BYD, an electric vehicle manufacturing behemoth in China and the second largest global EV company, estimates that its 2022 net income hit a record 17 billion yuan ($2.5 billion USD) in an initial filing with the Shenzhen Stock Exchange, reported Bloomberg. It would represent gains of roughly 458% year-over-year, blowing well past all analyst expectations, growth that several KraneShares funds captured as a top holding.

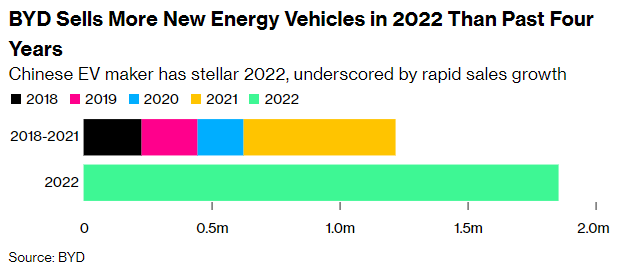

The EV giant also estimates that revenue in 2022 surpassed 420 billion yuan ($62.3 billion), more than double 2021’s amount for the company backed by Warren Buffet. BYD sold 1.86 million EVs in 2022, collectively more than all four previous years combined, driving impressive revenue and profit estimates.

Image source: Bloomberg

BYD’s internal production capabilities for components such as semiconductors and batteries meant it has been able to sidestep many of the supply chain woes that have plagued the industry in the last two years, and with its expansion into luxury vehicles later this year, 2023 looks to be another bright year for the Chinese EV giant.

BYD a Top 10 Holding In These KraneShares ETFs

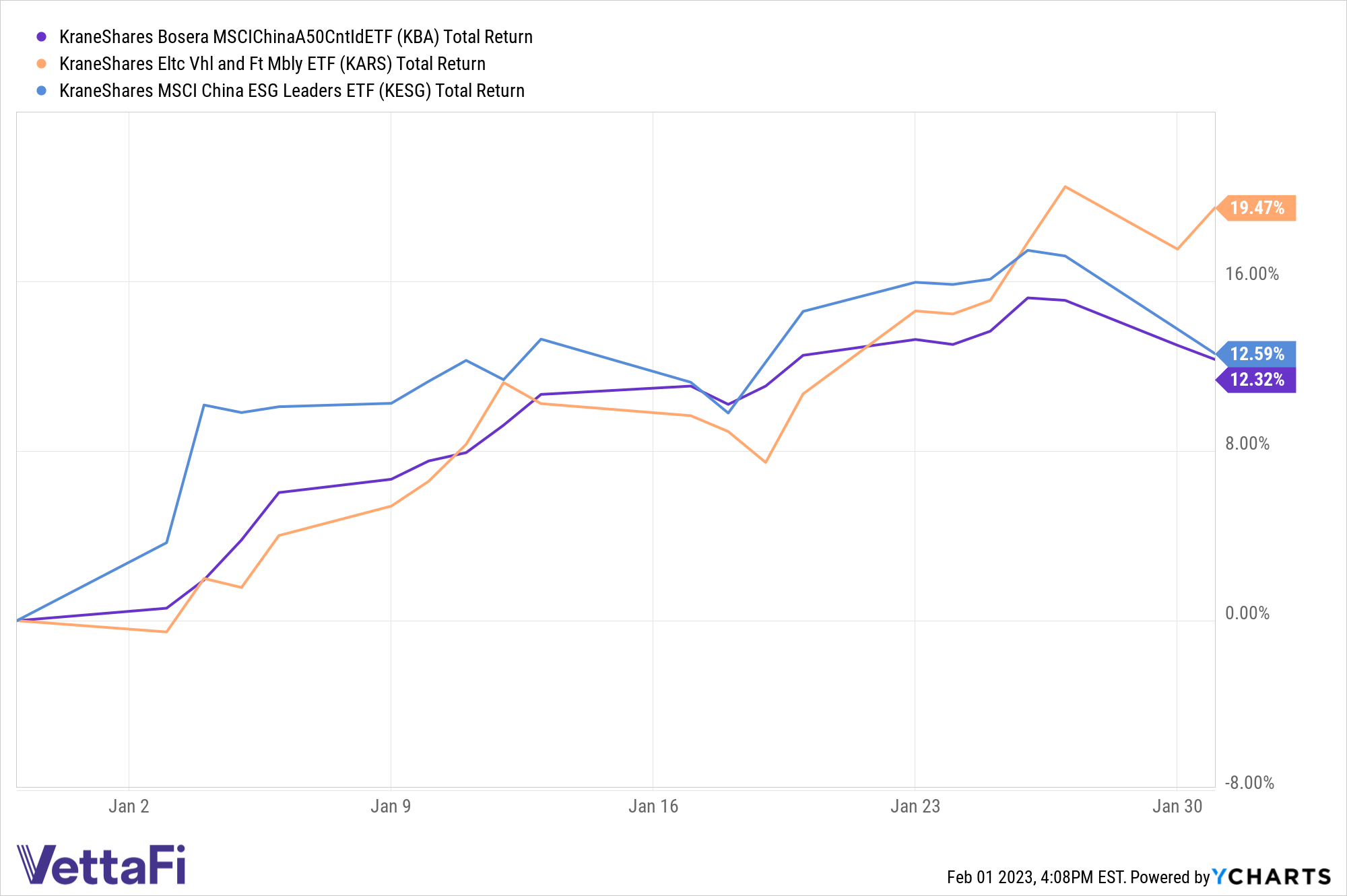

The KraneShares Bosera MSCI China A Share ETF (KBA) invests in Chinese A shares across multiple sectors — specifically those from the MSCI China A 50 Connect Index. This fund seeks to capture 50 large-cap companies that have the most liquidity and are listed on the Stock Connect, while also offering risk management through the futures contracts for eligible A shares listed on the Stock Connect.

BYD is carried at a 3.42% weight within KBA as of 01/31/2023 and the fund carries an expense ratio of 0.56% with fee waivers that expire on August 1, 2023.

The KraneShares Electric Vehicles and Future Mobility ETF (NYSE: KARS) offers a good solution for investors looking to capture the potential growth of major EV producers globally. KARS measures the performance of the Bloomberg Electric Vehicles Index, which tracks the industry holistically, including exposure to electric vehicle manufacturers, electric vehicle components, batteries, hydrogen fuel cells, and the raw materials utilized in the synthesis of producing parts for electric vehicles.

BYD is carried at a 2.85% weight in KARS as of 01/31/2023 and the ETF has an expense ratio of 0.70%

The KraneShares MSCI China ESG Leaders ETF (KESG) invests in the leading ESG companies within China and invests in several solar and renewable energy companies driving change within the country. The fund seeks to track the MSCI China ESG Leaders 10/40 Index, an index that is free float-adjusted and market cap-weighted and includes companies with high ESG ratings compared to their peers within their industries.

BYD is carried at a 3.51% weight in KESG as of 01/31/2023 and the fund has an expense ratio of 0.59%.

All three funds are up significantly to begin the year.

For more news, information, and analysis, visit the China Insights Channel.