Sustainability practices continue to be a growing focus by regulatory agencies, investors, and the global community in a world of increasing emissions. While reducing carbon emissions is a major focus, there is a whole host of green technology that is being created to tackle pollution and greenhouse gas-emitting practices.

Fortune Business Insights recently released their report on the green technology and sustainability markets from now until 2028, with a projected compound annual growth of 20.3%, equating to $41.62 billion by 2028.

The report anticipates North America being in the top position globally for green tech thanks to environmental investments and initiatives like the North American Climate, Energy and Environment Partnership. This partnership encourages governments to work towards sustainable solutions and promotes renewable energy, electric vehicles, and green technology.

Green technology spans a variety of industries, including air and water pollution monitoring, crop and forest monitoring, carbon footprint management, sustainable mining and exploration, water management, fire detection, green building, weather monitoring and forecasting, and others.

Most of the growth within the green technology market is seen on the solutions side of things as alternative, environmentally sustainable technologies are created to meet current climate crisis needs. It’s a market that is anticipated to continue growing, particularly on the solutions side versus the services side.

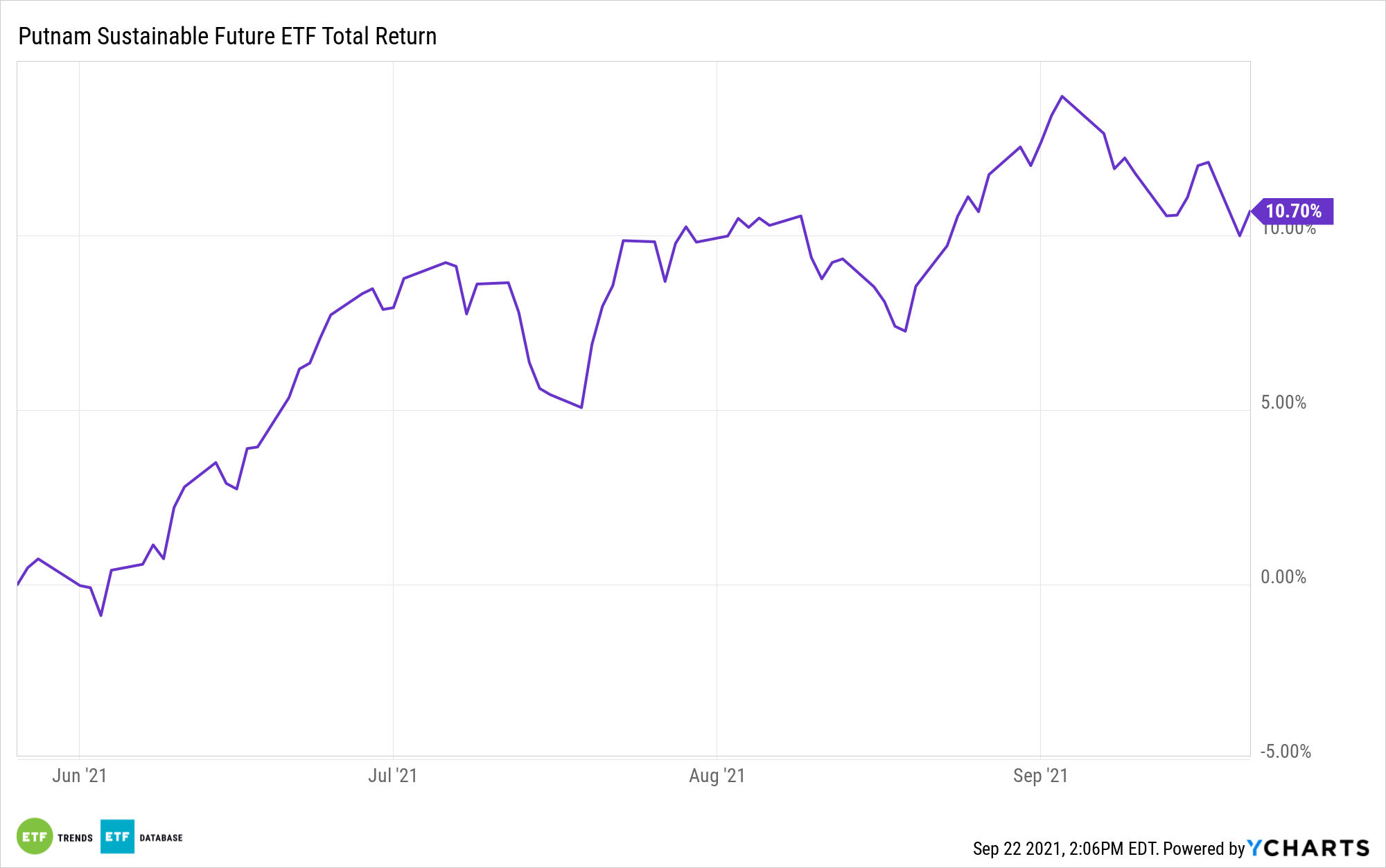

PFUT Invests in Green Technology and Tomorrow’s Solutions

The Putnam Sustainable Future ETF (PFUT) is an inclusionary ETF that invests in companies seeking to provide solutions to future sustainability challenges. It is a forward-looking approach as these companies are helping to develop ESG practices and solve problems related to sustainability.

PFUT focuses on impact companies as identified by its sustainability rating system. It invests in companies driving economic development, as Putnam believes that strong sustainability practices equate to strong financial growth.

As a semi-transparent fund using the Fidelity model, PFUT does not disclose its current holdings on a daily basis. Instead, it publishes a tracking basket of previously disclosed holdings, liquid ETFs that mirror the portfolio’s investment strategy, and cash and cash equivalents. The tracking portfolio is designed to closely track the actual fund portfolio’s overall performance, and actual portfolio reports are released monthly.

PFUT’s top sector allocations as of end of August were 32.21% in healthcare stocks, 29.58% in information technology, and 8.70% to consumer discretionary.

The ETF has an expense ratio of 0.64%.

For more news, information, and strategy, visit the Big Ideas Channel.