Hearing plenty about inflation in the financial market terms but not noticing it in daily life? Take a closer look at the grocery bill.

While the standard calculation of inflation is “ex food and energy,” food prices are soaring because agriculture commodities are doing the same. For all the talk about gold as an inflation hedge, plenty of “down on the farm” commodities are outshining bullion this year.

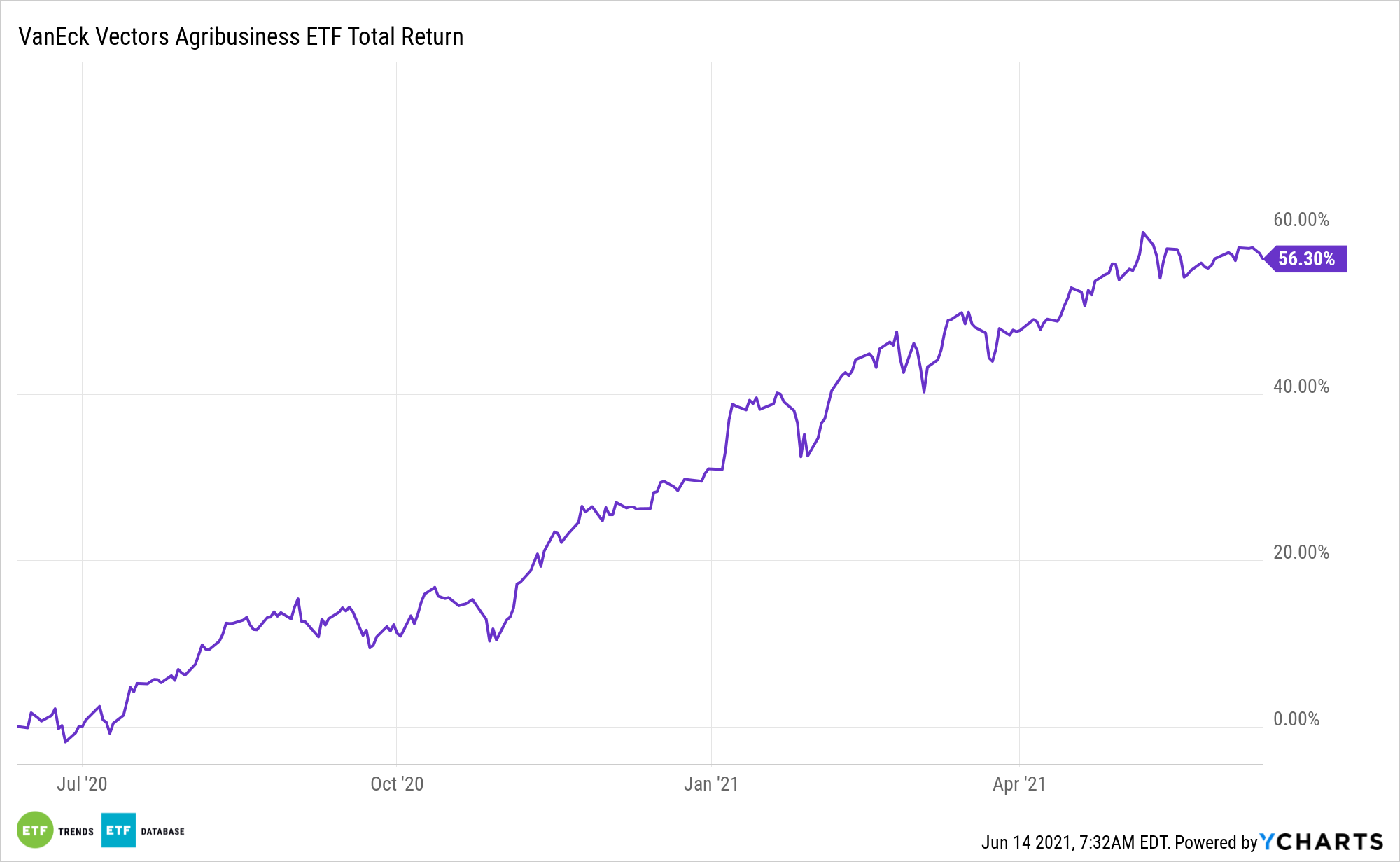

However, agriculture commodities can be volatile and usually aren’t territory reserved for individual investors. They can get in on the act with equity-based VanEck Vectors Agribusiness ETF (MOO). Up nearly 20% year-to-date, MOO follows the MVIS Global Agribusiness Index.

MOO’s 2021 showing jives with the notion that hard assets and equities often make for solid inflation-fighting tools. There are other reasons to like MOO.

“Many companies also exhibit what we view as fascinating longer term growth profiles as direct inputs and beneficiaries of the resource transition movement fueled by technological advances and sustainability,” according to VanEck research.

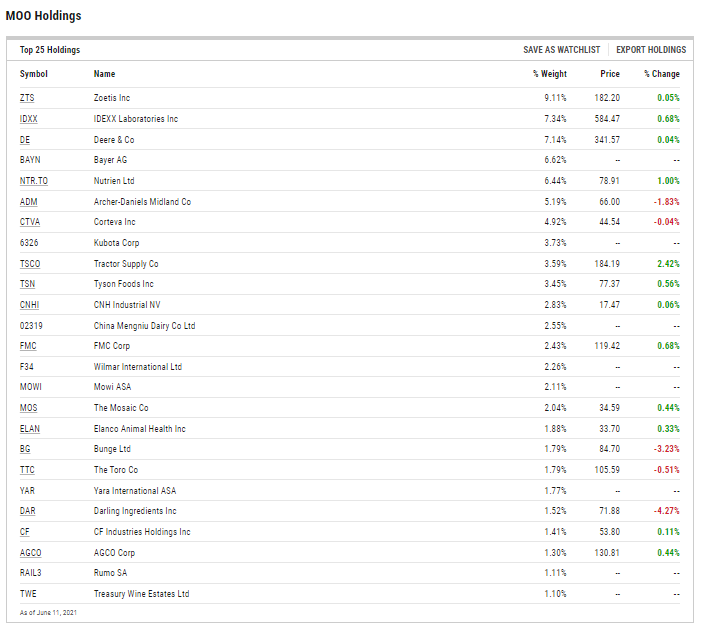

As just one example of an agribusiness company with a surprisingly innovative feel, Deere (NYSE: DE), MOO’s second-largest component, also resides in some well-known disruptive growth ETFs.

MOO is “positioned to meet growing demand as global population growth is driving increasing food demand and the need for efficient agricultural solutions,” adds VanEck.

MOO’s Cyclical/Defensive Blend

MOO is also built for this environment because it has substantial cyclical leanings, as the materials and industrial sectors combine for 44% of the fund’s roster. That exposure also positions MOO to capitalize on the value resurgence, which the fund is doing this year.

Additionally, nearly 43% of MOO’s geographic weight is allocated to ex-U.S. countries, a significant chunk of which are developed markets such as Germany, Canada, and Japan. That also adds to the fund’s value feel because of the 20 countries represented in the fund that aren’t the United States, many are home to stocks that trade at noticeable discounts to the S&P 500.

Some of MOO’s cyclical leanings are offset by an almost 28% weight to consumer staples stocks, but investors shouldn’t be deceived by the 25.8% weight to healthcare names. More than half the fund’s healthcare weight is allocated to animal care names, which represent a growthier corner of the healthcare sector.

Along with the benefits of inflation protection, MOO delivers to investors a value play with an element of defensive benefits and an international diversification.

For more news and information, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.