The semiconductor industry is continuing to grapple with supply chain woes this year, and those issues are plaguing an array of other industries.

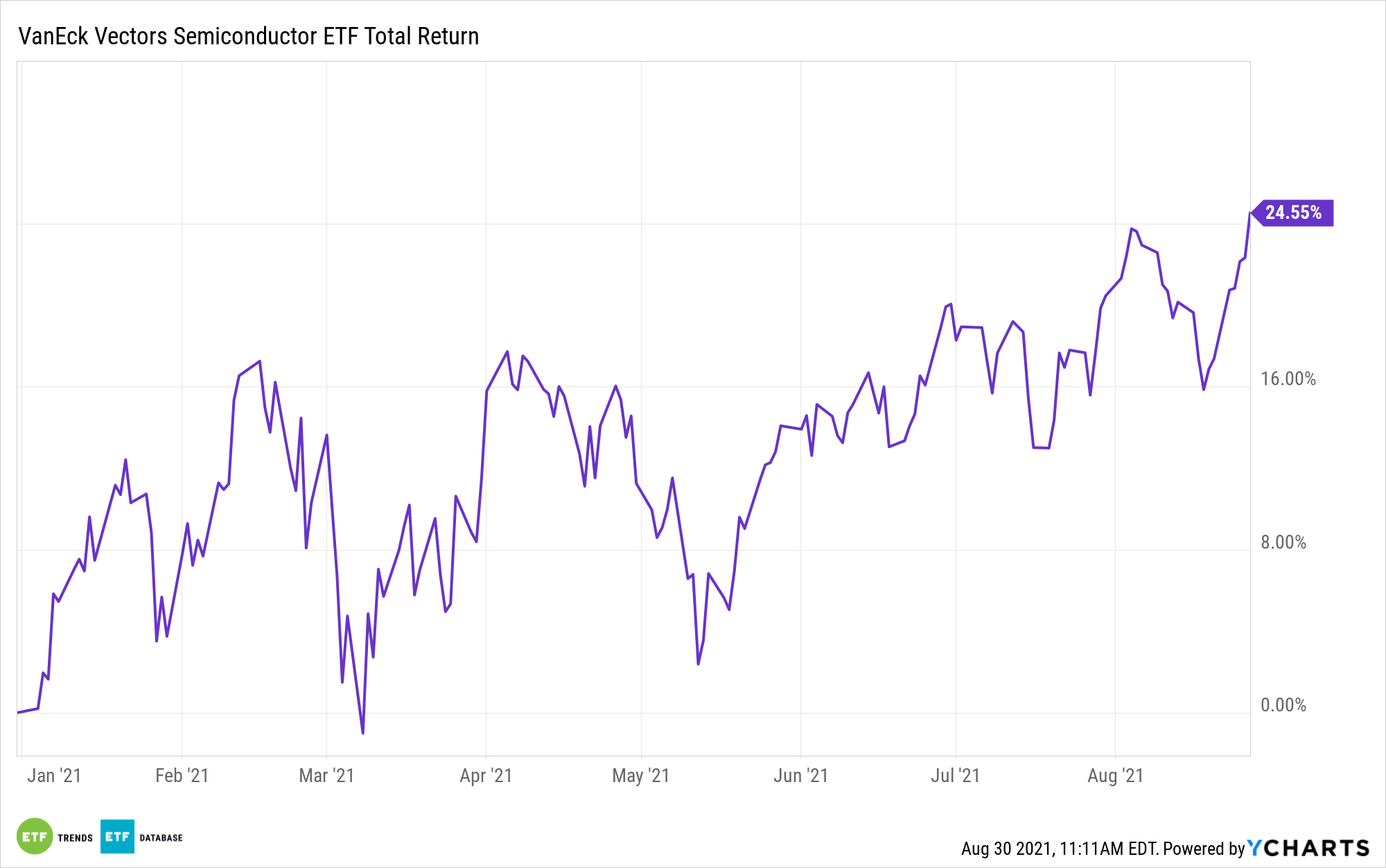

For investors, the good news is that semiconductor stocks aren’t feeling any ill effects. In fact, the VanEck Vectors Semiconductor ETF (SMH) is higher by more than 22% year-to-date and flirting with all-time highs.

While the supply chain issue is generating plenty of attention, and rightfully so, investors should understand what’s causing it, and the coronavirus pandemic isn’t entirely to blame. For example, a 2020 drought in Taiwan — home to SMH component and the largest chip foundry Taiwan Semiconductor (NYSE:TSM) — stalled some output there, as did a fire in Japan.

However, the pandemic did bring about some industry-level technology shifts that spurred chip demand, including working from home.

“Strong demand for electronic devices, in part because of widespread remote working and homebased learning, coupled with the push towards digitization, have helped the chip industry strongly hold its ground against the ramifications of the pandemic, although this has led to a chip crunch,” says VanEck product manager John Patrick Lee. “Demand for microchips was on the rise even before the pandemic disrupted supply chains and altered consumer needs.”

Another element in the supply chain conundrum is that chip makers such as SMH holdings, like Nvidia (NASDAQ:NVDA) and Qualcomm (NASDAQ:QCOM), make semiconductors that have multiple uses, meaning that those products have multiple end markets. A buyer of Nvidia chips in a particular industry may be competing against a customer from an unrelated industry for the same chip.

“Another key facet to understanding the semiconductor shortage is the fact that a significant overlap between industries that rely upon the same semiconductor technology, now exists,” adds VanEck’s Lee. “In other words, multiple separate, distinct industries use the same type of semiconductors, leading to exacerbated dislocations of supply and demand, against the backdrop of the COVID-19 outbreak.”

Geography matters as well. Nearly three-quarters of SMH components are US-based companies. That’s reflective of American chip producers accounting for almost half of global semiconductor sales. However, as Lee notes, the U.S. accounts for just 12% of production, down from 37% three decades ago. That situation may take a while to reverse and may also require some assistance from the government.

“Building semiconductor manufacturing operations is a huge capital investment, ranging between $10-$40 billion depending on the type of chip being produced. SIA estimates that the $20-$50 billion in federal grants would be needed over the next decade to reverse the loss of market share experienced in the last thirty years,” according to Lee.

For more news and information, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.