KraneShares has announced in a press release that it will be effecting a three-for-one share split of issued and outstanding shares of the KraneShares European Carbon Allowance ETF (KEUA).

After market close on December 10, 2021, the fund will split issued and outstanding shares and anticipates a 200% increase in the total number of outstanding shares.

Existing shareholders at the close of markets on December 9 will receive three shares for each single share they held, payable after the close on the payable date. The split-adjusted shares will begin trading again on December 13, 2021.

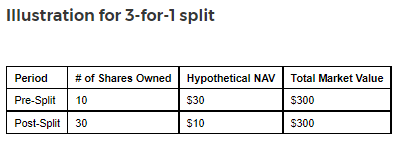

Image source: KraneShares Press Release

This split will not affect the market value or shareholders’ investment value of their shares, but it will affect the per share net asset value (NAV) and opening market price of KEUA beginning on December 13. The split will not create a taxable transaction for shareholders and will not incur transaction fees.

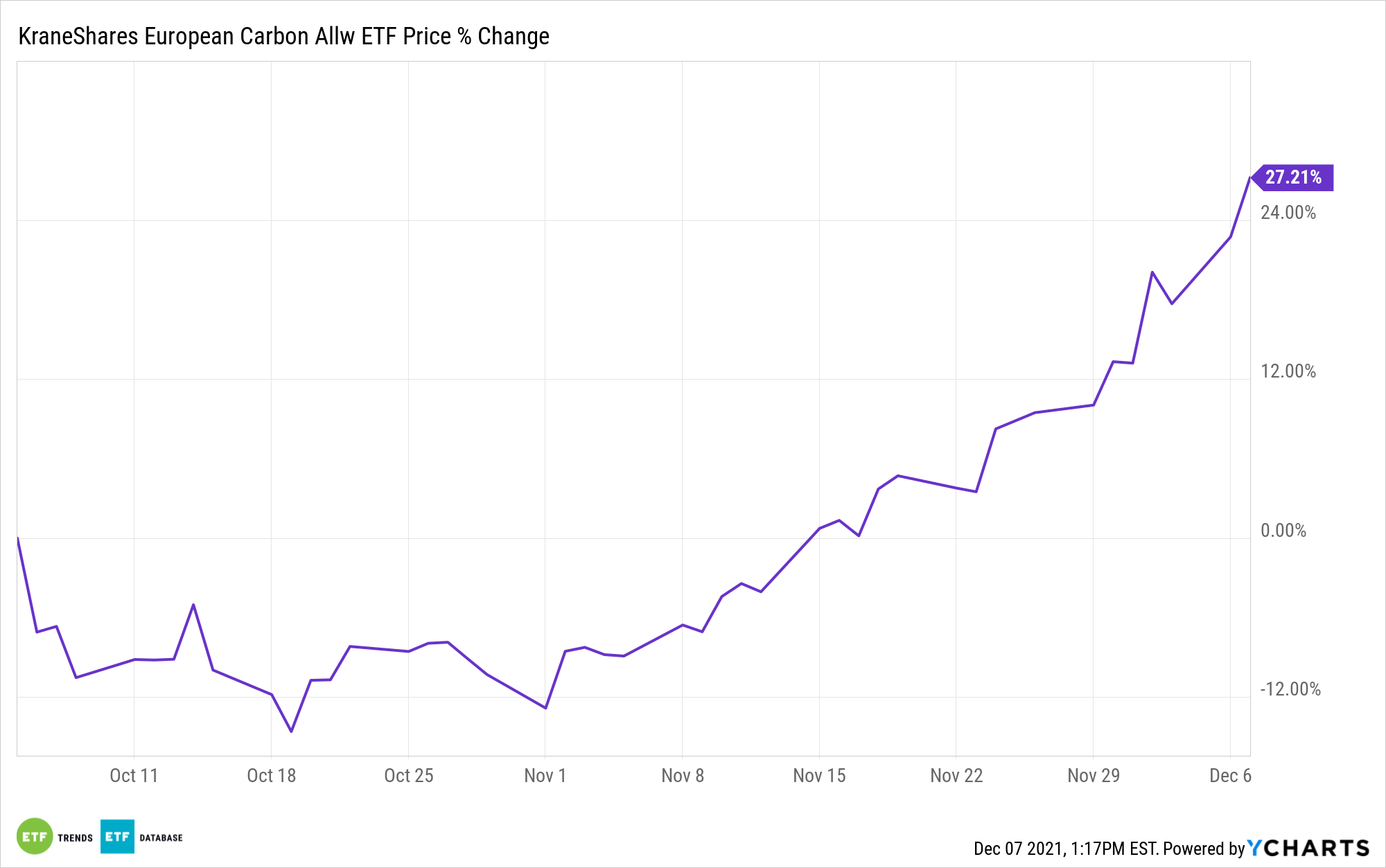

Stock splits happen for a variety of reasons but typically occur because the cost of a stock has grown in a way that might be prohibitive for many investors. The European carbon allowances cap-and-trade program has grown exponentially in recent months, with the costs of carbon soaring for the region. KEUA is currently trading close to $100 a share ($97.45 at time of print).

By splitting shares and thereby reducing the cost of gaining entrance to the European carbon allowances market, greater liquidity will be created for the fund as more investors buy in at the new share prices.

Luke Oliver, managing director and head of strategy at KraneShares, explained in a communication to ETF Trends that the decision to split shares comes from a desire to ensure that the fund remains scaled for investors of all sizes. “We’ve seen a pick up in trading volumes since the announcement which supports the move,” Oliver wrote.

KEUA Offers Targeted Exposure to EUA

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure into the EU carbon allowances market only and is actively managed.

The fund’s benchmark is the IHS Markit Carbon EUA Index, an index that tracks the most-traded EUA futures contracts, a market that is the oldest and most liquid for carbon allowances. The market currently offers coverage for roughly 40% of all emissions from the EU, including 27 member states as well as Norway, Iceland, and Liechtenstein. The annual cap reduction was recently increased from 2.2% to 4.2% to meet long-term carbon emission targets.

As the fund is actively managed, it may invest in carbon credit futures with different maturity dates or weight futures differently from the index. The fund potentially trades in CTFC-regulated futures and swaps above the CFTC 4.5 limit and is therefore considered a “commodity pool.”

KEUA has an expense ratio of 0.79%.

For more news, information, and strategy, visit the China Insights Channel.