As more investors become climate-aware and demand strategies to that effect, fund issuers are responding in turn. Yet it’s taking awhile to get more green coverage in the world of fixed income exchange traded funds.

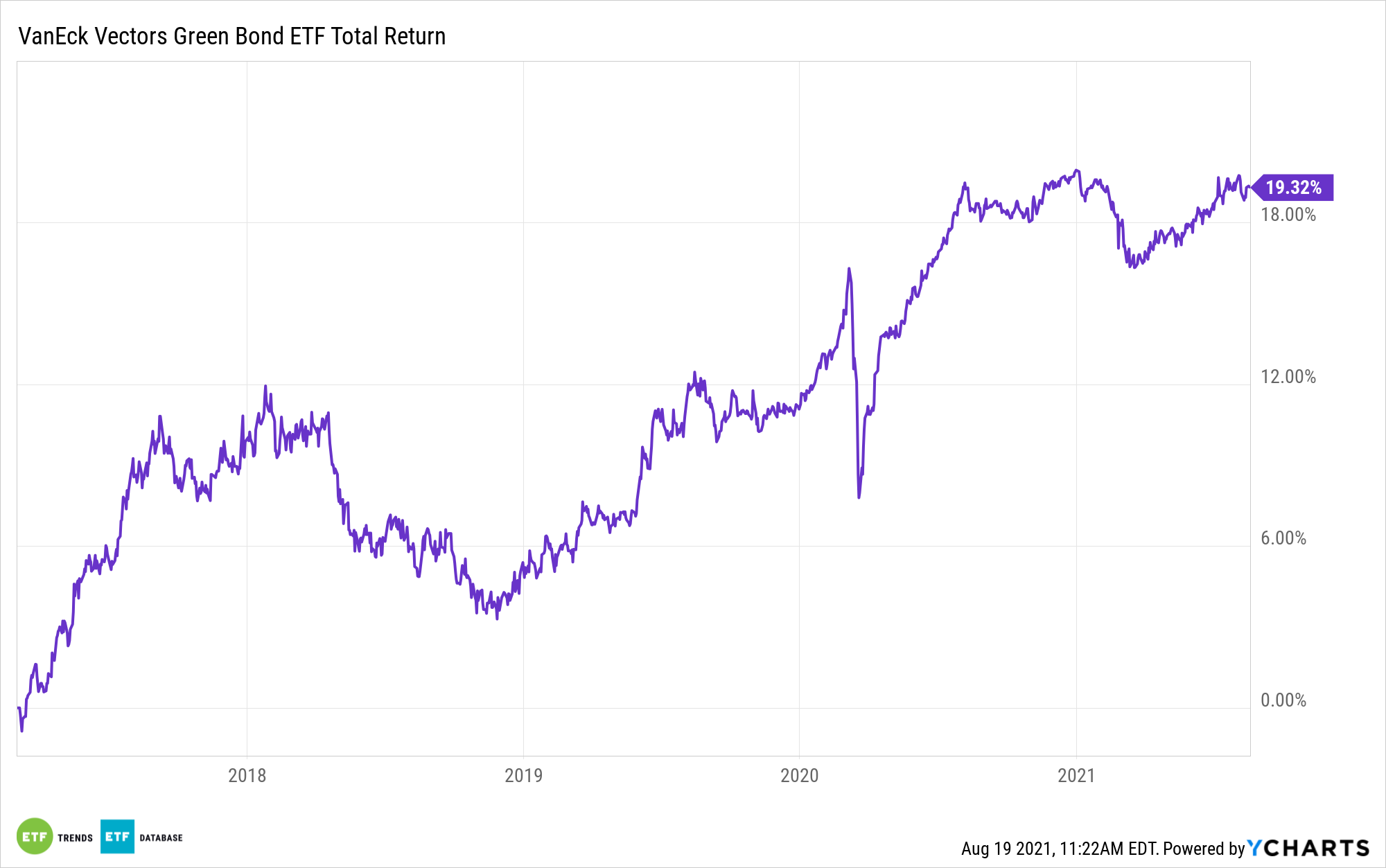

On that note, the VanEck Vectors Green Bond ETF (NYSEArca: GRNB) is a seasoned veteran among green fixed income ETFs. GRNB, which tracks the S&P Green Bond U.S. Dollar Select Index, turns five years old next March.

GRNB’s underlying index holds dollar-denominated green debt “issued to finance environmentally friendly projects, and includes bonds issued by supranational, government, and corporate issuers globally,” according to VanEck.

In other words, there’s no greenwashing here. Companies and governments whose bonds are found on the GRNB roster issue that debt explicitly for environmentally sound projects.

A Pioneering ETF

Green bonds are a small but growing part of the overall bond market. In the U.S. alone there’s ample room for growth in this asset class, due in large part to the dominance of Uncle Sam in terms of bond issuance and supply.

“Perhaps the greatest challenge facing investors wanting to fold ESG criteria into their bond portfolios is the makeup of the bond market itself,” says Morningstar analyst Neal Kosciulek. “As of the first quarter of 2021, U.S. Treasuries accounted for about 40% of market value of the total U.S. bond market, as measured by the Securities Industry and Financial Markets Association. Another 20% of the market comprised securitized bonds issued by Ginnie Mae, Fannie Mae, or Freddie Mac. Consequently, about 60% of the U.S. bond market points back to a single issuer: the United States government.”

Looked at differently, GRNB and its roster of 284 green bonds can act as ideal diversification tools for fixed income portfolios that are currently heavy on U.S. government bonds. Plus, with over 90% of its holdings classified as non-governments bonds, GRNB presents investors with more credit opportunities than standard aggregate bond funds.

“Eschewing non-U.S.-dollar-denominated bonds tilts GRNB heavily toward corporate issuers, resulting in greater exposure to the small contingent of junk-rated issuers that have raised green bonds,” adds Kosciulek.

However, credit risk isn’t alarming in GRNB as over three-quarters of its components carry investment-grade ratings and over half of those bonds are rated AAA, AA, or A.

For more news and information, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.