Earnings week kicks off in full this week and is expected to bring grim reports and even grimmer forecasts for the remainder of this year and heading into next year. The cost of persistent, high inflation and a strong dollar are likely to be visibly reflected in the bottom line of companies this earnings season, and right on cue, JPMorgan’s CEO Jamie Dimon has sounded a warning bell for the U.S. that recession looms on the very-near horizon.

While Dimon believes that the economy is “actually still doing well,” aggressive interest rate hikes from the Fed alongside quantitative tightening, the Russian war in Ukraine, and runaway inflation in the U.S. and globally have set the country on a path for recession by next summer.

“These are very, very serious things which I think are likely to push the U.S. and the world — I mean, Europe is already in recession — and they’re likely to put the U.S. in some kind of recession six to nine months from now,” Dimon told CNBC.

Dimon didn’t have any predictions for how long or severe such a recession would be, only that markets should price in all possibilities. The one certainty he could offer up was that market volatility would continue and that the S&P 500 could still fall by “another easy 20%” but that “the next 20% would be much more painful than the first.”

JPMorgan released its third-quarter earnings on Friday, one day after the highly anticipated September CPI report, all on the heels of a stronger-than-expected jobs report last Friday that reflected slowing but continued growth.

Invest for Volatility with Managed Futures

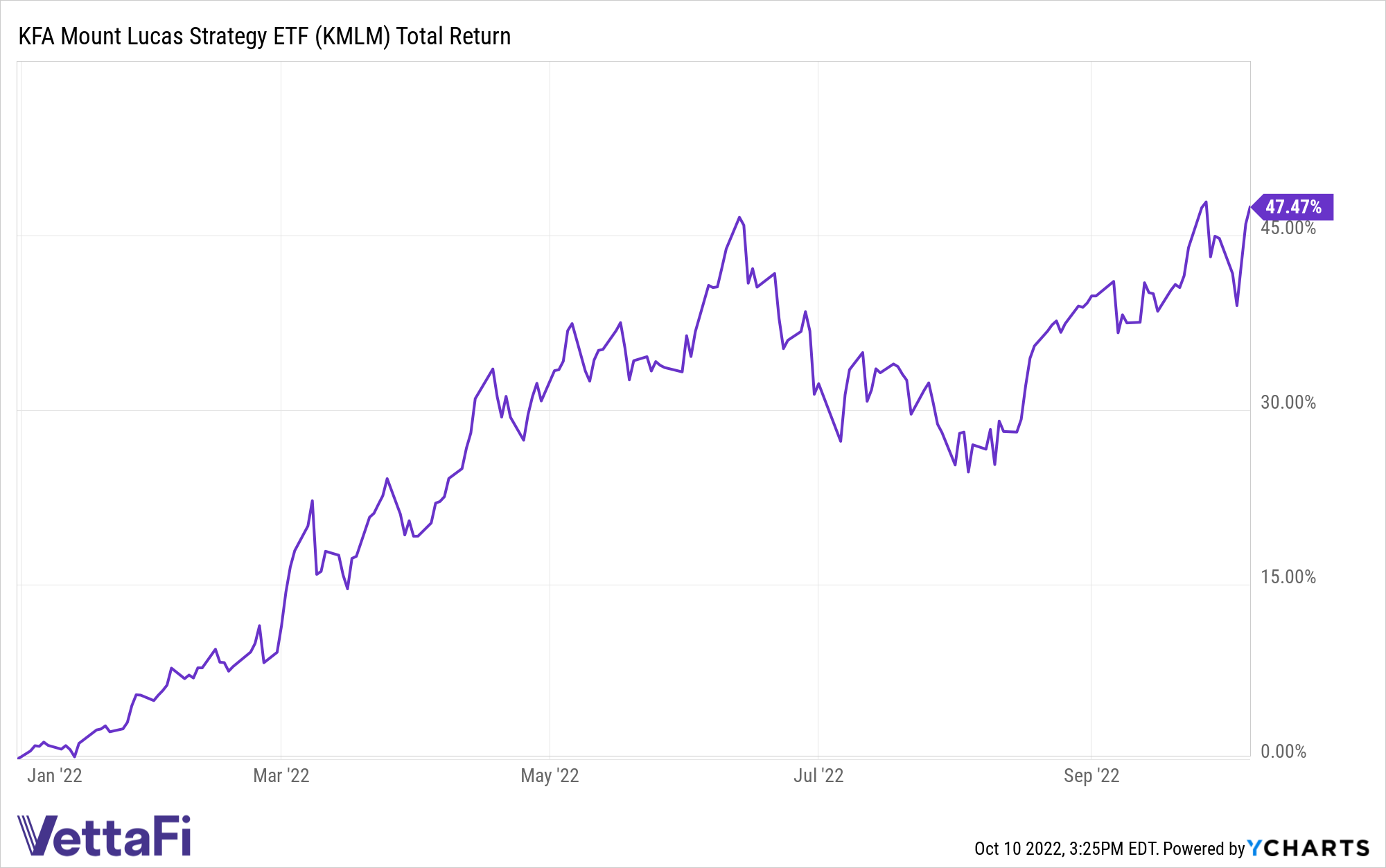

At a time when equities and bonds alike remain under pressure and move in correlation, advisors have been seeking alternative options for their portfolios, and one of the strongest performers of 2022 have been managed futures ETFs. Managed futures can provide non-correlated hedging opportunities during times of increased volatility for portfolios and the KFA Mount Lucas Index Strategy ETF (KMLM) from KFAFunds, a KraneShares company, invests in futures contracts in commodities, currencies, and global bond markets.

KMLM’s benchmark is the KFA MLM Index, and the fund invests in commodity currency and global fixed income futures contracts. The underlying index uses a trend-following methodology and is a modified version of the MLM Index, which measures a portfolio containing currency, commodity, and global fixed income futures.

The index and KMLM offer possible hedges for equity, bond, and commodity risk and have demonstrated a negative correlation to both equities and bonds in bull and bear markets. Investing in managed futures offers diversification for portfolios, and carrying them within a portfolio can potentially help mitigate losses during market volatility and sinking prices.

The index weights the three different futures contract types by their relative historical volatility, and within each type of futures contract, the underlying markets are equal dollar-weighted. Futures contracts will be rolled forward on a market-by-market basis as they near expiration.

Futures contracts in the index include 11 commodities, six currencies, and five global bond markets.

The index evaluates the trading signals of markets every day, rebalances on the first day of each month, invests in securities with maturities of up to 12 months, and expects to invest in ETFs to gain exposure to debt instruments.

KMLM carries an expense ratio of 0.92%.

For more news, information, and strategy, visit the China Insights Channel.