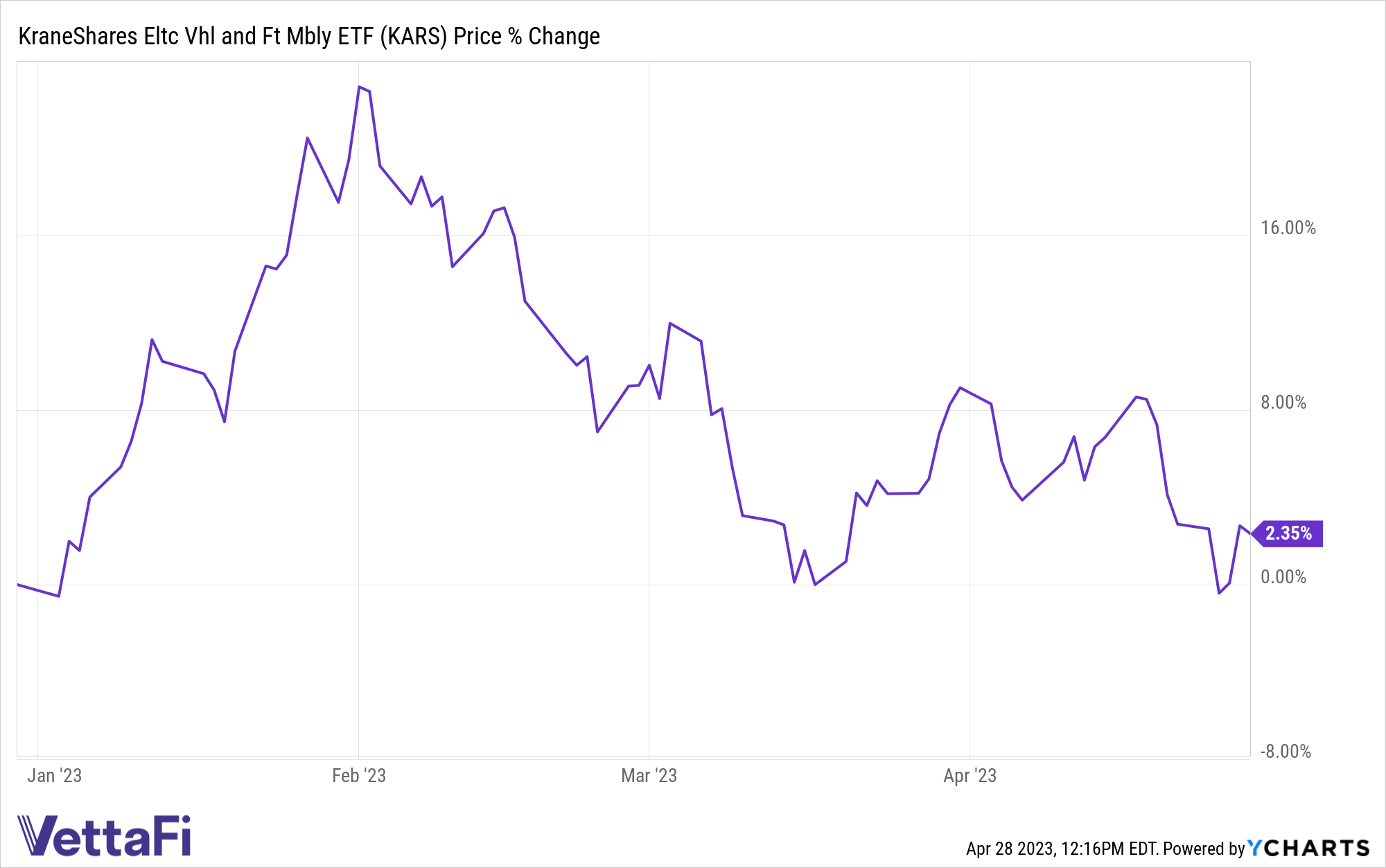

The KraneShares Electric Vehicles and Future Mobility ETF (KARS) offers a good solution for investors looking to capture the potential growth of major EV producers globally, such as BYD that is currently the fourth-largest holding of the fund at 4.14% weight. The fund takes not just a global approach to EV exposure, but also invests along the entirety of the value chain, offering diversification for EV investors, and is up 2.53% YTD.

Since the start of 2023, KARS has risen 2.35%.

KARS measures the performance of the Bloomberg Electric Vehicles Index, which tracks the industry holistically, including exposure to electric vehicle manufacturers, electric vehicle components, batteries, hydrogen fuel cells, and the raw materials utilized in the synthesis of producing parts for electric vehicles.

KARS invests in many familiar car companies such as Tesla, Ford, and Mercedes-Benz, and major Chinese EV manufacturers such as Li Auto, Nio, and BYD. It also goes a step beyond and invests in the companies that contributed to the EV value chain, such as Samsung, Panasonic, and Albemarle, a major lithium manufacturer.

KARS has an expense ratio of 0.70%.

For more news, information, and analysis, visit the Climate Insights Channel.