The internet sector in China continued to take hard hits in the third quarter of 2022, driven by sentiment, continuing COVID-19 lockdown concerns, and concerns around China’s economy. Though some headwinds still exist for the space, there are a number of potential tailwinds for China’s growthiest sector looking ahead and valuation opportunities for investors.

KraneShares has released the most recent quarterly earnings and performance report for the KraneShares CSI China Internet ETF (KWEB) that tracks China’s internet sector, diving into the subsector performance and outlook going forward. The following is a breakdown of subsector performance and an outlook for the space overall headed into the final quarter of 2022.

Subsector Performance

Companies from within the education subsector have experienced the strongest gains this year after being heavily impacted by the regulatory crackdown of online tutoring towards the end of 2021. Most online tutoring companies have since pivoted to tutoring in non-core subjects, tutoring adults, or have shifted to the education technology industry to generate revenues.

Travel-oriented businesses have had a difficult year but saw a significant rise towards the end of the quarter on the announcement that COVID travel quarantine requirements were being lifted in Hong Kong, what many hope is a potential precursor to Mainland policy change next year. Trip.com has since given positive guidance for this quarter due to the surge of interest in travel in China, with travel-related companies all buoyed by the return to travel.

Stimulus in September from the National Development and Reform Commission (NDRC) of China were seen as favorable for driving an increase in consumption, particularly in big-ticket purchases such as vehicles. KraneShares anticipates that the stimulus for consumers could help drive recovery for consumer sentiment as much of China recovers from lockdowns.

Image source: KraneShares’s Fall 2022 China Internet Earnings Report

Real estate remains a beleaguered sector in China, with the government moving to add foundational financial support and encourage developers’ completion of long-stalled projects.

“While the $1 trillion government bailout fund for prepaid projects could be sufficient to resolve issues surrounding unfinished projects and shore up buyer confidence, the timing of the fund’s launch is uncertain,” KraneShares wrote.

E-commerce remains in the spotlight because it is directly tied to consumer sentiment, which has lagged in China in recent months under the continuing waves of COVID lockdowns and real estate woes. That said, some of the largest e-commerce companies in China — Alibaba, Pinduoduo, and Meituan — beat negative analyst expectations in their most recent rounds of earnings.

Fintech companies demonstrated revenue growth year-over-year in this most recent quarter and could be carried even further by the shifting currency regimes driven by the strong U.S. dollar.

“The Renminbi has surpassed the Yen as the fourth most used currency in global payments, after the U.S. dollar, the Euro, and the Pound, nine which bodes well for the international expansion of China-based payments firms,” KraneShares wrote.

Logistics were a bright spot in the most recent quarter, demonstrating the strongest revenue growth year-over-year. This growth was driven largely by Full Truck Alliance, which is working aggressively to eliminate dead weight loss in the shipping industry and increase the efficiency of truckers and the movement of goods.

Entertainment, search, and social were all subsectors that fell to the middle of the pack of KWEB holdings in year-over-year revenue growth and share price performance.

“All three of these subsectors are heavily exposed to the health of China’s consumer, which has been under pressure from lockdowns and declines in real estate prices. However, the consumer is gradually recovering, and we believe that these companies should soon see a recovery in their core businesses as a result,” KraneShares predicted.

Tailwind Possibilities for China’s Internet Sector

The joint announcement of the agreement on audit reviews of Chinese companies by the SEC, the Public Accounting Oversight Board, the China Securities Regulatory Commission, and the Ministry of Finance at the end of August is seen as a big potential tailwind for Chinese companies listed in U.S. markets.

“We believe this represents a major positive development and increases the likelihood that US-listed internet firms will be able to comply with the Holding Foreign Companies Accountable Act (HFCAA),” KraneShares wrote.

Other possible tailwinds for China include eliminating the quarantine travel requirement for Hong Kong and approving 73 new games, which could signal a clear end of the regulatory cycle for China’s internet sector.

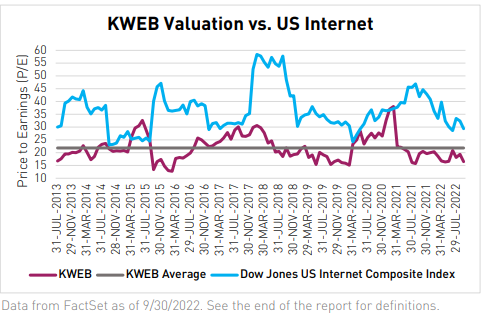

Chinese internet companies are trading at a current price-to-earnings ratio of 17.3x compared to their U.S. counterparts, which trade at a 31.2x P/E ratio, signaling investment opportunities at steep discounts.

Image source: KraneShares’s Fall 2022 China Internet Earnings Report

KWEB invests in companies that develop and market internet software and services, provide retail or commercial services via the internet, develop and market mobile software, and manufacture entertainment and educational software for home use. The fund has worked to convert all possible share classes over to Hong Kong shares instead of ADRs to protect investors in case of Chinese delistings within U.S. markets.

The ETF has an annual expense ratio of 0.69%.

For more news, information, and strategy, visit the China Insights Channel.