Schwab Asset Management today announced that it would reduce the operating expense ratios of 10 passively managed ETFs and actively managed mutual funds.

“We continually review our cost-effective product suite to find new opportunities to lower expenses for investors,” said David Botset, managing director, head of equity product management and innovation at Schwab Asset Management. “We’re committed to delivering products that are affordable, accessible and scalable, and very pleased to be able to continue to make our clients the beneficiaries of our strategic focus.”

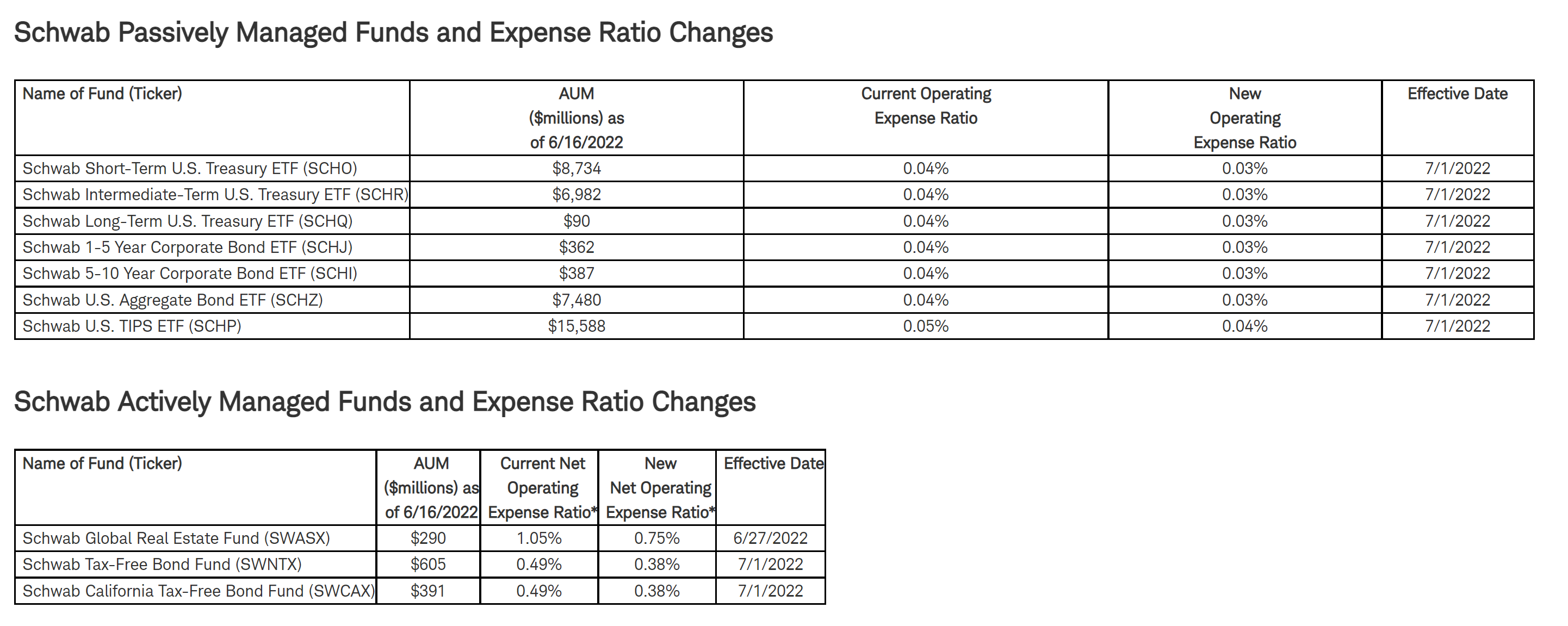

The Schwab Short-Term US Treasury ETF (SCHO), the Schwab Intermediate-Term US Treasury ETF (SCHR), the Schwab Long-Term US Treasury ETF (SCHQ), the Schwab 1-5 Year Corporate Bond ETF (SCHJ), the Schwab 5-10 Year Corporate Bond ETF (SCHI), and the Schwab US Aggregate Bond ETF (SCHZ) will all see their expense ratios drop from 0.04% to 0.03%, while the expense ratio for the Schwab US TIPS ETF (SCHP) will go from 0.05% to 0.04%.

On the mutual fund front, the Schwab Global Real Estate Fund (SWASX) will drop from 1.05% to 0.75%, while the Schwab Tax-Free Bond Fund (SWNTX) and the Schwab California Tax-Free Bond Fund (SWCAX) will both drop expense ratios from 0.49% to 0.38%.

These changes are effective July 1st.

For more news, information, and strategy, visit VettaFi.