Broadly speaking, investors view emerging markets as riskier than developed economies, and the same is true when comparing high-yield corporate bonds with investment-grade fare.

Combine emerging markets and junk bonds and the ingredients are there for risky and volatile recipe. That doesn’t mean the asset class should be ignored. The VanEck Vectors Emerging Markets High Yield Bond ETF (HYEM) is exceedingly relevant today against the backdrop of rising interest rates in some developing economies, especially given U.S. dollar price gyrations.

“The global exposure of many of the issuers allows the category to benefit from the spike in expected global growth rates this year,” says VanEck Head of Fixed Income ETF Portfolio Management Fran Rodilosso. “At the same time, emerging markets high yield corporates are one of the few areas where investors can still find yields that are still well above 5%.”

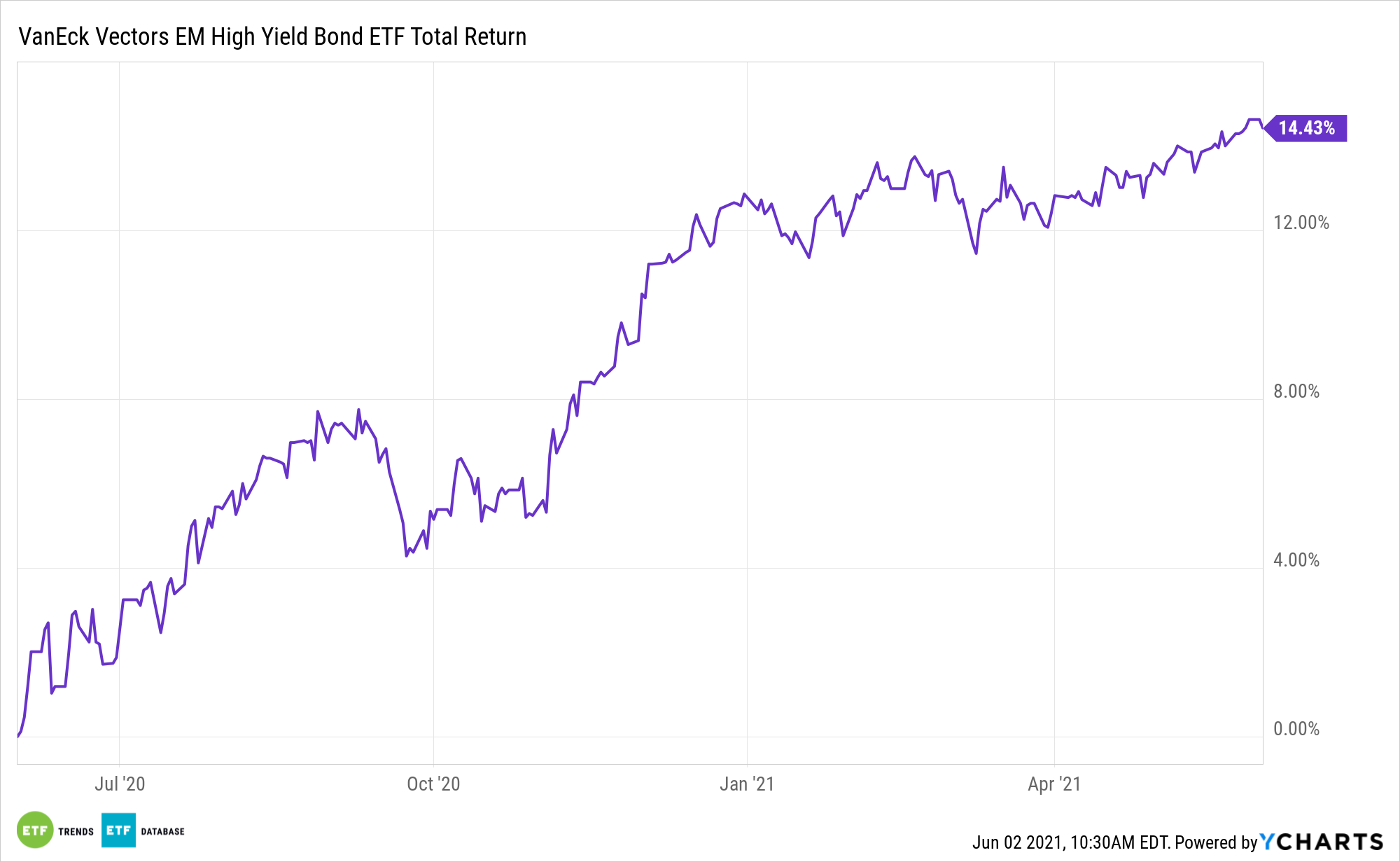

Additionally, HYEM, which has a 30-day SEC yield of 4.80%, offers outperformance potential. Over the past year, the VanEck exchange traded fund is higher by 15% while the J.P. Morgan EMBI Global Core Index and the Markit iBoxx USD Liquid High Yield Index are up 9.2% and 10.8%, respectively.

Bond Benefits Galore

The aforementioned performance profile offered by HYEM isn’t uncommon. Over the past three years, the fund has beaten both the dollar-denominated J.P. Morgan EMBI Global Core Index and the Markit iBoxx USD Liquid High Yield Index while maintaining a similar volatility profile to the former.

HYEM offers investors other benefits, including lower sensitivity to interest rates, which is a primary concern when investing in the bond market. The effective duration on the ICE BofA Diversified High Yield US Emerging Markets Corporate Plus Index – HYEM’s underlying benchmark – is 3.6 years. That’s lower than broader baskets of emerging markets dollar-denominated and local currency debt as well as the broader universe of corporate bonds from developing world issuers. Moreover, HYEM offers duration stability.

“Further, the segment’s duration has remained close to where it was five years ago,” adds Rodilosso. “The duration of USD emerging markets sovereigns, on the other hand, has extended significantly from about 6.7 five years ago, while the duration of broad emerging markets corporates was about 4.6 five years ago.”

The $821.1 million HYEM holds 838 bonds, 22.60% of which are from Chinese and Brazilian issuers. Eighty-seven percent of the fund’s roster is rated BB or B, according to issuer data.

For more news and information, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.