The Federal Reserve meets this week to decide the next round of interest rate increases, and markets are continuing their slide after a higher-than-anticipated May CPI report last Friday. The S&P 500 is once more back in bear territory and at an intraday low for 2022, down 3.1% in trading on Monday, while the Nasdaq Composite dropped 3.9% and the Dow Jones Industrial Average fell 2.3%, or 740 points, reported CNBC.

May’s 8.6% CPI report, soaring consumer prices in areas such as gas, food, and shelter creating weak consumer sentiment, and Fed willingness to do what it takes to bring inflation back under control have advisors and investors eyeing a recession with greater likelihood than before.

Dividend-yielding companies have become a popular play for advisors in choppy market conditions, and KraneShares offers a large-cap dividend ETF as well as a small-cap dividend ETF that have the dual benefits of exposure to dividends and the use of an equal-weighting strategy. Equal weighting tends to be a more popular strategy during times of volatility, as it spreads exposure evenly across sectors, potentially mitigating a degree of the volatility during times of market movement.

The KraneShares Large Cap Quality Dividend Index ETF (KLCD) offers investment in U.S. large-cap companies providing reliable dividend payments. The fund is benchmarked to the Russell 1000 Dividend Select Equal Weight Index and utilizes smart beta to invest in large-cap companies within the U.S.

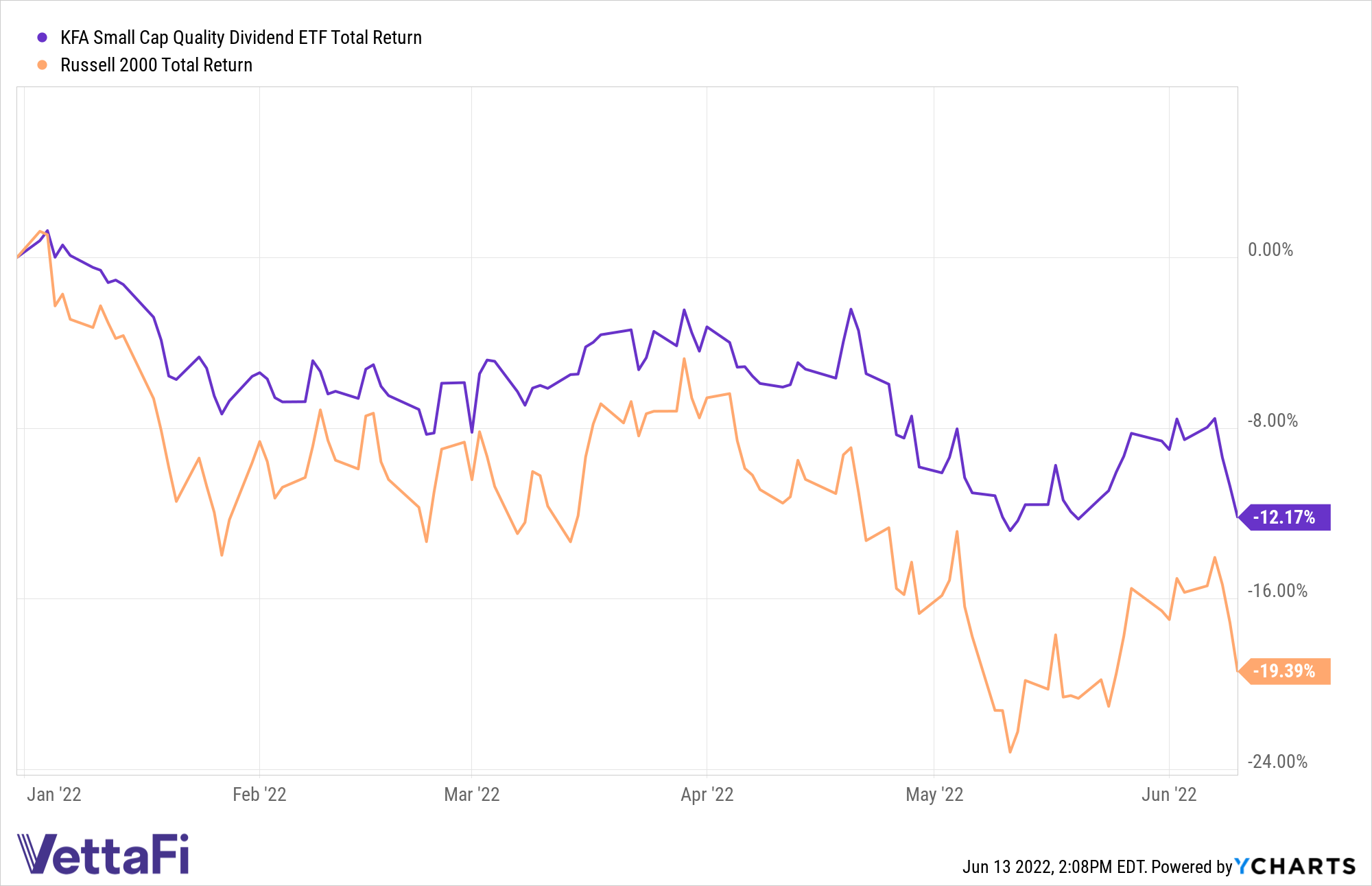

The KFA Small Cap Quality Dividend Index ETF (KSCD) offers value investing with an eye toward reliable growth. The fund is benchmarked to the Russell 2000 Dividend Select Equal Weight Index, which utilizes smart beta to invest in small-cap companies within the U.S.

Both funds have outperformed their broader indexes by offering exposure to companies that have demonstrated steady dividend growth over the course of 10 years with no decrease in quarter-to-quarter dividends per share and also have an established record of stable cash flow and a robust business model. These characteristics together demonstrate what the funds deem as “quality.”

KLCD and KSCD utilize a smart beta strategy that seeks to deliver alpha at a price point that is cost-effective for investors. The funds are positioned to potentially perform well in a down-market environment, as strategies that focus on dividend growth can potentially offer improved performance in said environments.

KLCD carries an expense ratio of 0.41%, and KSCD carries an expense ratio of 0.51%; KFA Funds is a KraneShares company.

For more news, information, and strategy, visit the China Insights Channel.