Markets are rallying on the hope of better performance for companies after Nike and FedEx both reported quarterly earnings that beat expectations, reported CNBC. With a hawkish Fed looming over early next year, economic slowing is expected in the new year and dividends will remain a strong choice for many advisors and investors in a challenged environment for equities.

The earnings news from Nike and FedEx was followed today by a report from the Conference Board that consumer confidence bounced back in December to hit its highest levels since April this year as consumers continue to shift from big-ticket items to services. 20.4% of consumers expect business conditions to improve in the next six months, an improvement over 19.8% last month, while 20.3% expect them to worsen over the same period, down from 21% last month.

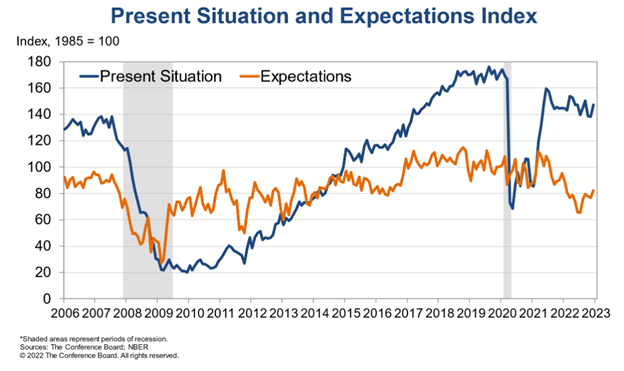

Image source: The Conference Board

The Present Situation Index is based on how consumers think businesses and the labor market conditions are right now while the Expectations Index is based on their short-term views for businesses, income, and labor market conditions. The Expectations Index has been hovering around 80 or lower for much of the year, levels typically aligning with recession.

The strong rally comes at a time when there is historically less liquidity in markets at the end of the year around the holiday season.

“These moves that you see today are just head fakes,” Matt Lloyd, chief investment strategist at Advisors Asset Management, told MarketWatch.

“We got sort of oversold and I think the market was looking for an excuse to rally, and the Nike and FedEx number provided that,” Sam Stovall, chief investment strategist at CFRA Research, told CNBC. “I really question, however, if this is something that’s going to be long-lasting.”

Investing in Dividends and Value With KVLE

It remains to be seen whether the current rally will extend through the remainder of the week and into the close of the year, but a still hawkish, aggressive Fed looms over early 2023, having indicated they wish to carry rates to at least 5% in the first half of the year.

With more rate hikes on the horizon and further economic slowing, dividends are likely to continue to be a popular play in 2023. For advisors looking for a fund that captures dividend-generating companies with a focus on value, the KFA Value Line Dynamic Core Equity Index ETF (KVLE) is worth consideration. KVLE invests in higher-yield companies while diversifying in a way that a “theme” portfolio does not.

The fund is a core equity portfolio of securities that are tilted to favor dividend yield, and it seeks to increase yield while avoiding investing solely in high yield sectors and stocks. It’s an approach that has yielded consistently better performance than the S&P 500 in 2022.

KVLE is benchmarked to the 3D/L Value Line Dynamic Core Equity Index and utilizes optimization technology to emphasize securities with solid dividend yields with the highest rankings in Value Line Safety and Timeliness. The fund uses a smart beta strategy in seeking more cost-efficient alpha and a risk management strategy that seeks to limit the effects of major market declines while also being positioned to capture positive returns.

KVLE carries an expense ratio of 0.55%.

For more news, information, and analysis, visit the China Insights Channel.