By Natalia Gurushina, VanEck

Will China’s unexpectedly weak activity gauges lead to a more aggressive policy response?

Please note: Emerging Markets Debt Daily will not be published on September 1st– September 6th. We look forward to resuming our daily updates on September 7th.

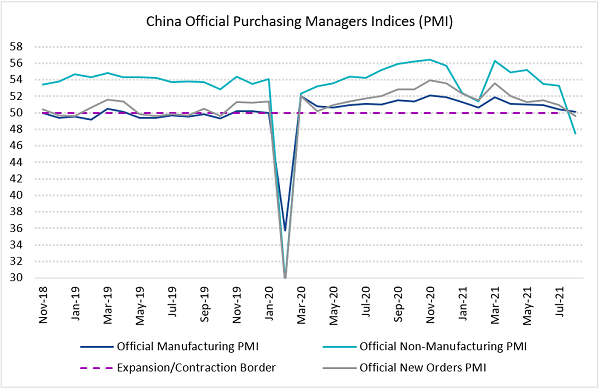

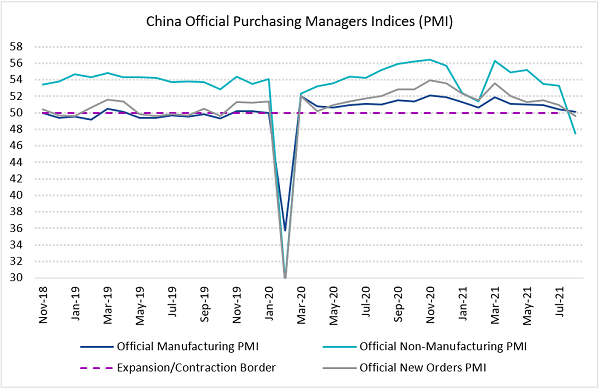

There are downside surprises and there are shockers. China’s August services PMI1was the latter. It dived deep into contraction zone (to 47.5 from 53.3 in July) against the expectation of a mild decline to 52.0. The manufacturing PMI also undershot consensus. It did manage to stay in expansion territory – but only barely (50.1 – see chart below). Other details looked bad as well. The new orders PMI moved to contraction zone (for the first time since February 2020), the new export orders PMI slipped to 46.7 (the weakest since June 2020), the large companies PMI moved perilously close to the expansion/contraction border (50.3), and the services new orders PMI collapsed to 42.2.

So, what caused the carnage, and what authorities are going to do about it? The first part of the question is really about how tighter regulations/tech clampdown stack up against “other stuff”. Well, the Delta outbreak in several cities was real, and the ensuing movement restrictions hit services. The same applies to supply chain issues and high freight prices, and their impact on exports and manufacturing. These factors are damaging, but they are likely to prove transitory. In the meantime, we should see more support coming via fiscal and monetary channels (potentially including another cut in the reserve requirements for banks). The regulatory overhaul, however, could be a different and longer-lasting issue – the state media just called it a “profound revolution” – and this raises legitimate questions about its impact on the labor market, income, and consumption, as well as on the private sector investments.

Growth “incidents” like this call for lower local rates – in China. But they are likely to feed growth concerns in the rest of EM. According to the IMF, emerging markets are expected to glow slower than then U.S. in 2021 – for the first time since the 1990s – and the market might not take the idea of further EM growth downgrades lightly. Because it’s not just growth – there’s a host of related issues, including fiscal performance and policy challenges for central banks that deal with rising inflation. Stay tuned!

Charts at a Glance: Sharp Deterioration in China’s Activity Gauges

Source: Bloomberg LP

1We believe PMIs are a better indicator of the health of the Chinese economy than the gross domestic product (GDP) number, which is politicized and is a composite in any case. The manufacturing and non-manufacturing, or service, PMIs have been separated in order to understand the different sectors of the economy. These days, we believe the manufacturing PMI is the number to watch for cyclicality.

Originally published by VanEck on August 31, 2021.

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan’s index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG – JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.