Michigan’s Department of Natural Resources recently announced it would be limiting logging in the state’s Lower Peninsula in order to utilize the forest for carbon offsets. The Pigeon River Country State Forest typically brings in money from oil and gas leases, timber sales, hunting licenses, and camping fees, but will now be working to conserve the red pine, aspen, and elk trees growing there for a different kind of revenue.

Carbon offsets are a type of currency that are used in the push to rein in harmful emissions globally. Heavy emission emitting companies are capped in the level of emissions they are allowed within cap-and-trade markets such as the U.S., Europe, and most recently China. Companies must use programs like Michigan’s to offset emissions beyond their cap.

Increasingly, companies are paying various entities to leave their trees instead of harvesting them for timber. Each tree is measured by foresters or satellites and the amount of carbon it can pull from the air is calculated, and then the offset is sold.

DTE Energy, the largest energy company in Michigan, has already entered into an agreement to purchase the offsets, which it will use to create offerings for customers that use natural gas, enticing them with smaller carbon footprint options. The agreement is the first of its kind that involves utilizing state land.

“When we polled other states around the nation, there are about 25 of them that are looking into similar programs,” said Scott Whitcomb, senior adviser for wildlife and public lands at Michigan’s Department of Natural Resources and former manager of Pigeon River Country. “We can expect others to probably follow in our footsteps.”

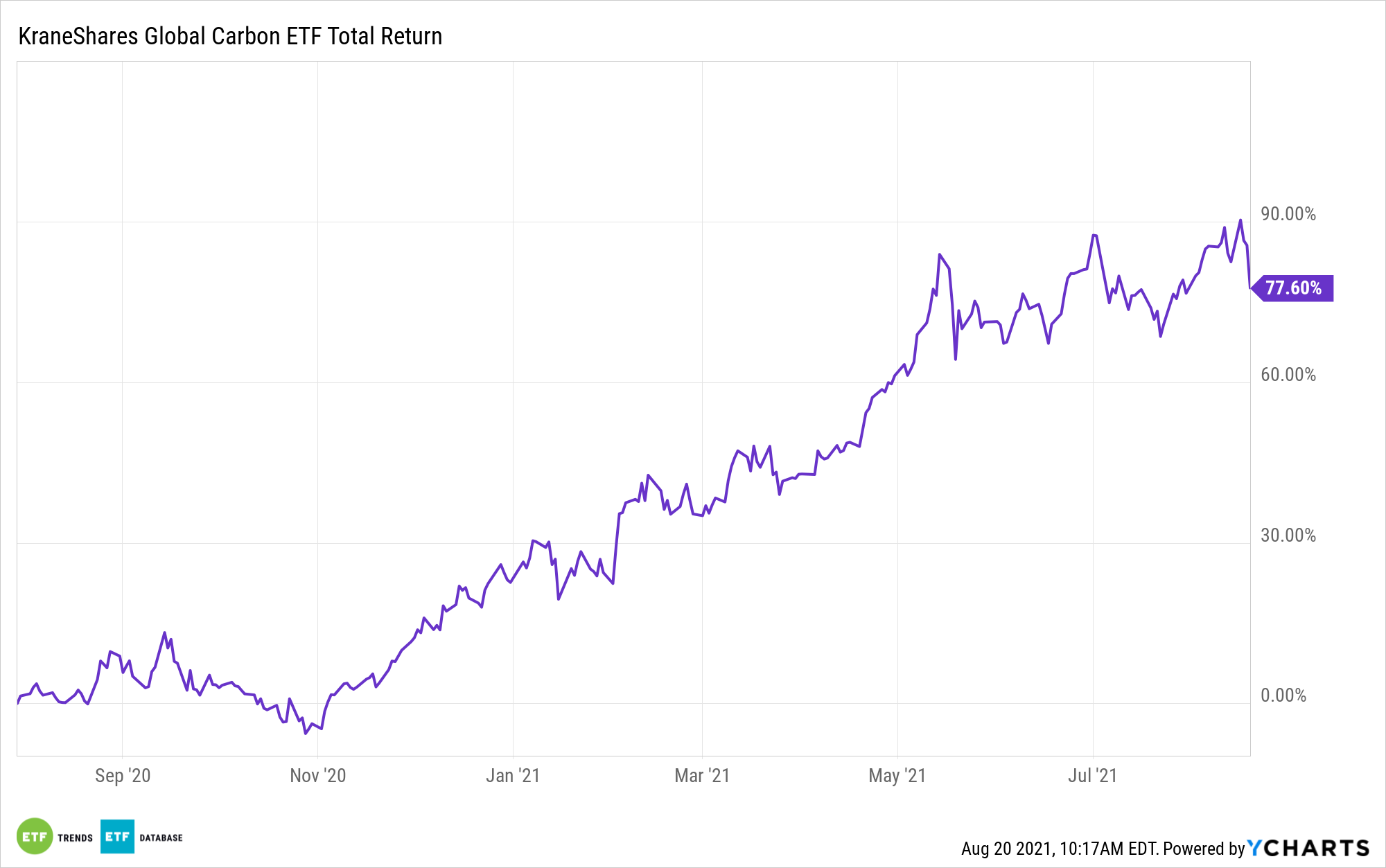

‘KRBN’ Invests in Carbon Offsets

Investors looking to support responsible investing and encourage pollution and emissions reduction can consider the KraneShares Global Carbon ETF (NYSE: KRBN), which offers a first-of-its-kind take on carbon credits trading.

KRBN tracks the IHS Markit Global Carbon Index, which follows the most liquid carbon credit futures contracts in the world.

This includes contracts from the European Union Allowances (EUA), California Carbon Allowances (CCA), and Regional Greenhouse Gas Initiative (RGGI) markets. North American pricing data is supplied by IHS Markit’s OPIS service, while European prices are supplied by ICE Futures Pricing.

As of December 31, 2020, those three carbon futures markets had a market size of $260.79 billion.

KRBN invests in its futures contracts via a Cayman Islands subsidiary, meaning it can avoid distributing the dreaded K-1 tax form to its shareholders.

According to IHS Markit, the global price of carbon was $24.05/ton CO2 as of December 31, 2020.

However, it’s estimated that carbon allowance prices will need to reach a range of $50 – $100 per ton of CO2 to achieve the emissions reductions goals of the Paris Agreement.

KRBN carries an expense ratio of 0.79%.

For more news, information, and strategy, visit the China Insights Channel.