Thanks in large part to low interest rates and depressed yields on fixed income assets like municipal bonds and Treasuries, preferred stocks and their related exchange traded funds are receiving renewed attention from income investors this year.

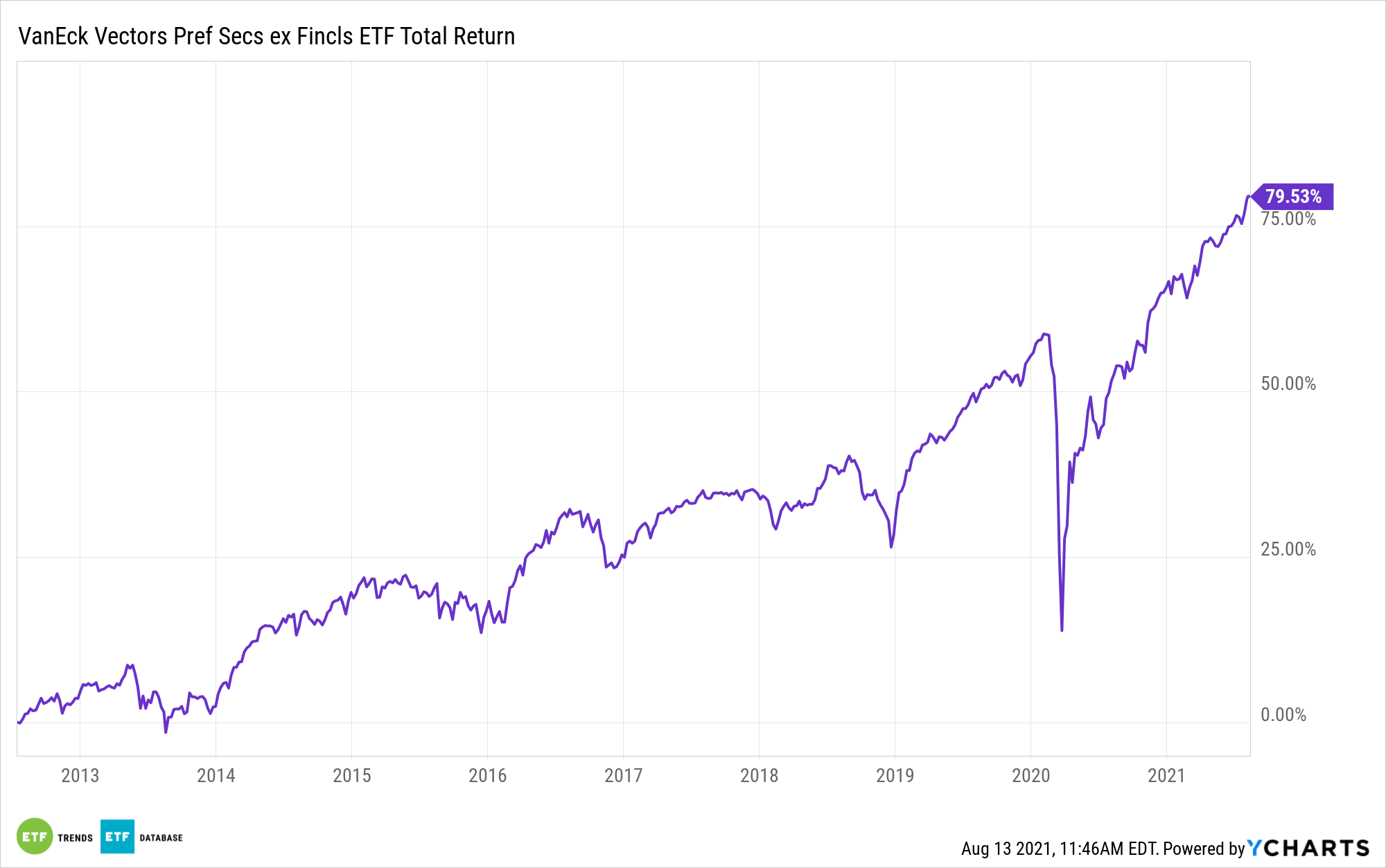

Investors willing to apply a bit more scrutiny to this high-yield asset class may find something to like with the VanEck Vectors Preferred Securities ex Financials ETF (PFXF). The $1 billion PFXF, which turned nine years old last month, tracks the ICE Exchange-Listed Fixed & Adjustable Rate Non-Financial Preferred Securities Index.

As the name of the ETF and its benchmark imply, preferred stocks issued by financial services companies are excluded. That makes for a unique ETF strategy in this asset class because banks are usually the largest issuers of preferred stocks. Moreover, excluding financial services preferreds may be a plus for PFXF investors.

“After the financial crisis of 2008, banks began issuing a significant amount of preferred stock to meet the higher capital levels required by regulators. This proliferation of preferreds issuance by financials has led to an over concentration of the sector, which now makes up over 65% of the U.S. preferreds market,” says Coulter Regal, VanEck associate product manager.

At a time when bank balance sheets are strong and those companies are boosting dividends on common stock, bank preferreds look alluring. However, PFXF is beating the widely followed ICE Exchange-Listed Preferred & Hybrid Securities Index by more than 300 basis points year-to-date and is doing so with significantly lower sector risk.

“PFXF helps limit this unnecessary sector concentration by targeting preferred securities issued by companies that operate outside of the financial sector, offering differentiated exposure, without sacrificing yield potential, compared to most broad-based preferred strategies,” adds Regal. “Beyond increased sector diversification, ex financial preferreds also display a few other notable features, including an increased proportion of preferreds paying cumulative distributions and a lower proportion of preferreds with a call feature relative to financial preferreds.”

Yet excluding bank preferreds doesn’t reduce PFXF’s diversity or its income potency, as highlighted by the fact that the ETF has 132 holdings and a 30-day SEC yield of 4.86%. As of July 31, 42.7% of PFXF’s holdings were from issuers in the utilities and real estate sectors. Another point in the ETF’s favor is that it may be less sensitive to interest rate changes than competing funds.

“Excluding financial preferreds generally results in a lower portion of perpetual issues which may help lower overall maturity and reduce impact of interest rate changes. Additionally, the portion of a preferred portfolio that are callable or convertible and the timing of the call and conversion features can impact its interest rate sensitivity,” concludes Regal.

For more news and information, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.