One of the lessons investors are learning in today’s low-yield environment is that if income is desired, it pays to evaluate asset classes beyond traditional bonds and equities.

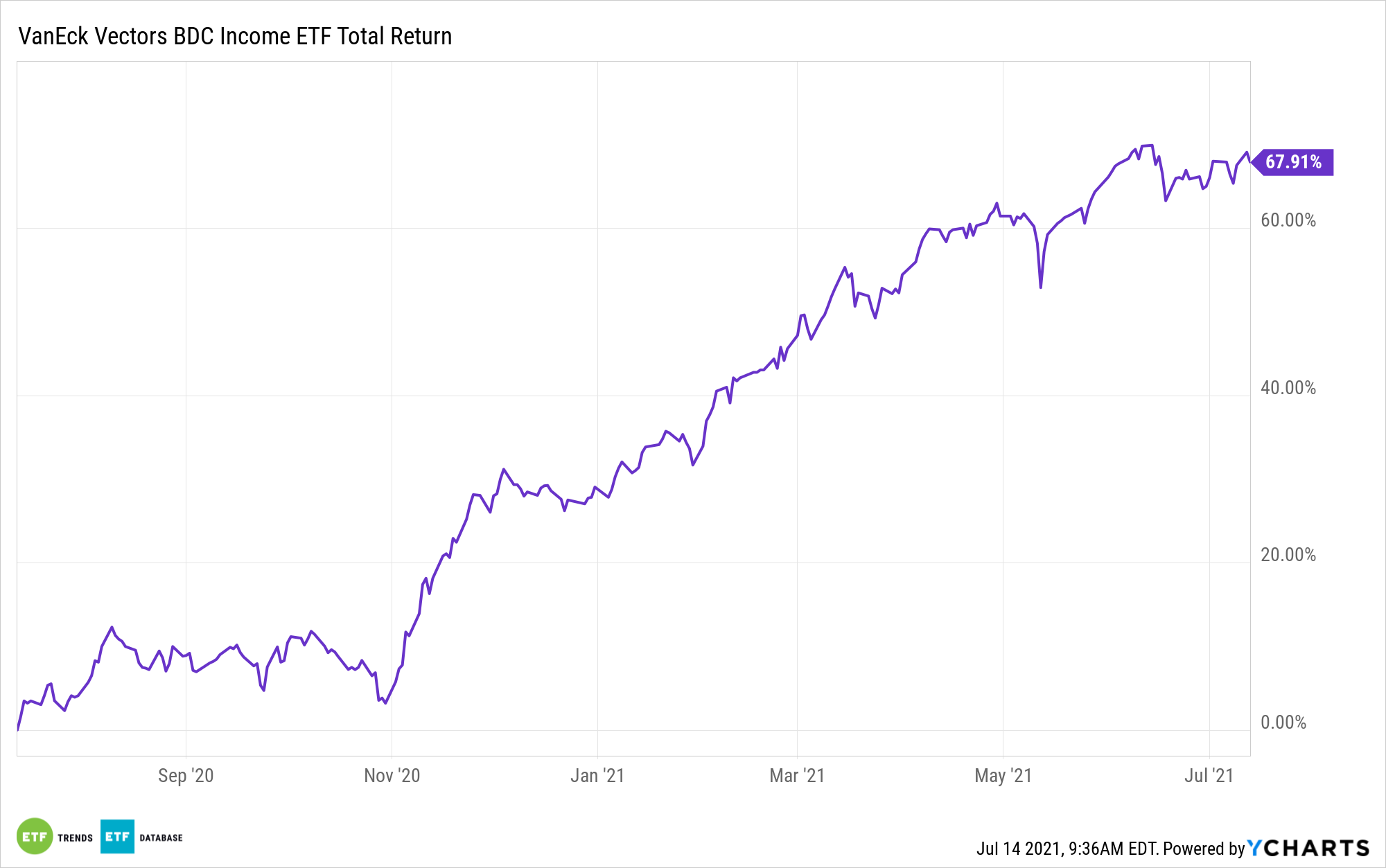

On the alternative income side of the ledger, there are business development companies (BDCs), which are accessible in exchange traded fund form via the VanEck Vectors BDC Income ETF (NYSEArca: BIZD). In terms of pure yield, BIZD delivers the goods with a whopping 30-day SEC yield of 8.15%, according to VanEck data.

As seasoned income investors know, high yields can mean elevated risk, particularly at the credit level. That’s a relevant consideration with BDCs because these companies are essentially lenders. They’re making loans to companies that cannot procure financing through traditional avenues. Said differently, a primary evaluation tool for BDCs is how many client loans are overdue. Fortunately, that number is dwindling.

“Additionally, and perhaps even more importantly, the portion of non-accrual status loans, or loans with overdue interest payments, in BDC portfolios have been falling over the last few quarters,” notes VanEck product manager Coulter Regal.

At the end of the first quarter, the average non-accrual at cost for Ares Capital, Main Street Capital, and Golub Capital – BDCs that combine for almost a quarter of the BIZD roster – was 2.5, well off the highs of 2020.

BIZD Is Ready for Rising Rates

As if the big yield and improving accruals aren’t enough, BIZD offers another favorable point for investors to consider: protection against rising interest rates. Like banks, BDCs get a lift from rising rates because that scenario lifts net interest margins (NIMs). Additionally, the bulk of loans made by BDCs feature floating rate components.

“In fact, many BDCs actually stand to benefit from a rise in base interest rates thanks to these floating rate loans paired with the fixed low rate debt that BDCs issued over the last year. This means that as base interest rates increase, BDCs will likely see higher net interest margins and increased annual net income,” adds Regal.

In the case of Ares, BIZD’s largest holding at an a allocation of nearly 16%, a rate hike of 100 basis points would lift annual net income by $10 million. Ratchet that rate hike number up to 300 basis points and the BDC’s annual net income could surge by $215 million, according to VanEck data.

For more news and information, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.