NIO Inc. (NIO), a leading Chinese manufacturer and designer of of electric vehicles, reported record highs in its latest earnings statement.

In June 2021, NIO delivered 8,083 vehicles, representing a 116.1% year-over-year increase. Over the three-month period that ended in June, the company delivered 21,896 vehicles, a 111.9% increase from last year.

NIO produces electric cars and SUVs, including one of the world’s fastest electric sports cars, the EP9.

In June, the company delivered 1,498 ES8s, NIO’s flagship six- and seven-seater smart electric SUV model; 3,755 ES6s, which is the company’s five-seater smart electric SUV model; and 2,830 EC6s, NIO’s five-seater smart electric coupe model.

All vehicles offer Nomi Mate 2.0, the world’s first in-vehicle artificial intelligence powered by cloud computer, voice interaction technology, and emotion engine, according to the NIO website. They also utilize NIO Pilot, a driver assist program that updates the firmware over the air and includes autonomous driving options.

Investing in NIO with KraneShares

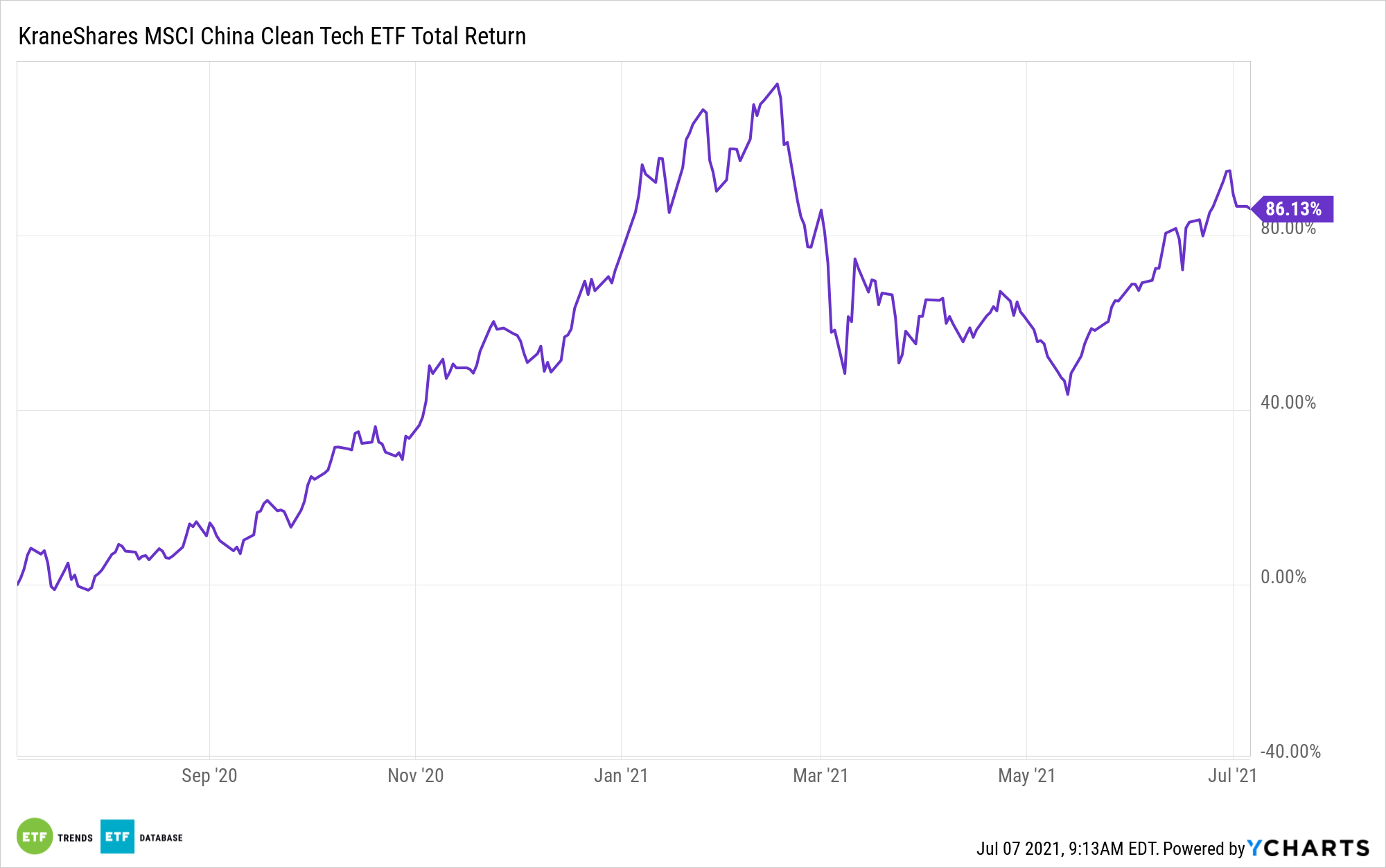

There are several China-focused ETF options that have holdings in NIO, including the $183 million KraneShares MSCI China Clean Technology Index ETF (KGRN).

