Environmental, social, and governance (ESG) investing has become an increasingly popular thematic investment opportunity, with over $21.5 billion invested in mutual funds and ETFs with ESG screens in the first quarter of 2021, according to the Wall Street Journal. That’s double the previous year’s first quarter net inflows.

To put that in perspective, by the end of 2019, $17.1 trillion was being invested and managed using an ESG thematic approach, either directly or managed by institutions that incorporated ESG practices and approaches in their investments.

Q1 2012’s assets invested, then, represent a 42% increase from two years prior.

How ESG Can Boost Returns

A recent study conducted by the NYU Stern Center for Sustainable Business and Rockefeller Asset Management found a fairly direct correlation between ESG investment and improved financial returns.

The study analyzed over 1,000 research papers between 2015 and 2020 and concluded that “sustainability initiatives at corporations appear to drive better financial performance due to mediating factors such as improved risk management and more innovation,” according to the authors of the paper.

Over 58% of the corporate studies done that were analyzed using ROA, ROE, or stock price showed a positive relationship.

Schroder’s 2020 Global Investor Study reported that 47% of people in 2020 were investing intentionally in sustainability. The shift has been towards investing with value alignment, but also seeking the growing profitability of the ESG sector. The same study reported 47% of people were investing in sustainable funds because of their reduced environmental impact, while 42% were investing because these funds often offered higher return potential.

Harnessing ESG with KGRN

China is currently the world leader in total renewable energy capacity, with 31% of the world’s capacity.

The KraneShares MSCI China Clean Technology Index ETF (KGRN) capitalizes on investing in clean technology in China’s booming economy.

KGRN tracks the MSCI China IMI Environment 10/40 Index and is based on five clean technology themes: alternative energy, energy efficiency, green building, sustainable water, and pollution prevention.

It allows investors exposure directly to ESG market movers in China by investing in companies such as NIO Inc., an electric car company (carried at 10.2% weight); Contemporary Amperex Technology, a lithium ion developer and manufacturer (6.04% weight); and Xinyi Solar Holdings, a solar glass and components manufacturer (4.99% weight).

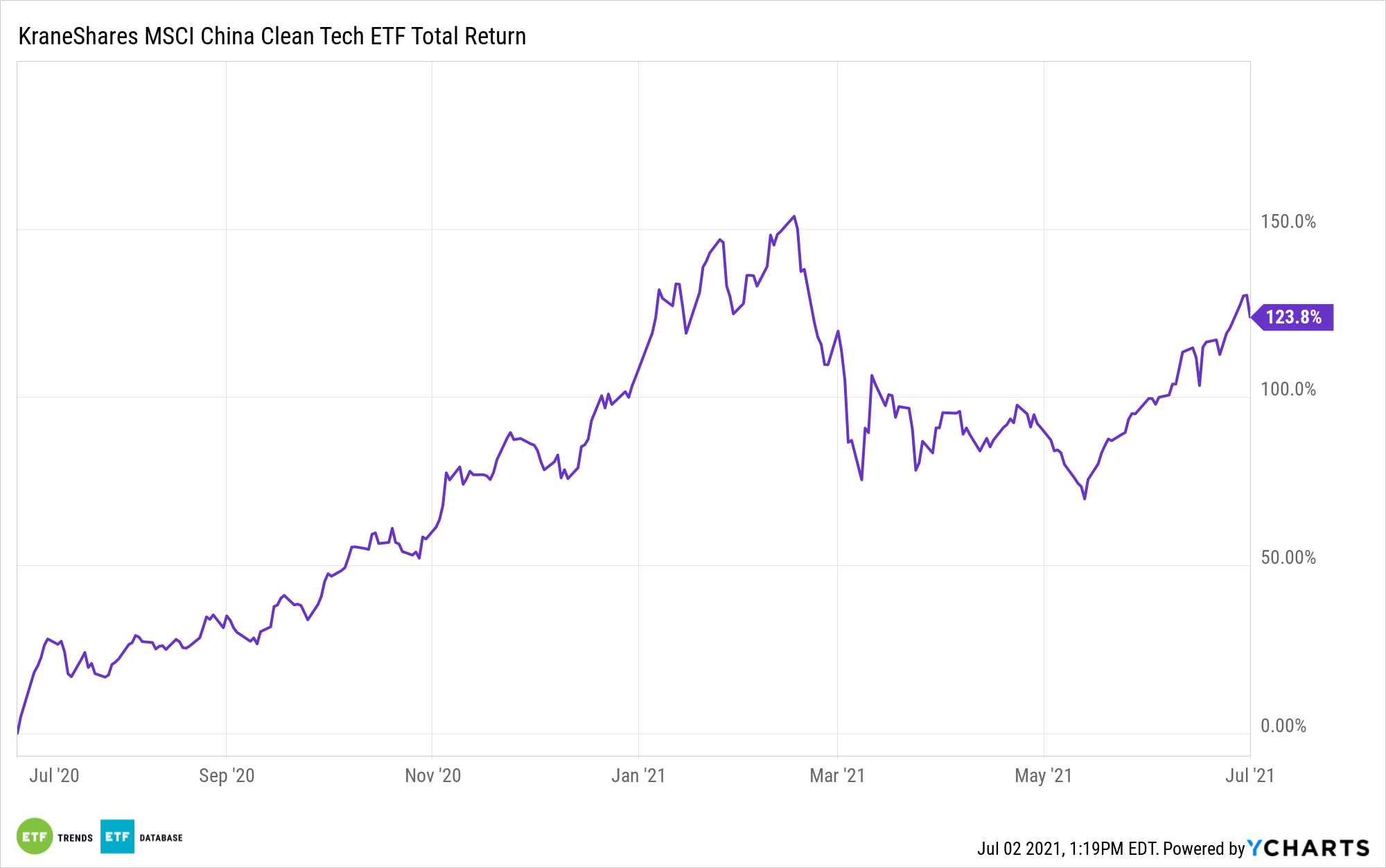

KGRN, which has $177 million in assets under management, is up 123% over the past 12 months.

The ETF has a expense ratio of 0.79%.

For more news, information, and strategy, visit the China Insights Channel.