Investors frequently hear about the benefits of tapping the emerging markets consumer theme – one that largely revolves around China. The KraneShares CICC China Consumer Leaders Index ETF (NYSEARCA:KBUY) is an example of exchange traded fund with dedicated access to Asia’s powerhouse.

KBUY, which is nearly two months old, tracks the CICC China Consumer Leaders Index. That benchmark “consists of the investable universe of publicly traded China-based companies whose primary business or businesses are in the consumption-related industries such as home appliance, food & beverage, apparel & clothing, hotels, restaurants, and duty-free goods,” according to KraneShares.

Some recent data points have shown signs of softness in the world’s second-largest economy, but Beijing is also taking steps to prop up consumption. China has been looking to increase internal consumption to reduce the economy’s sensitivity to exports, and those efforts appear to be paying dividends. While some data points indicate the Chinese economy and consumer spending are slowing, policymakers remain proactive.

Call on the KraneShares KBUY ETF

“The KBUY portfolio provides extensive exposure to a wide range of brands including home appliances, alcohol and liquor, and food and apparel. Many investors are surprised to learn that China’s retail sales surpassed that of the United States in 2019 when China clocked 5.8 trillion dollars worth-of-good sold versus 5.5 trillion dollars here in the United States,” according to Brendan Ahern of KraneShares. “Even with the world’s largest middle-class population, China still has immense potential for further consumption growth. Recent advancements in E-Commerce platform technologies and discounted group buying programs have helped domestic brands expand their reach to lower-tier cities.”

When it comes to sector ETFs, many investors solely focus on domestic offerings. Investors considering these ETFs in China should note that there is likely to be dispersion among the various sectors, as is the case with domestic fare.

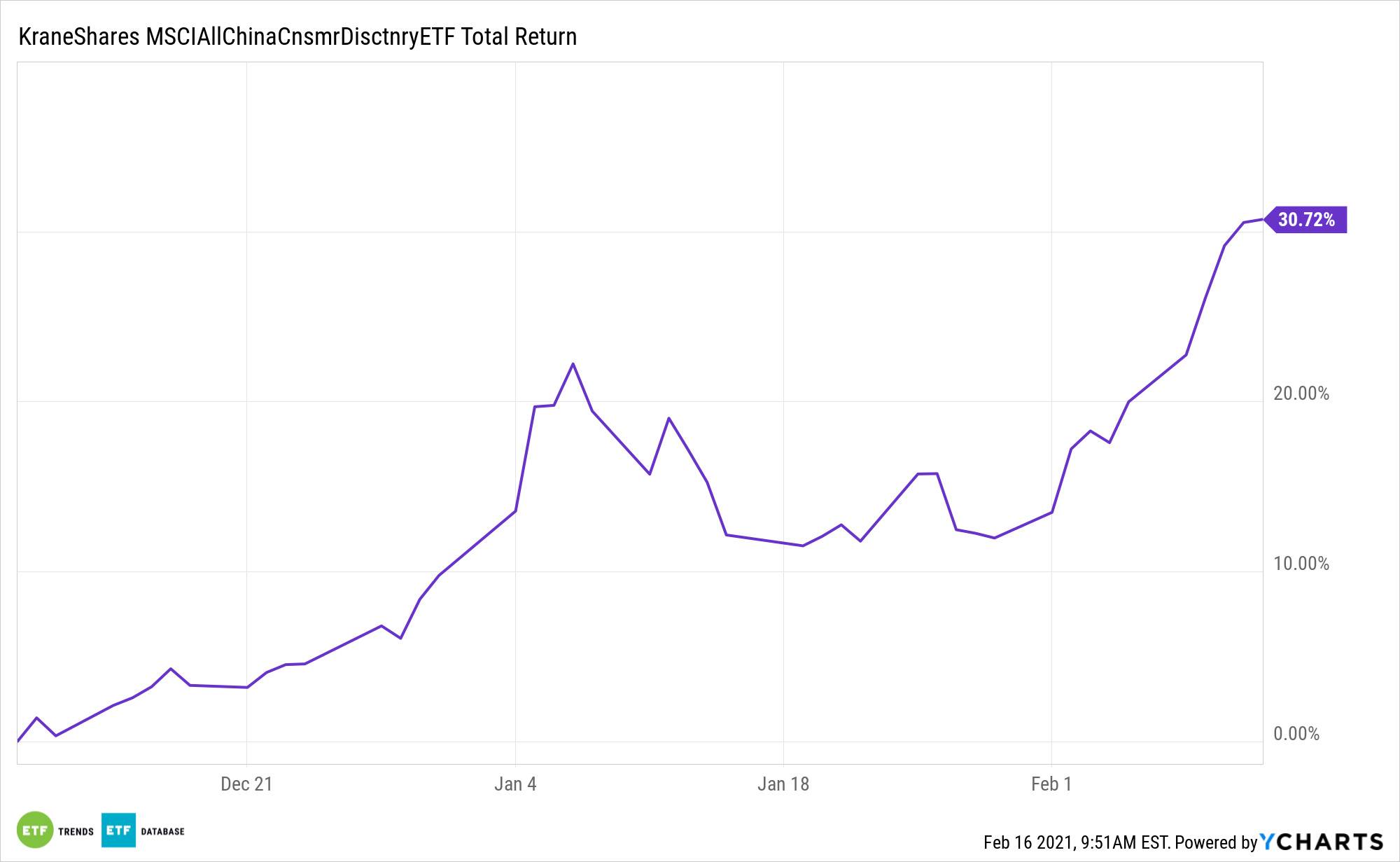

Still, KBUY’s price action suggests that although the ETF’s components have a heavy domestic focus, the fund stands to benefit from the U.S. and China resolving their trade issues.

“We are also seeing how rising incomes in China have contributed to an overall consumption upgrade, consisting of a stronger preference for high-quality products, brand loyalty, and more luxury spending,” adds Ahern. “New technology infrastructure, such as mobile payments, big data, artificial intelligence (AI), and cloud computing, is significantly enhancing the shopping experience, making it much more convenient and efficient as well as enabling companies to reach much larger audiences.”

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.