Greenhouse gas emissions had fallen during the onset and majority of the COVID-19 pandemic but are now estimated to rise to pre-pandemic levels, reports the BBC.

Carbon dioxide fell in 2020 by 5.4%, but the Global Carbon Project has predicted a 4.9% rise by the end of this year, highlighting the need and urgency behind carbon emission reduction practices and policies. Coal and gas emissions are estimated to increase in 2021 by more than the amount they fell by in 2020, although carbon emissions produced from oil are anticipated to remain under pre-pandemic levels.

This increase has been a surprise to scientists who had estimated that the rise would be much more gradual and spread across multiple years, and doubly concerning because economies are not yet fully recovered from the pandemic.

“What many of us were thinking in 2020 – including me – was more of a recovery spread out over a few years, as opposed to a big hitch in 2021,” said Dr. Glen Peters of the Center for International Climate Research (Cicero) in Oslo, Norway.

If emissions are not cut any further and the world continues warming at the current rate, the 1.5 degree Celsius limit set in the Paris Agreement of global warming would be reached in just 11 years, according to a recent UN report.

The Climate Summit is currently underway in Glasgow and has seen pledges of methane emissions reductions and the ending of deforestation practices by 2030, but there has also been a lot of divisiveness between countries at a time when curbing global warming is of the utmost importance.

KRBN Set to Capture Carbon Allowance Market Growth

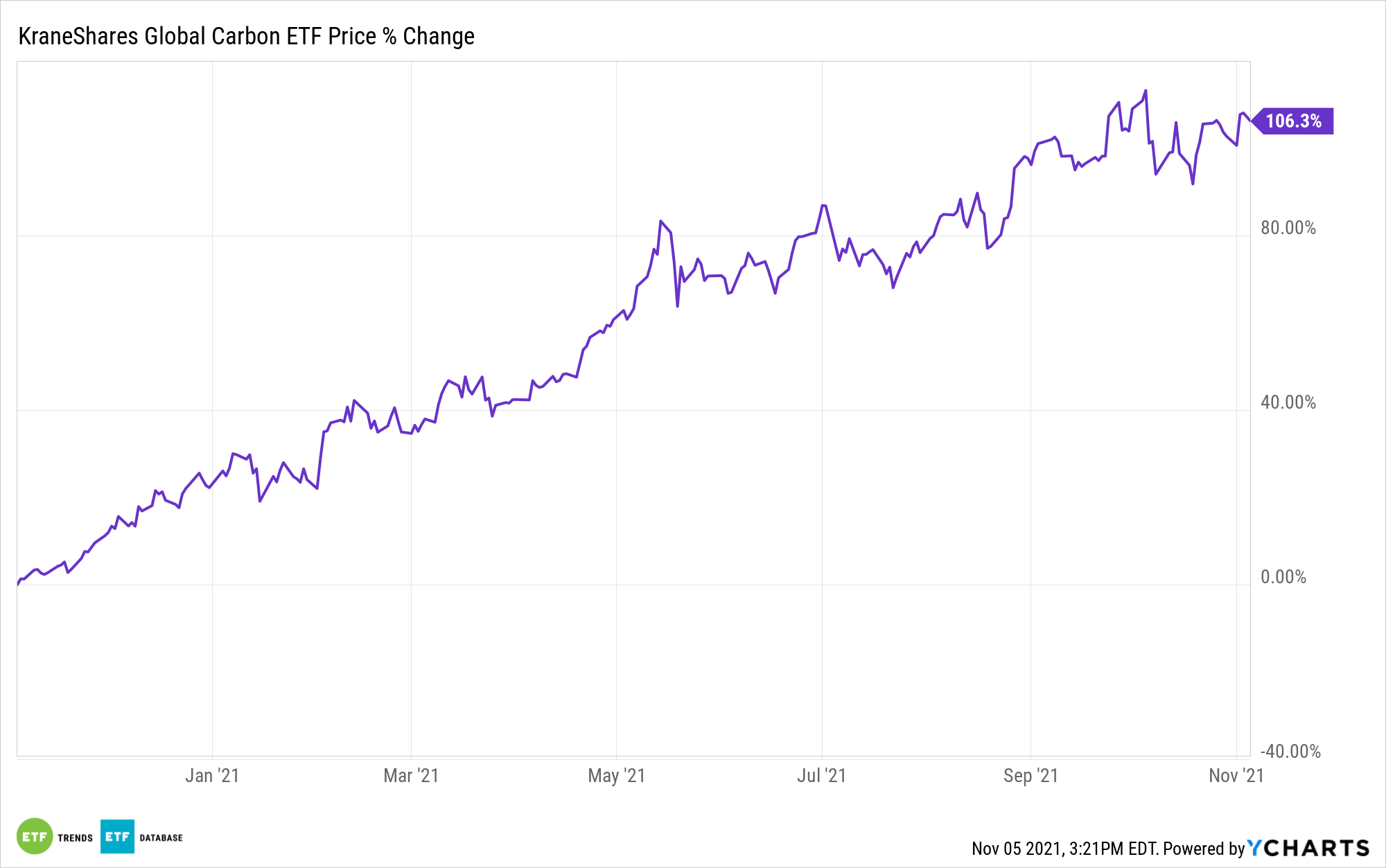

The KraneShares Global Carbon ETF (NYSE: KRBN) offers a first-of-its-kind take on carbon credits trading and is in a position to capture the rise in carbon allowance prices as emissions limits become more stringent.

KRBN tracks the IHS Markit Global Carbon Index, which follows the most liquid carbon credit futures contracts in the world.

This includes contracts from the European Union Allowances (EUA), California Carbon Allowances (CCA), and Regional Greenhouse Gas Initiative (RGGI) markets. North American pricing data is supplied by IHS Markit’s OPIS service, while European prices are supplied by ICE Futures Pricing.

KRBN invests in its futures contracts via a Cayman Islands subsidiary, meaning that it can avoid distributing the dreaded K-1 tax form to its shareholders.

KRBN carries an expense ratio of 0.78% and has over $1.1 billion in net assets.

For more news, information, and strategy, visit the China Insights Channel.