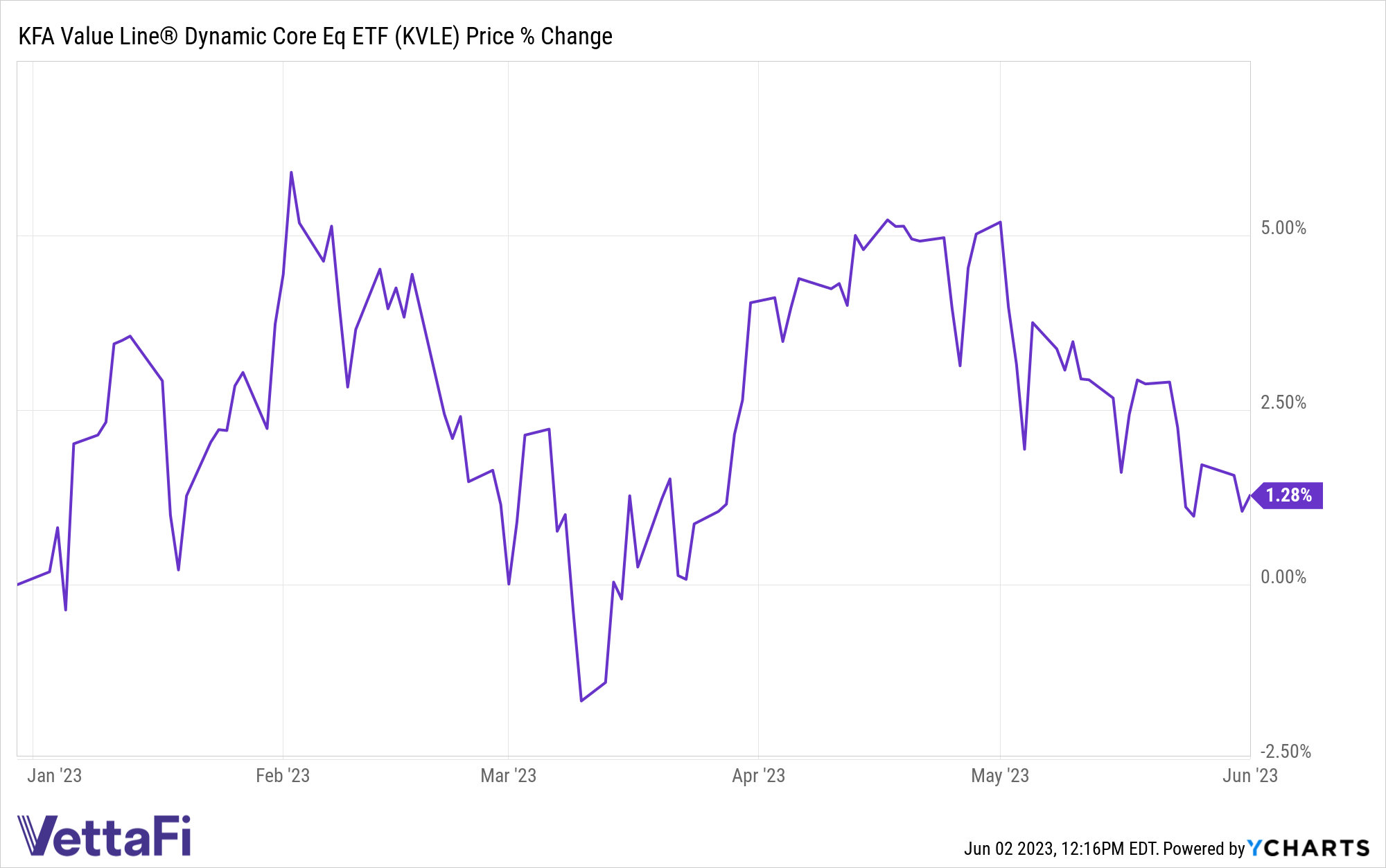

The dual boost of May’s strong job’s report and the debt ceiling bill passage in the Senate sent markets ripping upward Friday. The KFA Value Line Dynamic Core Equity Index ETF (KVLE) is a dividend strategy fund that benefits during periods of market gains while seeking to limit losses during market declines.

The S&P 500 rose 1.4% in midday trading and the Nasdaq Composite reached a level not seen since April 2022, reported CNBC. Meanwhile, the VIX Volatility Index dropped to its lowest since November 2021 at 14.82 on Friday.

May’s job’s report revealed 339,000 new jobs compared to expectations of 190,000. It’s the 29th consecutive month of job growth, but May’s report also came with data that could lend credence to a Fed June interest rate pause.

The average hourly earnings made smaller year-over-year gains than expected, and unemployment came in higher than forecast.

“There was a little bit of a flavor for everyone today,” Charlie Ripley, senior investment strategist at Allianz Investment Management, told CNBC. “It’s kind of providing that mixed picture for the Fed.”

KVLE Benefits on Market Gains, Optimizes Dividends

Advisors looking to increase dividend strategy allocations should consider the tactical KFA Value Line Dynamic Core Equity Index ETF (KVLE).

The fund is a core equity portfolio of securities that are tilted to favor dividend yield. It seeks to increase yield while avoiding investing solely in high-yield sectors and stocks.

See also: “KVLE’s Dividend Strategy Produces Better Yields Than S&P 500“

KVLE is benchmarked to the 3D/L Value Line Dynamic Core Equity Index. The fund utilizes optimization technology to emphasize securities with solid dividend yields with the highest rankings in Value Line Safety and Timeliness.

The fund uses a smart beta strategy in seeking more cost-efficient alpha. It also employs a risk management strategy that seeks to limit the effects of major market declines and capture positive returns.

The two largest holdings by weight within KVLE are Apple (AAPL) at 7.88% and Microsoft (MSFT) at 7.55% as of 06/01/2023.

KVLE carries an expense ratio of 0.55%.

For more news, information, and analysis, visit the China Insights Channel.