A China country-specific exchange traded fund targeting environmentally friendly companies has been climbing as the emerging country doubles its new renewable energy capacity.

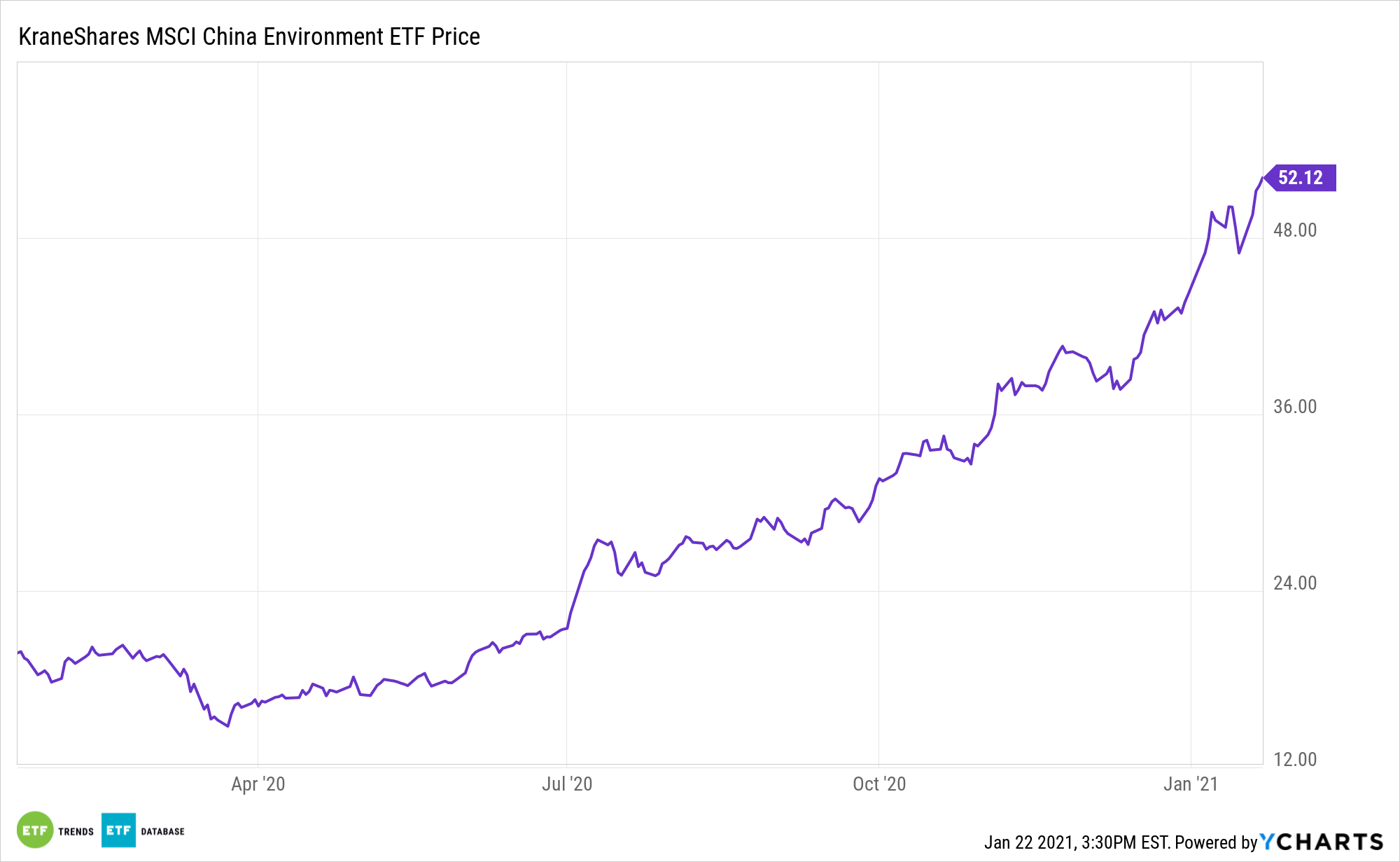

The KraneShares MSCI China Environment Index ETF (KGRN) has increased 53.3% over the past three months, and jumped 160.7% over the past year.

The KraneShares MSCI China Environment Index ETF tracks the performance of the MSCI China IMI Environment 10/40 Index, which is comprised of securities that derive at least 50% of their revenues from environmentally beneficial products and services. The fund provides investors exposure to Chinese companies that focus on contributing to a more environmentally sustainable economy by making efficient use of scarce natural resources or by mitigating the impact of environmental degradation.

The underlying index is based on five key clean technology environmental themes, including Alternative Energy, Sustainable Water, Green Building, Pollution Prevention, and Energy Efficiency.

In 2020, China more than doubled its construction of new wind and solar power plants year-over-year, reflecting Beijing’s pledge to cut fossil fuel dependence and bring carbon emissions to a peak within a decade, the South China Morning Post reports.

Against “the backdrop of carbon-neutral development, I think the Chinese government will tend to adopt relatively relaxed standards to promote the sector’s development,” Robin Xiao, an analyst with CMB International Securities Corp, told Bloomberg.

China, which is also the world’s biggest greenhouse gas emitter, added 71.67 gigawatts of wind power capacity in 2020, the most ever and almost triple its 2019 levels, according to the National Energy Administration. In comparison, global new wind capacity was increased by 60.4GW in 2019, according to data from the Global Wind Energy Council. New solar power capacity rose to 48.2GW in 2020 after falling for two straight years.

“China’s smashing wind power building records and continuing with strong solar growth makes the country a top destination for foreign clean energy investment,” Jeanett Bergan, an executive of Norway’s largest pension fund KLP, told South China Morning Post.

For more news, information, and strategy, visit the ESG Channel.