Green bonds are a growing part of the fixed income landscape, and there’s an appetite for those issues. The success of the VanEck Vectors Green Bond ETF (NYSEArca: GRNB) confirms as much.

In traditional form, green bonds are debt used by companies and governments to fund environmentally friendly projects. With governments prioritizing climate awareness and sustainability, there are myriad avenues for increasing green debt issuance, including in the municipal bond market. The new VanEck HIP Sustainable Muni ETF (SMI) taps into that theme.

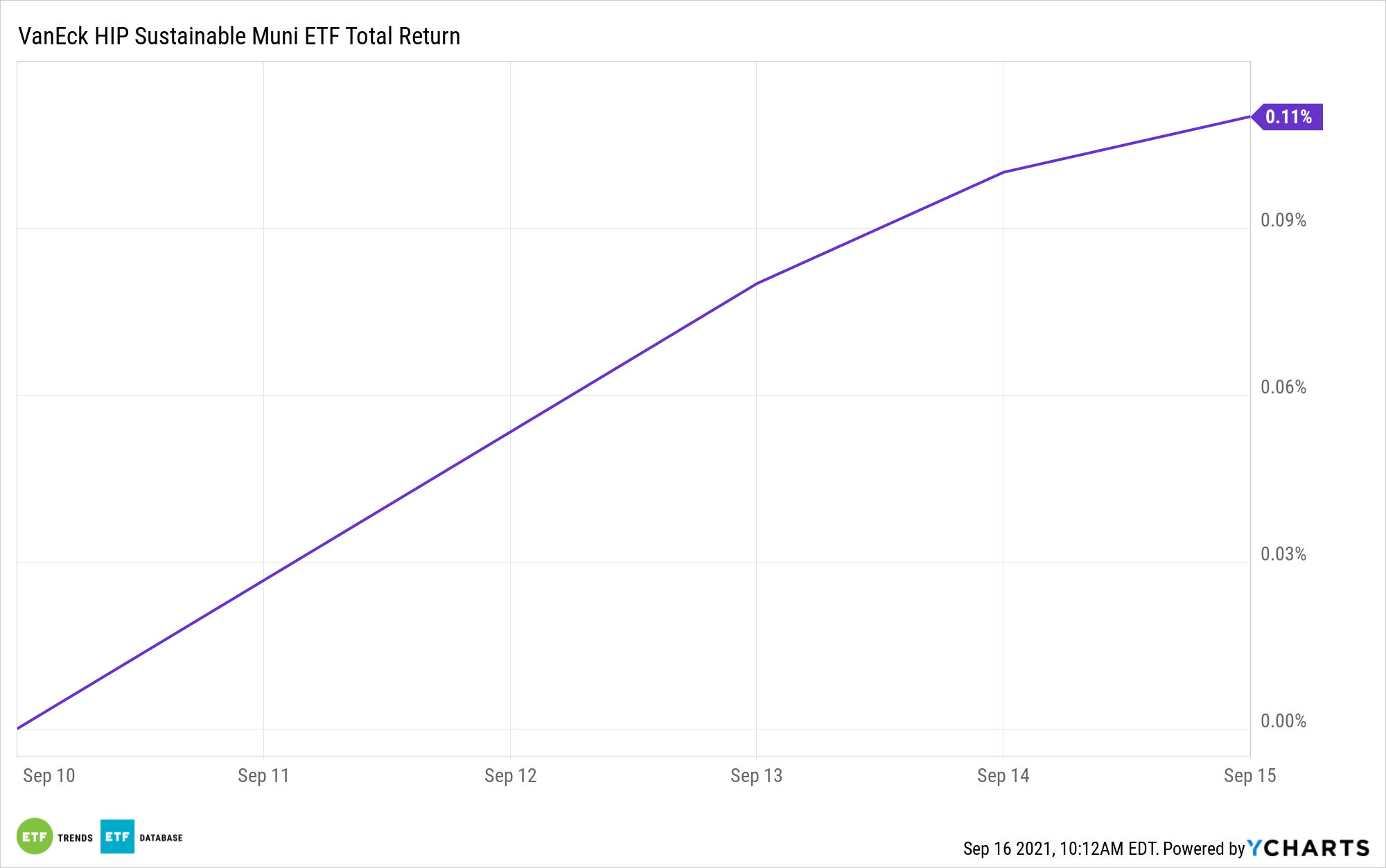

SMI, which debuted last week, is an actively managed ETF. Active management could serve investors in the green municipal bond space, a corner of the bond market that’s still in its infancy.

SMI “seeks current income generally exempt from federal income tax by investing in investment grade municipal debt securities that have been issued to fund operations or projects that support or advance sustainable development, as well as promote positive social and environmental outcomes,” according to VanEck.

Sizing Up SMI

Green bonds are an up-and-coming slice of the vast municipal bond market, but the audience for these bonds and SMI could be wide.

To begin with, many investors are embracing environmental, social, and governance (ESG) and climate-aware strategies and have been clamoring for more bond options in these arenas. Secondly, municipal bonds have long been favored assets for retirees, due in part to high credit quality, low default risk, and tax benefits. As climate change continues permeating national conversations, more investors, including those in older demographics, may look to marry bonds with going green.

“Because they are designed to benefit the environment, green bonds may include additional disclosures to investors—and some state and local government issuers of green bonds have included an independent verification of the environmental impact of the project. These features mean that investors may have additional considerations when evaluating whether to purchase green bonds,” according to the Municipal Securities Rulemaking Board (MSRB).

With an effective duration of 6.12 years, SMI is in the intermediate-term camp and its credit quality is stout with 83.62% of its holdings residing in investment-grade territory, according to VanEck data. The remainder of the bonds in the fund aren’t yet rated. Green munis issued in New York and California combine for 60.6% of the new ETF’s weight, and Pennsylvania checks in at 15%.

SMI charges 0.24% per year, or $24 on a $10,000 investment, which is cost-effective among active funds.

For more news, information, and strategy, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.