Income investors are facing a dilemma, thanks to low yields on municipal bonds and Treasuries. Depressed credit spreads are taking some of the blush off corporate bonds, further compounding the conundrum faced by bond investors in 2021.

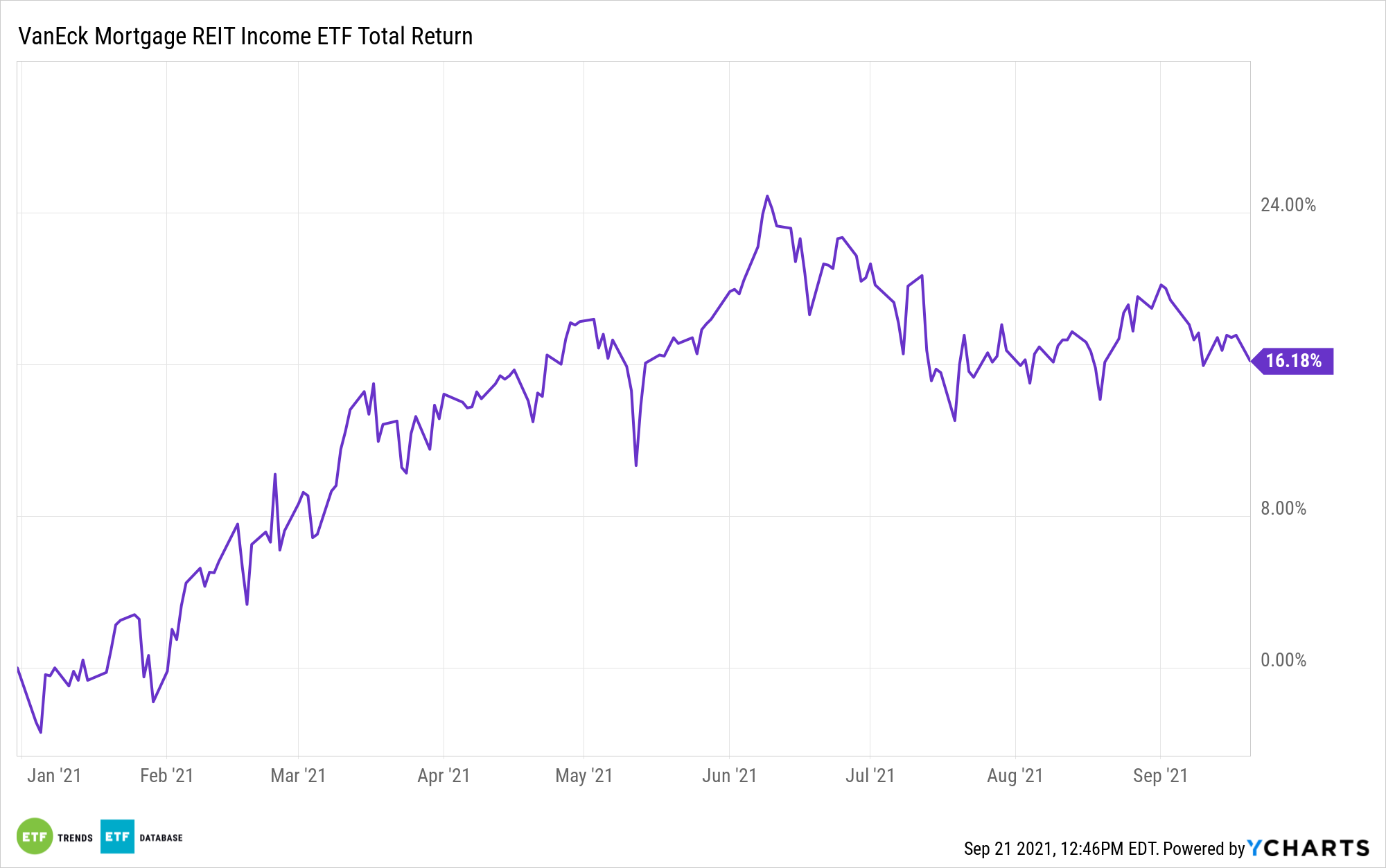

That doesn’t mean that they have to embrace exceptionally risky assets to boost their income profiles, though. Enter mortgage real estate investment trusts (mREITs) and the VanEck Vectors Mortgage REIT Income ETF (MORT). MORT, which follows the MVIS US Mortgage REITs Index, has a 30-day SEC yield of 7.90%, which is otherworldly in this environment.

For the uninitiated, mREITs are REITs that provide real estate financing by buying mortgages or mortgage-backed securities (MBS). The allure of mREITs is twofold. First, the asset class is known for high dividends, as highlighted by MORT. Second, mortgage REITs help real estate investors get in the game without having to have direct ownership or financing commitments of a property.

Indeed, the income allure of MORT is hard to ignore, but 2021 isn’t a one-off for the VanEck fund because mREITs typically sport higher yields than many bond assets.

“Dividend yields offered by mortgage REITs have historically been higher than yields on more traditional income oriented assets like Treasury securities or corporate debt,” says VanEck analyst Coulter Regal.

As Regal notes, there is a trade-off. Actually, there’s more than one. Mortgage REITs use leverage, have credit risk, and are vulnerable to rising interest rates because those rising rates make mortgage borrowing less attractive. However, some of that risk is offset by the favorable tax treatment offered by REITs.

“Another contributing factor to high yields, is favorable tax treatment and a requirement for REITs to distribute the vast majority of their income to shareholders. To qualify as a REIT, the trust must distribute at least 90% of its taxable income to shareholders. In turn, REITs typically don’t pay any corporate income taxes because their earnings have been passed along as dividend payments. The unique structure and tax advantages of REITs, along with the additional risk exposures mentioned above, translates into higher yield potential than what might be earned in traditional fixed-income markets,” according to Regal.

Bottom line: In today’s ultra-low-rate environment, MORT could be worth a look by aggressive, long-term, income-minded investors.

“An allocation to mortgage REITs may also add much desired diversification benefits to a portfolio thanks to historically low correlation to equities and traditional fixed income instruments. However, as mentioned previously, mREITs come with elevated risk compared to other traditional income investments and should be considered in an allocation decision,” concludes Regal.

For more news, information, and strategy, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.