Managed futures continue to be a compelling story in 2022 as markets wobble, bounce, slide, and recover in a dance driven by uncertainty and investor sentiment towards a variety of influences — inflation, rising interest rates, economic slowdown, and more. The KraneShares Mount Lucas Index Strategy ETF (KMLM) had a strong year, with over $140 million in flows year-to-date as of August 9. KFA Funds, a KraneShares company, gave a detailed analysis regarding fund performance and allocation in the second quarter.

KMLM’s benchmark is the KFA MLM Index, and the fund invests in commodity currency and global fixed income futures contracts. The underlying index uses a trend-following methodology and is a modified version of the MLM Index, which measures a portfolio containing currency, commodity, and global fixed income futures.

The index weights the three different futures contract types by their relative historical volatility, and within each type of futures contract, the underlying markets are equal dollar-weighted. Futures contracts will be rolled forward on a market-by-market basis as they near expiration.

Futures contracts in the index include 11 commodities, six currencies, and five global bond markets.

KMLM began the second quarter positioned long in commodities that performed strongly in April and May but gave back much of their gains in June. The position moved from net long 71% to net long 36% by the end of the quarter. KMLM was also long when the U.S. dollar performed strongly in both April and June and the fund began the quarter net short 71% and ended net short 88%. KMLM was short global bonds that offered strong performance throughout the entirety of the quarter, going from a position that was net short 112% to net short 123%.

Overall, the fund was up 33.1% for the 12 months ending on June 30, 2022.

Investing in the Second Half with KMLM

Looking ahead, KFA funds anticipates that tightness in commodities markets will continue for the foreseeable future, while currency markets could continue to offer opportunities.

“Currency markets were maybe the most interesting in the quarter as the dollar strengthened. Currency markets are often the sharp end of macro volatility; this was no exception,” KFA Funds wrote.

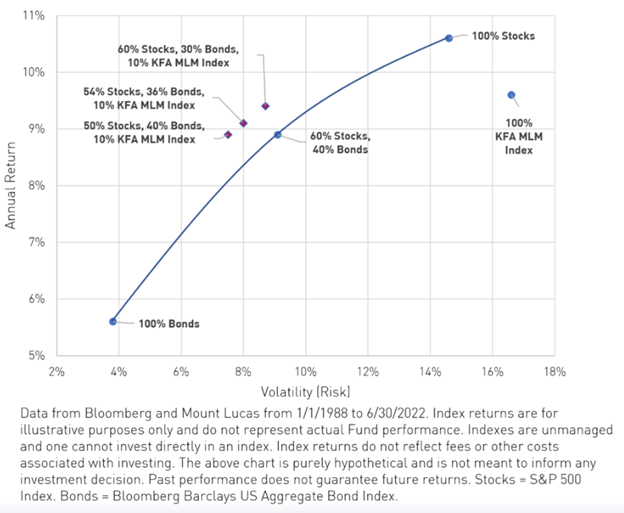

Managed futures can provide non-correlated hedging opportunities during times of increased volatility for portfolios and the KFA Mount Lucas Index Strategy ETF (KMLM) can be a strong compliment to a traditional 60/40 portfolio.

“Allocating as little as 10% may yield risk-adjusted performance benefits as demonstrated in the chart below,” KFA explained.

Image source: KFA Funds

The index and KMLM offer possible hedges for equity, bond, and commodity risk and have demonstrated a negative correlation to both equities and bonds in bull and bear markets. Investing in managed futures offers diversification for portfolios and carrying them within a portfolio can potentially help mitigate losses during market volatility and sinking prices.

The index evaluates the trading signals of markets every day, rebalances on the first day of each month, invests in securities with maturities of up to 12 months, and expects to invest in ETFs to gain exposure to debt instruments.

KMLM carries an expense ratio of 0.92%.

For more news, information, and strategy, visit the China Insights Channel.