The World Bank recently upped its estimated economic growth for China this year from 8.1% to 8.5%, according to MarketWatch. While the estimate is dependent on vaccination continuance, it is a positive sign of continued recovery in a pandemic-ravaged world.

China is one of the first major economies to be recovering and experiencing economic rebound from the pandemic. Although some areas of China are experiencing controlled travel to curtail the spread of new and active variants of the COVID-19 virus, by and large the Chinese economy has hit recovery mode. Consumer and factory activity have returned to their pre-pandemic levels.

The World Bank’s upgraded estimate came after a report in April noting that, of the East Asian countries, China and Vietnam’s economies were the only ones to achieve a “V-shaped” recovery in 2020. In other words, China’s output was back above pre-pandemic levels and moving forward.

China anticipates having roughly 40% of its population vaccinated by early summer of this year, but the World Bank says “a full recovery will also require continued progress toward achieving wide-spread immunization.”

Investing in China’s Projected Growth with KBA

With a robust Chinese economy predicted for the remainder of this year, investors are increasingly looking to gain access to China’s markets.

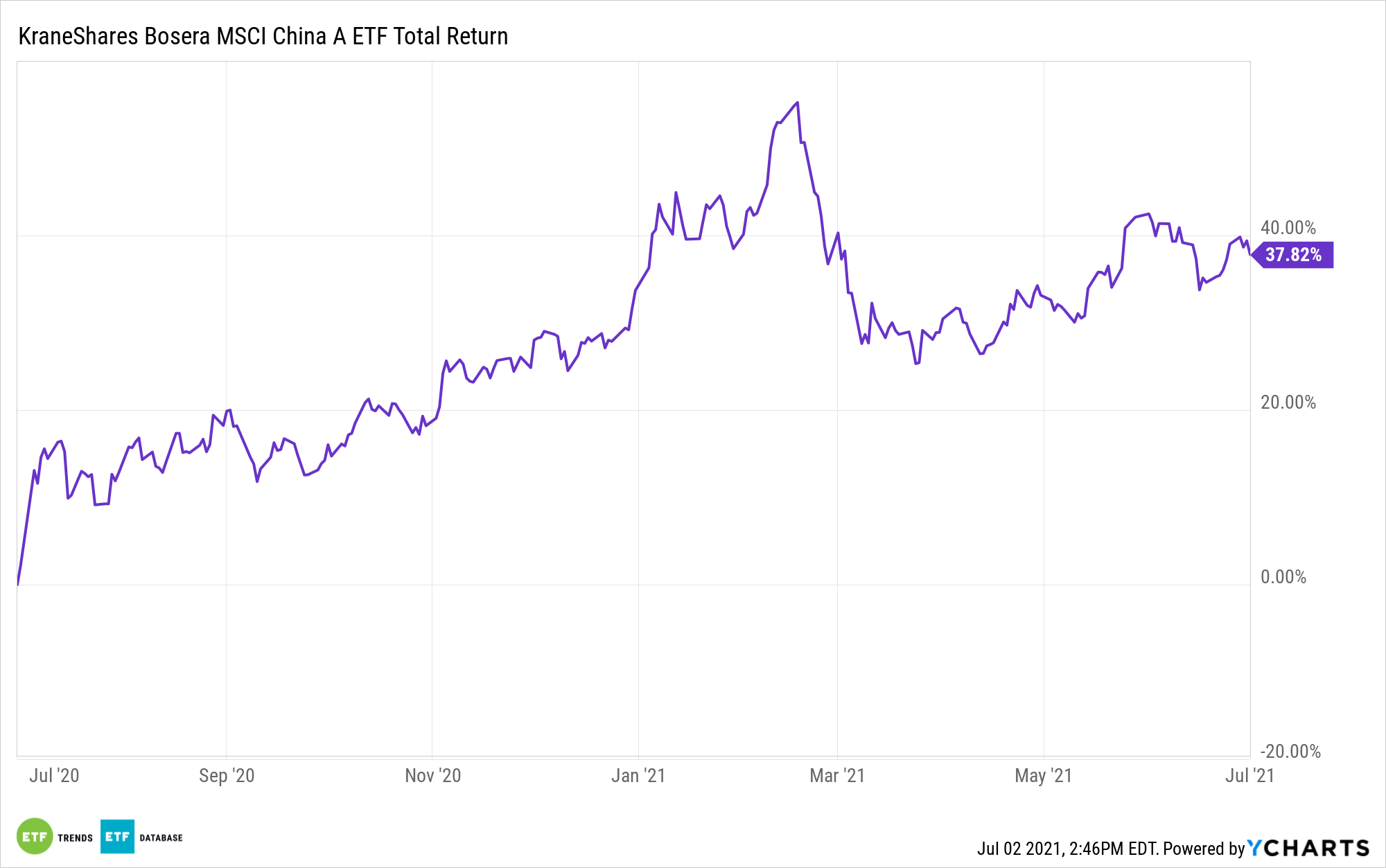

For investors looking for access to China’s A-share market, the KraneShares Bosera MSCI China A Share ETF (KBA) invests in Chinese A-shares—specifically, the MSCI China A Share Index.

The ETF captures mid cap and large cap representation of Chinese equities listed on the Shenzhen and Shanghai Stock Exchanges, which have been historically closed to U.S. investors. At $868 million in assets under management, KBA remains the largest MSCI-linked China A-share ETF available in the U.S.

KBA offers exposure across a wide variety of sectors, with 20.37% invested in financials, 19.38% in consumer staples, 12.5% in industrials, 12% in healthcare, and 11.85% in information technology.

“With over $1.5 trillion benchmarked to the MSCI Emerging Markets Index, full inclusion of Mainland Chinese equities could see significant flows into the securities KBA owns today,” as reported on the KraneShares website.

For more news, information, and strategy, visit the China Insights Channel.