An abundance of doubt has been circulating in the past few months as to the validity of ESG investments and the “greenwashing” that some companies are potentially partaking in. Some investors might interpret that as the space being a risky place for investments, but others are viewing it as an indication that the space is robust and thriving and reflects a market maturity.

Back in August, international firm DWS made headlines when its former global head of sustainability, Desiree Fixler, accused the company of misrepresenting its ESG investments in its annual report, reported Financial Times. The company is currently under investigation in Europe and the U.S. but denies the allegations.

The whistleblowing sparked a wave of accusations within the ESG market of greenwashing practices by companies and of funds not reflecting actual ESG investment. Some took this as an alarm that the space was too risky to invest in, but others see it as a mark of a robust market that is thriving and ensuring its own growth.

“I appreciate the fact that this is being tabled because it means we’re all getting more rigorous,” says Kirsty Jenkinson, head of sustainable investment and stewardship strategies at the California teachers’ pension fund, Calstrs. “I’d rather have it this way because then the onus is on us to make the best choices.”

The impact of ESG investing as of now is somewhat difficult to measure with any accuracy across the entire industry, as there are no standards in place. In Europe, there are more stringent requirements for ESG reporting, and while the SEC has signaled interest in accountability within the space for companies reporting, there are no federal mandates so far.

Asset managers that are able to provide clear numbers and transparency from companies that ensures that their ESG investments are actually contributing to increased sustainability would have a lot to gain, believes Jason Hill, financial services expert at PA Consulting.

“Step one is measuring carbon impact, but what we want is the year-on-year trends of the impact, which we’ve not seen yet,” Hill says. “This will give a huge competitive advantage to those that get that out there. At the moment, it’s ‘trust us’ — but soon it will be ‘look at us.’”

Putnam on the Leading Edge of ESG Investment

Putnam believes in sustainability and holds ESG practices as a core aspect of its investment approach as combatting climate change becomes an increasing focus across industries and globally.

Putnam’s ESG-focused active sustainability managers are a fundamental part of its work to align shareholder ESG values with investment practices by engaging directly with the companies invested in as to their ESG fundamentals and practices.

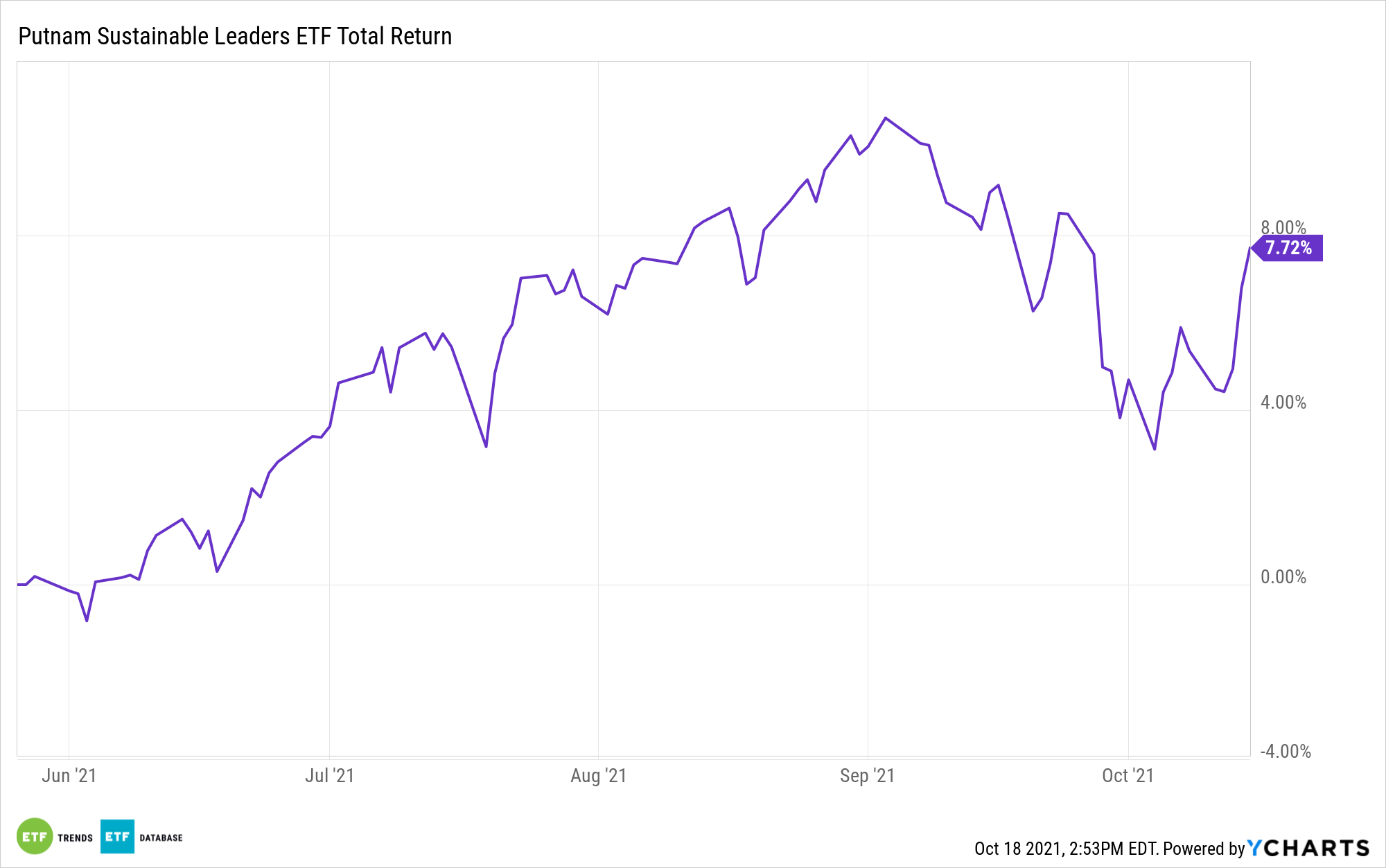

The Putnam Sustainable Leaders ETF (PLDR) invests in companies whose focus on ESG issues goes well beyond just basic compliance and for whom ESG practices are an integral part of their long-term success. These companies have transparent goals and provide consistent, measurable progress updates.

As a semi-transparent fund using the Fidelity model, PLDR does not disclose its current holdings on a daily basis. Instead, it publishes a tracking basket of previously disclosed holdings, liquid ETFs that mirror the portfolio’s investment strategy, and cash and cash equivalents. The tracking portfolio is designed to closely track the actual fund portfolio’s overall performance, and actual portfolio reports are released monthly.

Holdings as of the end of September included Microsoft Corp. at 8.19%, Apple at 7.29%, and Amazon.com at 5.03%. The fund was heavily allocated to information technology stocks at 32.47%, followed by healthcare at 16.55% and consumer discretionary at 14.94%.

PLDR has an expense ratio of 0.59% and had 61 holdings as of the end of August.

For more news, information, and strategy, visit the Big Ideas Channel.