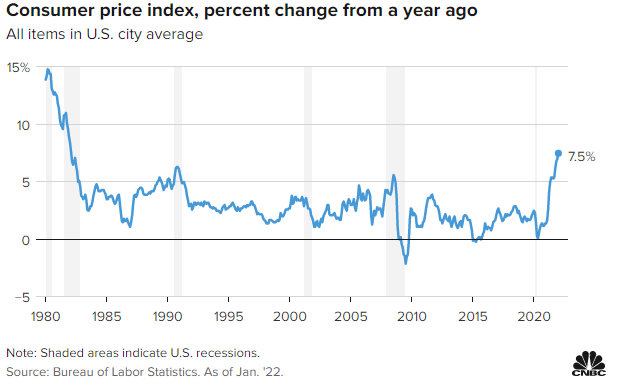

The consumer price index report was released today, rising 0.6% for the month of January and pushing annual inflation to 7.5%, the highest gain in 40 years. Despite record highs, Nancy Davis, founder of Quadratic Capital Management, cautioned in a communication to ETF Trends that the current environment of inflation has been arrived at through unconventional means in a way that Federal Reserve monetary tightening cannot change.

Consumer prices have risen enormously in the last year, while real earnings for workers rose just 0.1% for January when calculating inflation. According to CNBC, core inflation rose 6%, with every CPI number defying analyst expectations.

Image Source: CNBC

“With another surprise jump in inflation in January, markets continue to be concerned about an aggressive Fed,” said Barry Gilbert, asset allocation strategist at LPL Financial. “While things may start getting better from here, market anxiety about potential Fed overtightening won’t go away until there are clear signs inflation is coming under control.”

Markets are now calculating and bracing for aggressive interest rate increases, but Davis points out that this isn’t a matter of straightforward inflation driven by the typical inflationary pressures alone. The current inflation began primarily within supply chain constraints, an issue that no amount of Federal Reserve policy can address.

“Many of the factors driving inflation higher seem to be caused by supply chain constraints and fiscal stimulus and could naturally fade away on their own. However, those factors take a lot longer than expected to slow down. At the same time, commodity prices are increasing and further fueling inflation,” explains Davis.

Davis cautions that advisors and investors need to watch the rates markets and not just the CPI for guidance when judging inflation. The Consumer Price Index isn’t giving the entire picture, and taking into account the forward guidance from the Fed, Davis believes that the rates market is actually priced for disinflation.

“Investors should not take the Fed’s ability to control inflation for granted. Inflation-linked assets can offer diversification and could be helpful in a portfolio if inflation is not as transitory as most expect and if the reduction in monetary support from the Fed is not sufficient to push down inflation,” Davis says.

Hedging for Inflation with IVOL

Davis is the portfolio manager of the Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL) from KFAFunds, a KraneShares company. IVOL is designed to have a twofold hedge against an increase in fixed income volatility and/or an increase in inflation. The fund also seeks to maximize yield curve increases, either brought about by long-term interest rates increasing or short-term interest rates falling; both are tied to big-equity market declines.

IVOL is the first of its kind in active and passive options and offers access to the OTC fixed income options market, the mechanism it uses for long interest rate volatility. The fund invests in a mix of U.S. Treasury Inflation-Protected Securities (TIPS) of any maturity, which are U.S. government bonds whose principal amounts increase with inflation.

It also invests in long options directly tied to the shape of the U.S. interest rate swap curve, which steepens when the spread between longer-term debt instrument swap rates and shorter-term debt instruments grows larger, flattens when the spread grows smaller, and inverts when the spread is negative.

IVOL is actively managed by Quadratic Capital Management, an alternative asset management firm with experience in the options and volatility markets. It expects to invest less than 20% of the fund in option premiums and seeks to purchase options with a time-to-expiration between six months and two years.

IVOL carries an expense ratio of 1.05% and has approximately $2.1 billion in assets under management.

For more news, information, and strategy, visit the China Insights Channel.