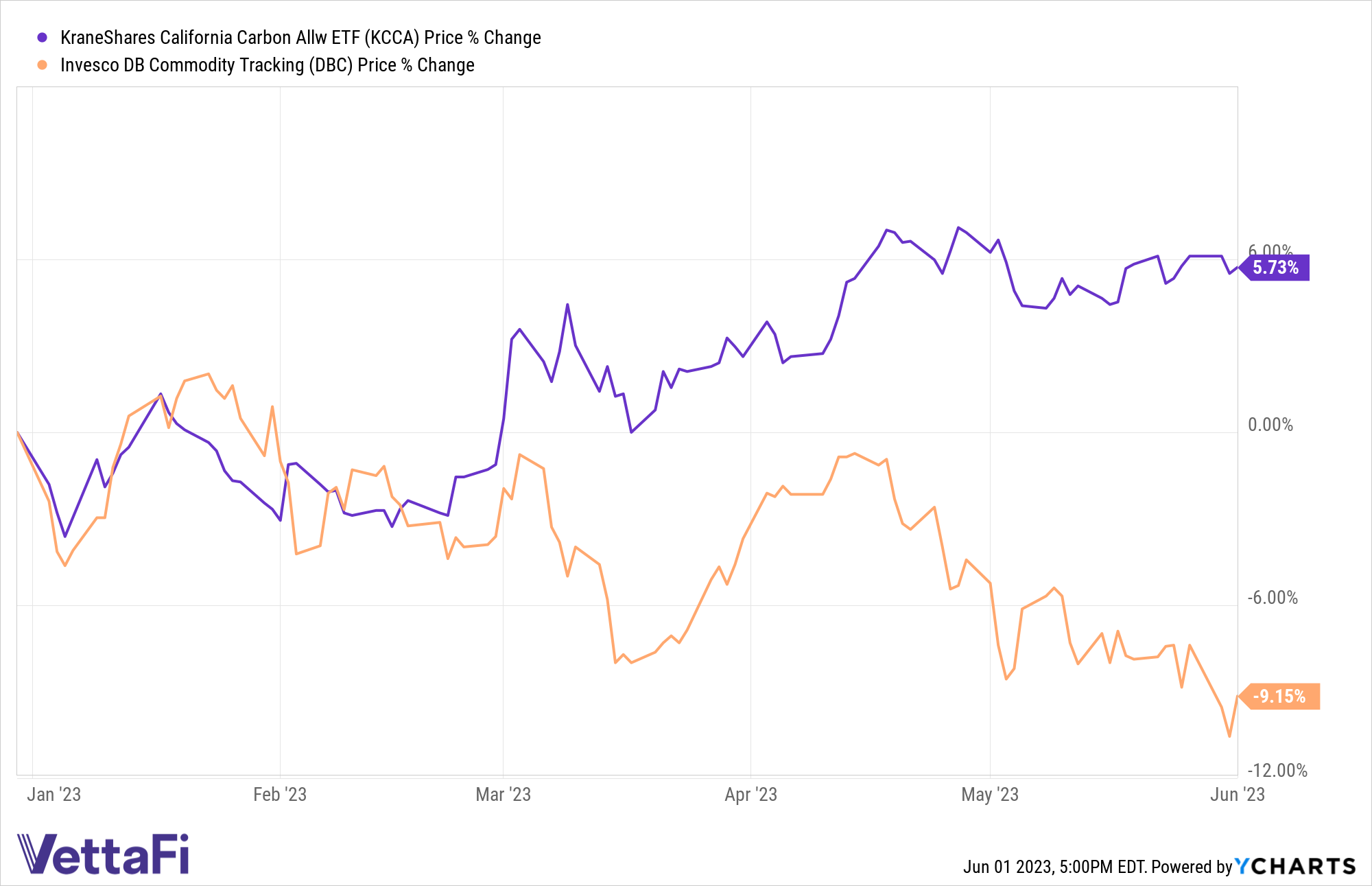

Commodities face several headwinds as a U.S. recession looms over the second half of the year. Broad commodities are down year-to-date but California’s carbon allowances are up, and the KraneShares California Carbon Allowance ETF (KCCA) offers exposure.

Oil and natural gas prices continue to fall in the U.S. as stockpiles grow. Wheat, copper, and a number of other metals and major commodity futures are down YTD. Gold futures are up on recession fears but not enough to carry commodities as a whole.

Broad commodity ETFs such as the Invesco DB Commodity Index Tracking Fund (DBC) are down for the year. DBC is an ETF that invests in the 14 largest and most heavily traded commodities such as oil, natural gas, gold, and more.

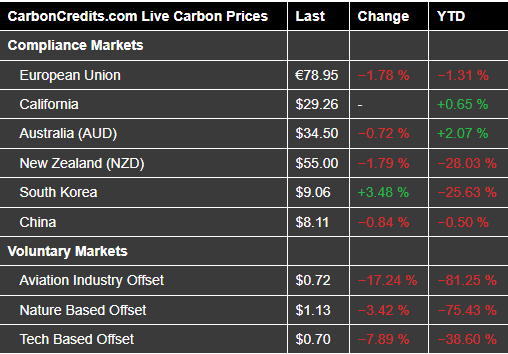

California Carbon allowances, an often overlooked commodity class, are up 0.65% YTD as of 06/01/2023 according to Carbon Credit. It’s only one of two major carbon compliance markets to be up for the year, presenting an opportunity for investors.

Image source: Carbon Credit

Diversify Broad Commodities Exposure With KCCA

KCCA offers targeted exposure to the joint California and Quebec carbon allowance markets and will benefit from California’s aggressive push to reduce emissions alongside the increasing demand for allowances within the market. Carbon allowance investing is worth considering for the diversification benefits that it can bring to portfolios.

KCCA is a fund that offers exposure to the California cap-and-trade carbon allowance program. This market is one of the fastest-growing carbon allowance programs worldwide. Its benchmark is the IHS Markit Carbon CCA Index and includes up to 15% of the carbon credits from Quebec’s market.

KCCA is currently up 5.73% YTD compared to DBC’s -9.15% YTD.

The index measures a portfolio of futures contracts on carbon credits issued by the CCA. The index only includes futures with a maturity in December in the next year or two. The fund also uses a wholly-owned subsidiary in the Cayman Islands which makes a K-1 unnecessary for taxes.

KCCA carries an expense ratio of 0.78%.

For more news, information, and analysis, visit the Climate Insights Channel.