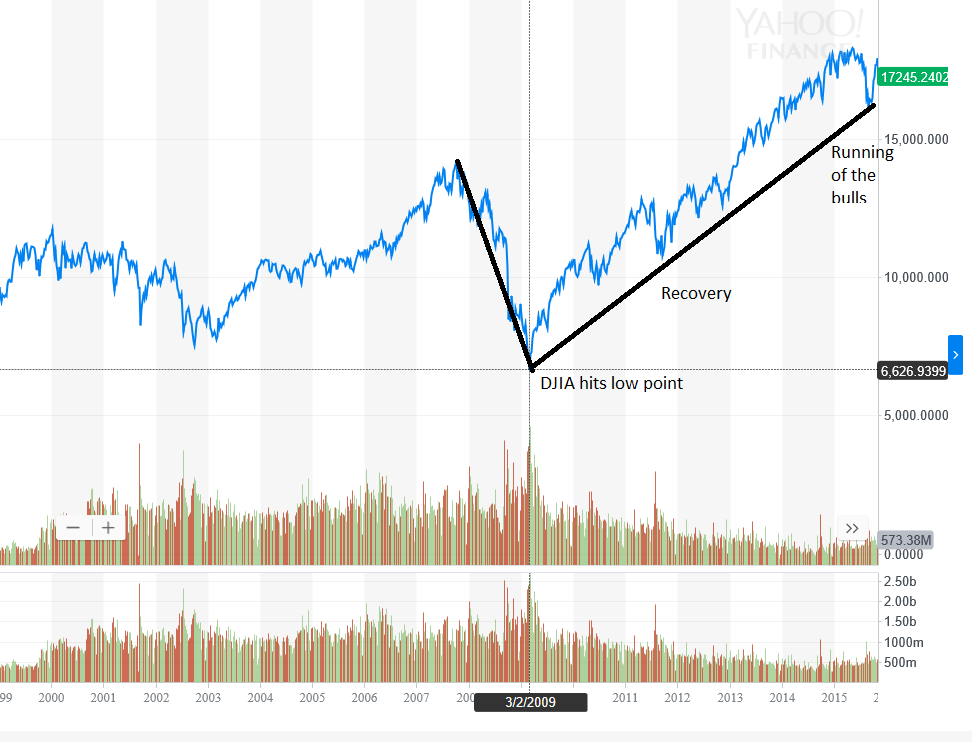

Nobody wants to hear talk of a recession, but the word is starting to creep into financial markets lexicon more often than not lately with economists warning that the bull run since the recovery from the financial crisis in 2007-08 will eventually run out of steam.

![]()

Most market prognosticators cite the inversion of the Treasury yield curve as the predictive indicator for a recession–when yields on the two-year Treasuries are higher than the 10-year Treasuries. Whether this prescience proves to be true or not, it’s advisable for an investor to adjust his or her investment strategy, particularly for fixed-income securities.

Related: What Bond Markets are Saying About Next Recession

Personal finance website Pocketsense.com cited ways to invest in bonds during a recession:

- Watch the direction of interest rates

- Review current bonds for duration–shorter durations work best

- Minimize exposure to high-yield corporate bonds–stick with investment-grade

- Diversify risk

Here are some fixed-income ETFs to utilize when the economic climate signals a recession.

ProShares Investment Grade—Intr Rt Hdgd (BATS: IGHG)

IGHG tracks the performance of the Citi Corporate Investment Grade (Treasury Rate-Hedged) Index with long positions in investment grade corporate bonds issued by both U.S. and foreign domiciled companies. This is particularly important during a recession when the propensity for a company to default on its debt is higher. As such, IGHG focuses on investment-grade issues to reduce credit risk.

Xtrackers Inv Grd Bd Intst Rt Hdg ETF (BATS: IGIH)

IGIH seeks investment results that track the performance of the Solactive Investment Grade Bond – Interest Rate Hedged Index where a portion IGIH’s total assets will reside in long positions in U.S. dollar-denominated investment-grade corporate bonds. As in the case of IGHG, this strategy effectively eliminates exposure to riskier bonds with fund allocations in investment-grade issues.

iShares 1-3 Year Credit Bond ETF (NASDAQ: CSJ)

CSJ tracks the investment results of the Bloomberg Barclays U.S. 1-3 Year Credit Bond Index where 90 percent of its assets will be allocated towards a mix of investment-grade corporate debt and sovereign, supranational, local authority, and non-U.S. agency bonds that are U.S. dollar-denominated and have a remaining maturity of greater than one year and less than or equal to three years–this shorter duration is beneficial during recessionary environments.

SPDR Blmbg Barclays Inv Grd Flt Rt ETF (NYSEArca: FLRN)

FLRN seeks to provide investment results that mimic the performance of the Bloomberg Barclays U.S. Dollar Floating Rate Note < 5 Years Index. At least 80 percent of assets will go towards securities that include U.S. dollar-denominated, investment grade floating rate notes. This floating rate component can take advantage of higher yields in a recession as well as protect the investor against credit risk with investment-grade issues and a duration of less than five years.