KGRN tracks the MSCI China IMI Environment 10/40 Index and is based on five clean technology themes: alternative energy, energy efficiency, green building, sustainable water, and pollution prevention.

KGRN, which has 10.5% of its portfolio in Nio, is up 86.13% over the past 12 months.

The ETF has a total annual fund operating expense of 0.79%.

Capitalize on Nio with ‘KARS’

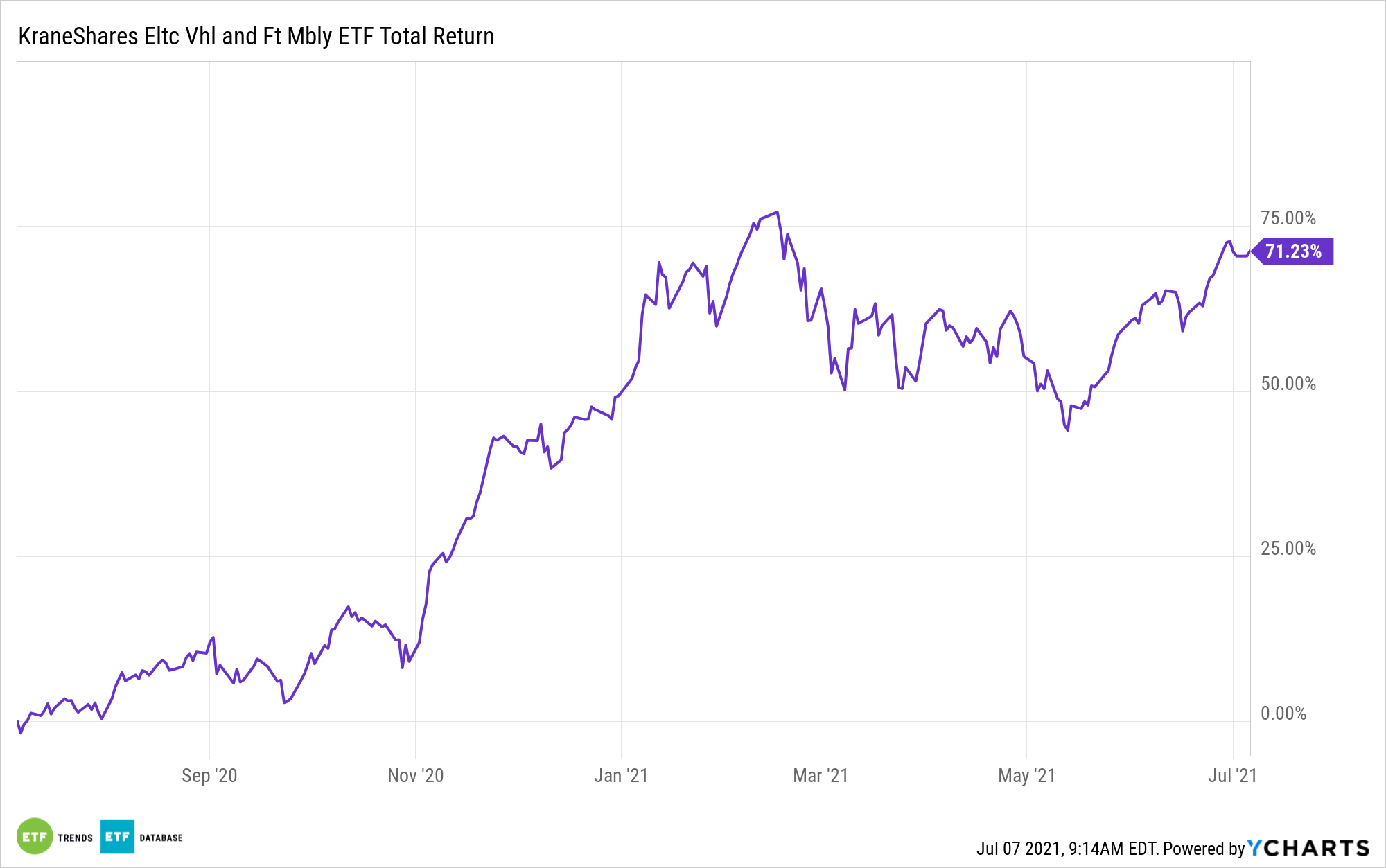

Meanwhile, the $218 million KraneShares Electric Vehicles and Future Mobility ETF (KARS) offers a more direct play on the EV space.

The fund tracks the Solactive Electric Vehicles and Future Mobility Index, an index that tracks companies that manufacture electric vehicles or parts, as well as companies that are pushing to change the future of travel.

KARS, which has 6.47% of its holdings in NIO, is up 71.23% over the past 12 months.

The fund has a total annual fund operating expense of 0.72%.

For more news, information, and strategy, visit the China Insights Channel.