“Based on historical statistics over nearly the past two years, a 50% hedged approach consistently provided a competitive return compared to a fully hedged or unhedged portfolio,” Bruno said.

ETF investors may consider alternative options that take a more neutral view on foreign currency movements through a handful of 50% hedged/50% unhedged options, including the IQ 50 Percent Hedged FTSE International ETF (NYSEArca: HFXI), IQ 50 Percent Hedged FTSE Europe ETF (NYSEArca: HFXE) and IQ 50 Percent Hedged FTSE Japan ETF (NYS Arca: HFXJ). All three funds have approximately half their currency exposure of the securities in the underlying index hedged against the U.S. dollar on a monthly basis.

Along with the neutral hedged international ETFs to diversify away from large-cap U.S. stocks, investors may also consider multi-factor small-cap investments to capture potential opportunities at home.

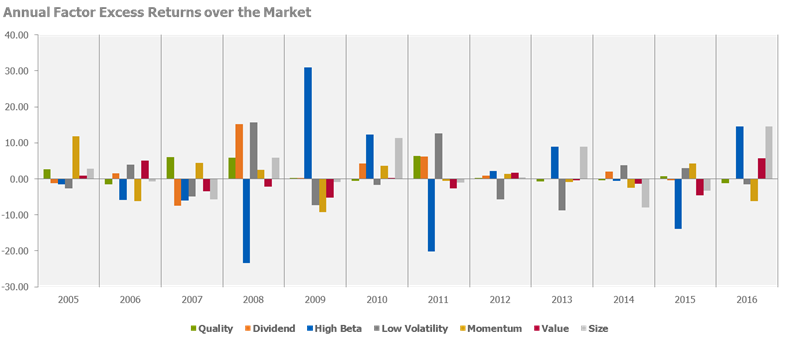

A factor can describe any characteristic relating to a group of securities that can help explain their risk and return. Some of the most common factors that have been historically outperformed include size, value, quality, momentum, and volatility. The various factors can be combined to form a multi-factor, smart-beta ETF strategy.

“Single factors have been highly cyclical from year to year, and timing can be a difficult endeavor,” Bruno said. “Combining multiple factors creates a more diversified solution to potentially enhance returns over time.”

Investors may also focus on the small-cap segment as smaller stocks have historically outperformed large-cap stocks over time and recovered faster from downturns. Small-caps may also outperform ahead as the segment have historically done better than large-caps in periods of rising rates.

When looking beyond U.S. large-caps, investors can also consider something like the IQ Chaikin U.S. Small Cap ETF (NasdaqGM: CSML), which tries to reflect the performance of the Nasdaq Chaikin Power US Small Cap Index, which applies a shareholder yield screen and the so-called Chaikin Power Gauge, a quantitative multi-factor model that identifies securities expected to outperform their peers, to select components from the Nasdaq US 1500 Index. The target focus will include small capitalization stocks.

“The Chaikin Power Gauge is a factor-based model which combines four primary factors, including value, growth, technical, and sentiment to select stocks with the potential to provide enhanced returns over time,” Tom Psarofagis, Director of ETF Product Management at IndexIQ, said.

Financial advisors who are interested in learning more about opportunities outside of U.S. large-caps can watch the webcast here on demand.