Investors looking for alternative sources of income may want to give mortgage real estate investment trusts (mREITs) a look. Those who don’t want to stock pick in this high-yield asset class can turn to exchange traded funds, including the VanEck Vectors Mortgage REIT Income ETF (MORT).

The $324.6 million MORT, which turned 10 years old last week, follows the MVIS US Mortgage REITs Index. Investors often embrace for REITs for above-average yields, but MORT really ratchets up that proposition. For example, the fund sports a 30-day SEC yield of 8.05%, which is well above what investors earn with standard REIT ETFs.

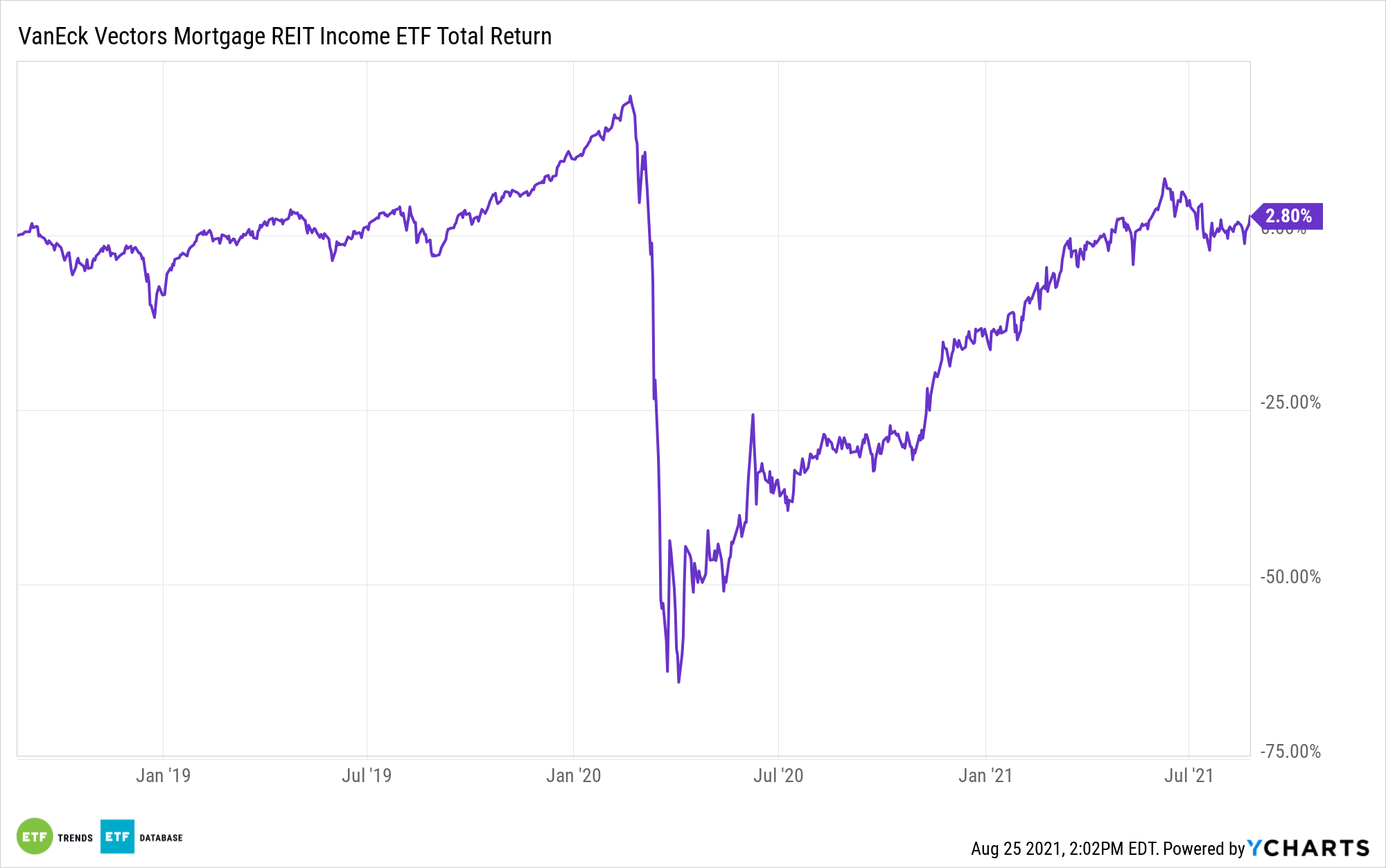

MORT is bouncing back from its COVID-19 nadir and offers investors more potential for capital appreciation along with that tempting yield.

“Mortgage real estate investment trusts are one such area, as the sector offers near double-digit yields and, in some cases, the opportunity for meaningful price appreciation. This comes after the sector got a scare at the beginning of the pandemic, thanks to a series of margin calls owing to mostly short-term financing that was marked to market at depressed prices during the initial rout,” reports Carleton English for Barron’s.

Home to 25 mREITs, MORT is higher by 12.42% year-to-date. There is potential for that number to matriculate higher if prognostications on some of the fund’s components prove accurate. MFA Financial (NYSE:MFA) is an example of a MORT holding analysts are enthusiastic about.

“The New York–based REIT has lowered its cost of funding through securitizations, recognizing a 15% quarter-over-quarter drop in interest expense from the most recent quarter. Roughly two-thirds of its asset-based financing is nonmark-to-market, with the bulk of that portion coming from securitizations,” according to Barron’s.

MFA Financial is the eleventh-largest MORT component at a weight of 4.05%. Redwood Trust (NYSE:RWT) is another MORT holding that Wall Street likes.

According to Barron’s: “’We expect strong mortgage banking activity, recovering asset prices, and increased call activity to enable [Redwood Trust] to generate solid ROE and grow book value (and potentially the dividend),’ wrote Bose George, analyst at KBW, in a note last month.”

Redwood Trust accounts for 2.63% of MORT’s roster as of Aug. 23.

For more news and information, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.