China’s real estate woes have been splashed across global media headlines since the end of last year, but aside from the sensational coverage surrounding default risk, the collapse of Evergrande, and non-payments by Chinese mortgage owners, little else is known outside of mainland China about the beleaguered sector. David Gan, senior credit analyst at Nikko Asset Management, the largest fixed income manager in Asia, recently sat down with KraneShares to discuss current events in China’s real estate sector and to provide an outlook going forward.

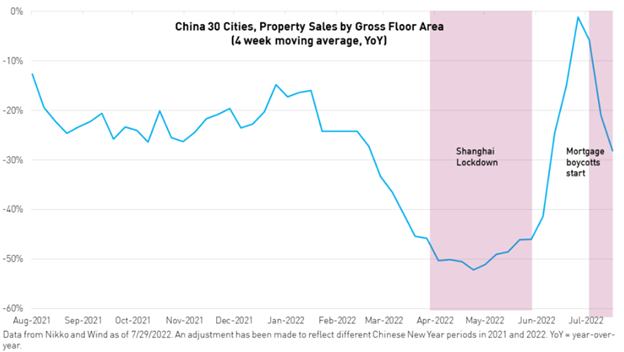

Gan opened with discussing the current boycotts by homebuyers happening in China, a result of Evergrande and other real estate developers facing difficulty securing financing to complete housing projects that have already been financed out in advance by the homebuyers through a mortgage, a common practice in China.

“The most immediate impact by this boycott to the China property sector is certainly negative,” Gan explained. “But in the medium term this may conversely actually help in the sector recovery as the boycott pushes the government to intervene and to support the sector.”

Image source: KraneShares’ Q&A with David Gan

In the near term, boycotts will result in three negative pressures for the real estate sector in China: negative homebuyer confidence, more strict management by local governments of property escrow, and a reluctance by banks to offer loans to real estate developers. The reduced demand, reduction of liquidity for property developers, and difficulty in acquiring loans could have strong impacts for real estate in the interim.

The boycotts, however, could be a catalyst for government interference and could finally bring about real change for the sector, as the government has thus far largely not intervened in the defaults of property developers in the last year, offering minimal support that has been below the expectations of the public, according to Gan.

“With the recent mortgage boycott however, the sector weakness has now also demonstrated a very visible social cost and we see this social cost to the government as heavier than the economic one and thus likely to generate a stronger policy response that could help in the sector recovery,” said Gan.

Currently there are rumors that the Chinese government is putting together a $1 trillion renminbi (equivalent to $146 billion USD) real estate bailout fund from media sources in China, but there is no official indication yet as to the authenticity of such a plan. That being said, if such a plan were to be implemented at that amount, Nikko believes that it would be enough to resolve the incomplete property projects and create confidence in the real estate sector once more.

“From the viewpoint of credit investors, it is important to know that the focus of this fund is likely to be on resolving problems at the project level and by developers who have already defaulted or extended their debts,” Gan explained.

Gan went on to discuss the oversupply in cities as well as the default rates in the property sector and expectations going forward.

Investing Along China’s Credit Curve

Nikko Asset Management are the sub-advisors and active managers for the KraneShares Asia Pacific High Yield Bond ETF (KHYB), a fund that invests in USD-denominated high yield debt securities from companies in Asia, excluding Japan. The fund is poised to capture the recovery and growth of the Asian bond market.

“Given this backdrop of slowing but continuing defaults as well as the expectation of slow recovery but balanced by a likelihood of substantial upcoming government action, we continue to stay invested in this sector but are focused on stronger credits,” Gan explained.

KHYB is benchmarked to the JP Morgan Asia Credit Index (JACI) Non-Investment Grade Corporate Index and invests in high yield fixed income securities, or “junk bonds,” that are rated below the four highest categories (Ba1/BB+ or lower) by at least one credit rating agency, or, if unrated, are determined by the sub-advisor to be of similar quality.

Nikko, the sub-advisor, uses top-down macro research and bottom-up credit research to create the portfolio, as well as a proprietary process that is a combination of qualitative and quantitative factors used to value an issuer’s credit profile.

By moving the credit curve up, KHYB will be more defensive against the benchmark and have shorter duration bonds than the index. When the bonds mature, Nikko can decide how and when it wants to redeploy and invest in new bonds, depending on market conditions.

KHYB carries an expense ratio of 0.68%.

For more news, information, and strategy, visit the China Insights Channel.