By re-hedging and re-investing after a bear market sell-off, Swan believes the DRS is superior to market timing. One of Swan’s core beliefs is that it is difficult, if not impossible to call the tops and bottoms of markets and to build a successful long-term strategy by timing the markets. This truth is especially relevant in emerging markets. As seen in the previous graph, emerging markets are noted not only for their steep declines but also for their very sharp rallies. In other words, if your timing is slightly off and you miss the rally, you miss big.

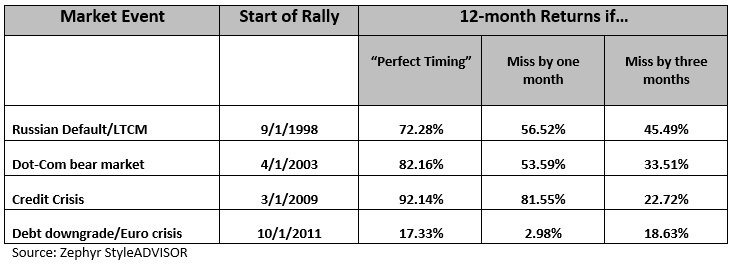

Below is a table showing the returns of emerging markets coming off the bottom. The first two columns specify a market sell off and the date of when the rally started. The middle column shows the 12-month return if someone had perfect foresight and bought at the bottom of the market. The fourth column is the impact of missing the first month of the rally and the final column shows the 12-month returns if the first three months of the rally are missed.

We believe the above information simply reinforces the importance of Swan’s motto: “Always Invested, Always Hedged.”

We also believe that our approach to managing risk in emerging markets is completely unique. By hedging against bear markets and seeking to generate cash flow through option premium, we believe we have fundamentally changed the risk/return profile of emerging markets.

Marc Odo is the Director of Investment Solutions at Swan Global Investments, a participant in the ETF Strategist Channel.

Important Notes and Disclosures:

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes non-qualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®). All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970–382-8901or www.swanglobalinvestments.com. 217-SGI-082417