Investors frequently hear about valuations as they realte to equities, but hunting for good bargains also has its applications in the world of corporate bonds.

The VanEck Vectors Moody’s Analytics IG Corporate Bond ETF (MIG) helps with that objective, making it unique relative to old-guard corporate debt exchange traded funds. MIG, which debuted last December, follows the MVIS® Moody’s Analytics® US Investment Grade Corporate Bond Index.

While traditional corporate bond ETFs weight component by issue size, the equivalent of market capitalization weighting in equity funds, MIG’s index breaks from the pack by not only featuring bonds that are attractively valued but those that have a lower probability of being downgraded. MIG’s methodology is all the more relevant at a time when investors are scrambling for income, leading many to corporate bonds due to scant yields on Treasuries and municipal debt.

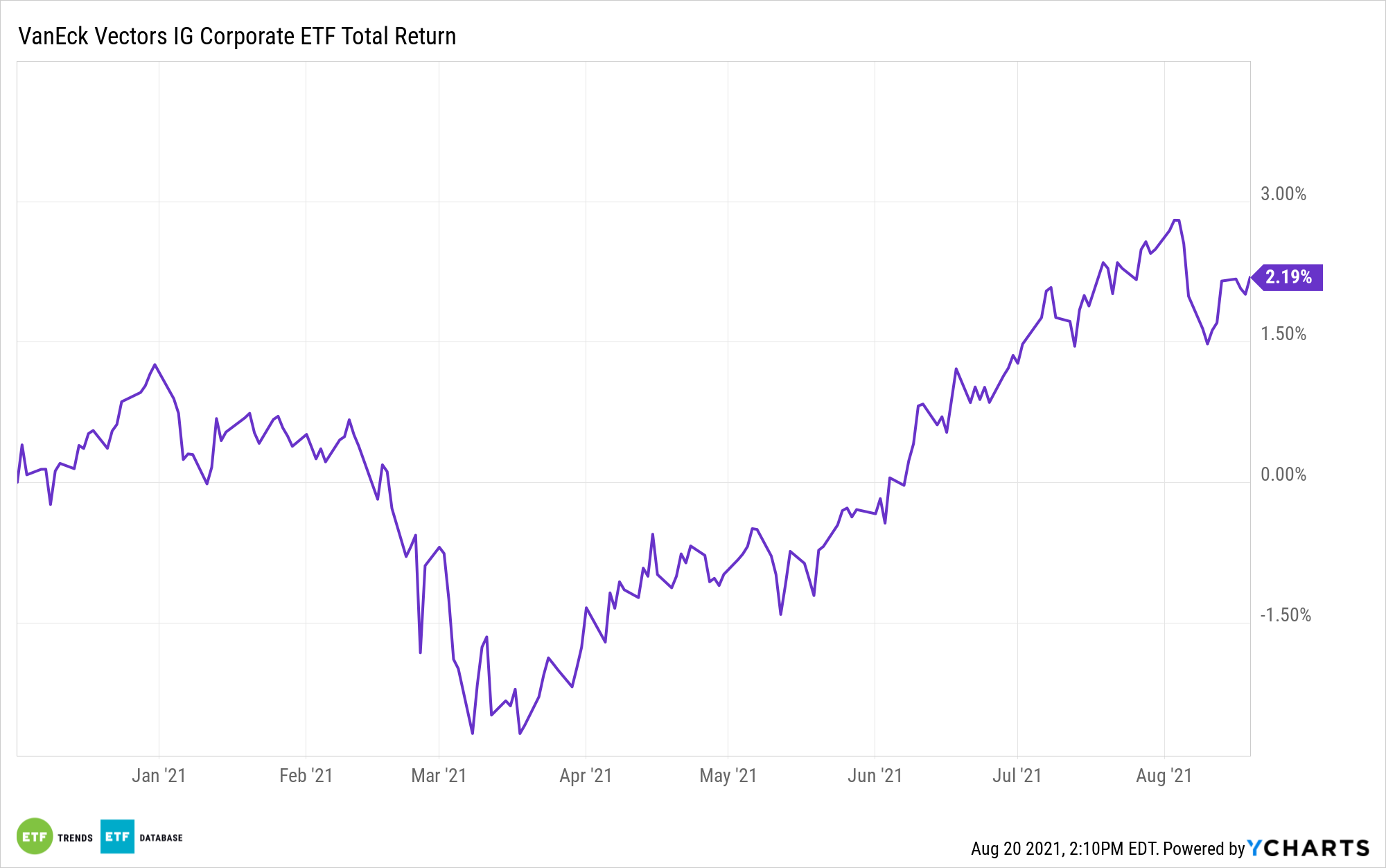

“With generally tight credit spreads and a longer overall duration than asset classes such as high yield, investment grade corporates were no exception,” says William Sokol, VanEck senior ETF product manager. “However, flows into corporate bonds have remained strong due to the incremental yield and relative safety the asset class provides.”

Value Proposition vs. Value Traps

As some chastened value equity investors learned, while that factor lagged growth for the better part of decade until late 2020, there’s a big difference between a credible value proposition and a value trap. The same is true with corporate bonds. Some bonds may appear to be a good value, only to disappoint investors with a surprising downgrade.

Good value in corporate bonds comes from identifying issues with higher credit spreads than the modeled value of the issue. By applying that methodology, MIG may help investors earn more reward with less risk.

“Attractively valued investment grade bonds outperformed the broad investment grade market by 1.25% through 7/31/2021,” adds Sokol. “Although this segment of the market has a somewhat shorter duration than the broad market, the vast majority of outperformance (approximately 80%) came from a greater benefit from credit spread tightening in the period.”

Embracing value in corporate bonds doesn’t mean taking on credit risk. As is the case with traditional rivals, the bulk of MIG’s roster dwells in BBB territory, but over 18% of its 156 holdings are rated AAA, AA, or A, according to issuer data.

The average maturity of MIG components is nearly 12 years and almost 36% of the issues in the fund are from financial companies, while a third hail from the technology and energy sectors.

For more news and information, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.